The Wall Street Journal has annoyed me again today. See if you can spot how they got my dander up:

A rallying stock market, rising bond yields and the return of inflationary pressures are creating new challenges for the Federal Reserve….Many Fed watchers see the prospect of tax cuts and fiscal spending under Donald Trump, as well as rising oil prices and inflation expectations, pointing to a pickup in the pace of rate increases.

….Many money managers say an upsurge of inflation throughout 2017 ranks among the top risks to a continued advance in U.S. stocks….On the bond market, meanwhile, a gauge of 10-year inflation expectations rose to the highest level in more than two years and edged above the Fed’s 2% inflation target….The fiscal stimulus Mr. Trump has proposed could boost demand and send inflation higher. Expectations of higher inflation have firmed further after the agreement by oil-producing nations boosted crude prices.

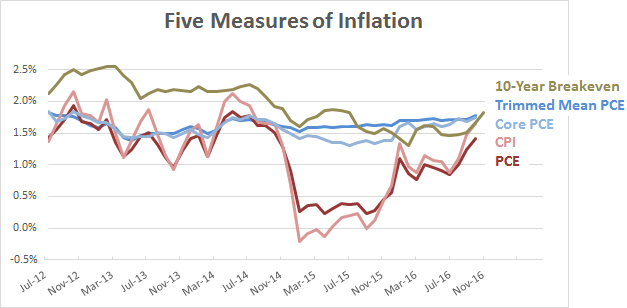

Sigh. Here’s a chart of all the commonly used inflation measures:

The ordinary measures of inflation (in red) are rising, but only to the level of two years ago—and well below the Fed’s target of 2 percent. The core measures of inflation (in blue) are pretty steady at well under 2 percent. And the 10-year-breakeven (in brown), which is a measure of inflation expectations, has been on a steady downward march for three years.

The only measure that’s both rising and breaking past the 2 percent target is the 10-year-breakeven—but only if you look at the daily change over just the past five weeks. So which measure does the Journal show in its chart? The daily change of the 10-year-breakeven over the past five weeks.

Inflation is always right around the corner, isn’t it? No matter how you have to twist things to make it come out that way, it’s always right around the corner.

But maybe we should turn the corner first before we panic. After all, 2 percent is a target, not a ceiling. After years of sub-2-percent inflation, surely we can wait until we’ve had at least a few months of 3 percent inflation before we break out the hammer and shatter the punch bowl?