One of my regular readers emailed today to note that the price of oil has been creeping up over the past six months:

Admittedly, oil prices are volatile, but it’s possible to see a pattern in longer-term views. The worldwide supply glut from fracking in the 2014-2016 window (which decreased prices) has been taken up by increasing demand. Now we are at supply-limited pricing again, with fracking included. So if there’s any shock to supply, unless the Saudis open up the spigots (if they can), the price will spike up. I don’t sense wide awareness of this.

That got me curious. Here’s what long-term oil prices look like over the past 40 years:

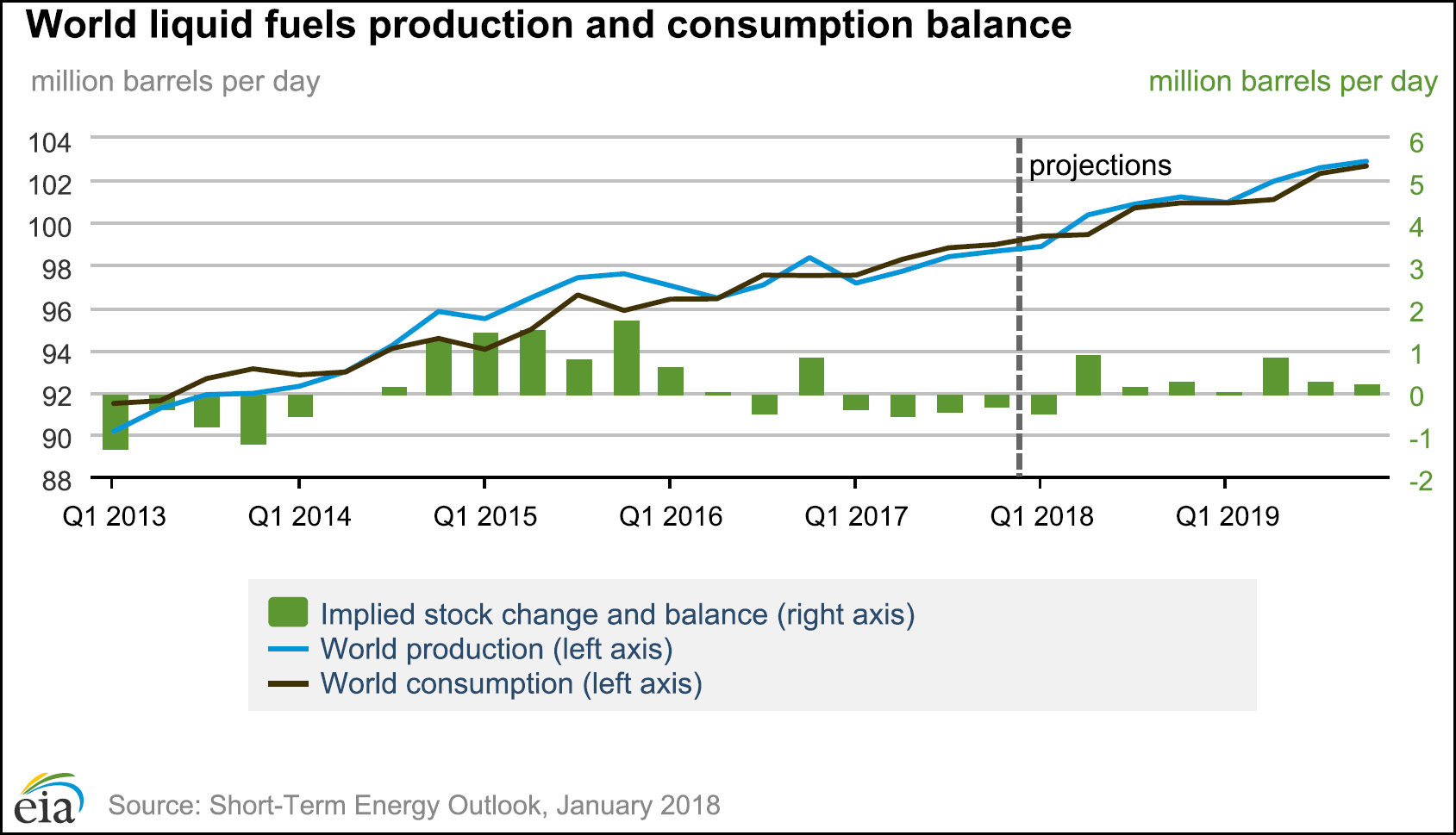

There’s nothing that looks especially concerning in these numbers, but the basic oil-recession cycle is fairly simple: (a) economic expansion leads to higher demand for oil, (b) demand eventually bumps up against supply constraints, (c) oil prices spike, (d) leading to a recession. However, the Energy Information Administration seems to think supply will continue to keep up with demand over the next couple of years:

For the time being, it doesn’t look like oil will be a constraint on growth in the near future. But ask me again next month and I might change my mind.