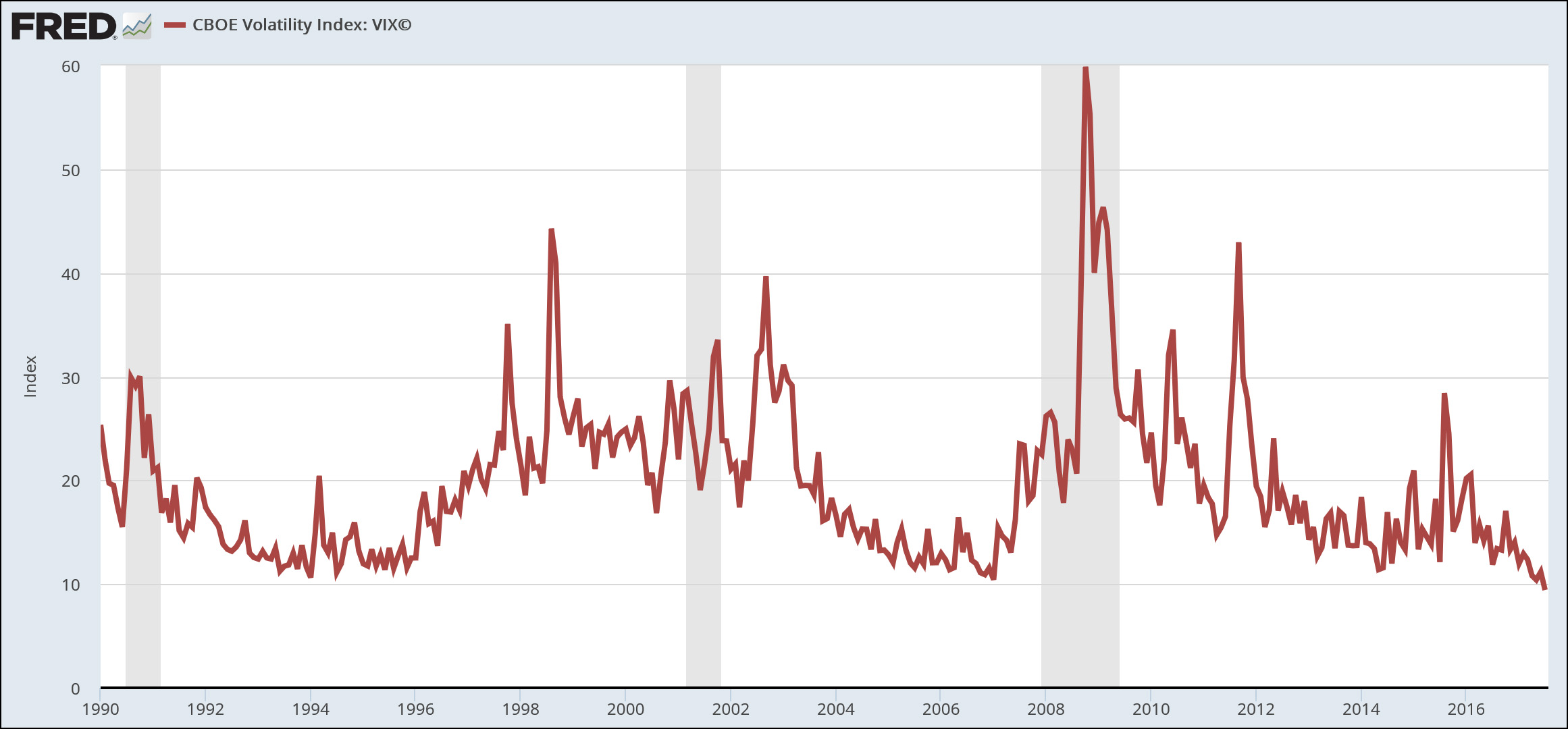

The Wall Street Journal reports that the VIX volatility measure is near its all-time low:

A key measure of market volatility is on pace to set a new all-time low for the first time since 1993….The VIX tends to rise when investors are anxious and stocks are falling. The opposite is happening Tuesday, as equities are rising around the world thanks to a positive reading of business sentiment in Europe and some good corporate earnings results from companies including Caterpillar Inc. and McDonald’s Corp.

With a close under 10 on Tuesday, the VIX will have closed in single digits in nine straight sessions—by far its longest streak ever….Many investors and analysts say markets are eerily calm this year and that a surge in volatility could be on the horizon if stocks slip from their recently-set record highs.

So what does it all mean? Beats me:

The VIX was low in 1994 and nothing happened. It spiked in 1998 and nothing happened. It was low again in 2006, and nothing happened. It spiked in late 2008, long after the Great Recession had already started. Now it’s low again.

My gut tells me that a low VIX spells complacency and leads to a greater tolerance for stupid risks, which eventually produces a recession. But the data doesn’t really suggest that it means much of anything.