The Wall Street Journal reports that the Chinese economy isn’t looking great right now:

The Wall Street Journal reports that the Chinese economy isn’t looking great right now:

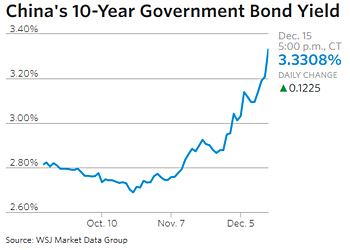

Chinese authorities halted trading in key bond futures for the first time on Thursday, as panicky investors sold the securities on concern that a long, credit-fueled bull market was coming to an end amid slowing growth, capital outflows and heightened government concern about asset bubbles. China’s 10-year and 5-year Treasury bond futures recorded their biggest ever drops in early trading, falling by 2% and 1.2%, respectively, prompting exchange authorities here to suspend the securities. Trading resumed only after China’s central bank injected around $22 billion into the short-term money market.

Just a reminder: when bond yields go up, it means bond prices are going down. They’re going down because everyone is selling. And everyone is selling because they want to put their money someplace else—preferably someplace non-Chinese.

If China’s economy really is in trouble, it means that Donald Trump could have more leverage over China than he expected. He won’t need a 35 percent tariff. Even a modest targeted tariff on certain key goods could be enough to rattle the Chinese economy even further and bring them to the negotiating table.

Of course, the Chinese might refuse to be bullied and retaliate instead, even if it hurts their own economy. Who knows? What’s more, if China’s economy really does tank, that will affect the US as well—and not in a way that brings any jobs back. More likely, it would slow global growth and put Americans out of work.

Welcome to real-world economics, Mr. Trump. Slogans don’t work here, and the iron triangle constricts your options just as much as it does any other president. I hope you’re ready.