Corporate America is about to go on a spending spree! They’re so excited about Donald Trump that they can’t hold themselves back!

Except, um, maybe that’s not it after all. The Wall Street Journal reports that the stock market rally of the past month might be due to something more mundane:

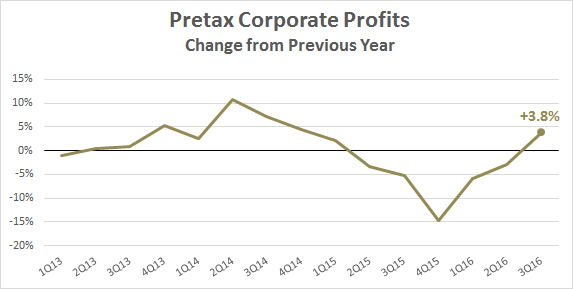

The 6.7% rally since then, much of it since Election Day, has largely been attributed to the potential for tax cuts, looser regulation and fiscal spending under the president-elect. But the rise has also coincided with a fundamental improvement: U.S. companies’return to earnings growth.

“It’s earnings growth that drives stocks over the long term,” said Tom Cassidy, chief investment officer at Univest Wealth Management Division…Earnings for companies in the S&P 500 grew 3.1% in the third quarter from a year earlier, according to FactSet, entering positive territory for the first time since the first quarter of 2015, when they grew 0.5%. Analysts polled by FactSet expect the rebound to continue, and are estimating a 3.2% growth rate in the fourth quarter of 2016.

The third quarter, needless to say, was back when everyone was expecting Hillary Clinton to be the next president of the United States. Corporations may indeed be excited by the prospect of lower taxes and the end of pesky regulations, but if you want to know why the stock market is rallying, profitable companies are a more likely explanation than anything Trump is promising.