The Congressional Research Service has analyzed the 2017 Republican tax bill and concluded that it had no noticeable effect on GDP, consumption, domestic investment, or wages. But wait! What about the reinvestment of overseas profits, which the act allowed companies to repatriate at a low tax rate?

One of the major sources of anticipated increased investment through supply-side effects is international capital flows….Some also argued that eliminating the tax barrier to repatriating funds (as was done with the tax revision) would lead to reinvestment in the United States of unrepatriated earnings held abroad in U.S. subsidiaries.

Let’s check! What happened to all those repatriated earnings?

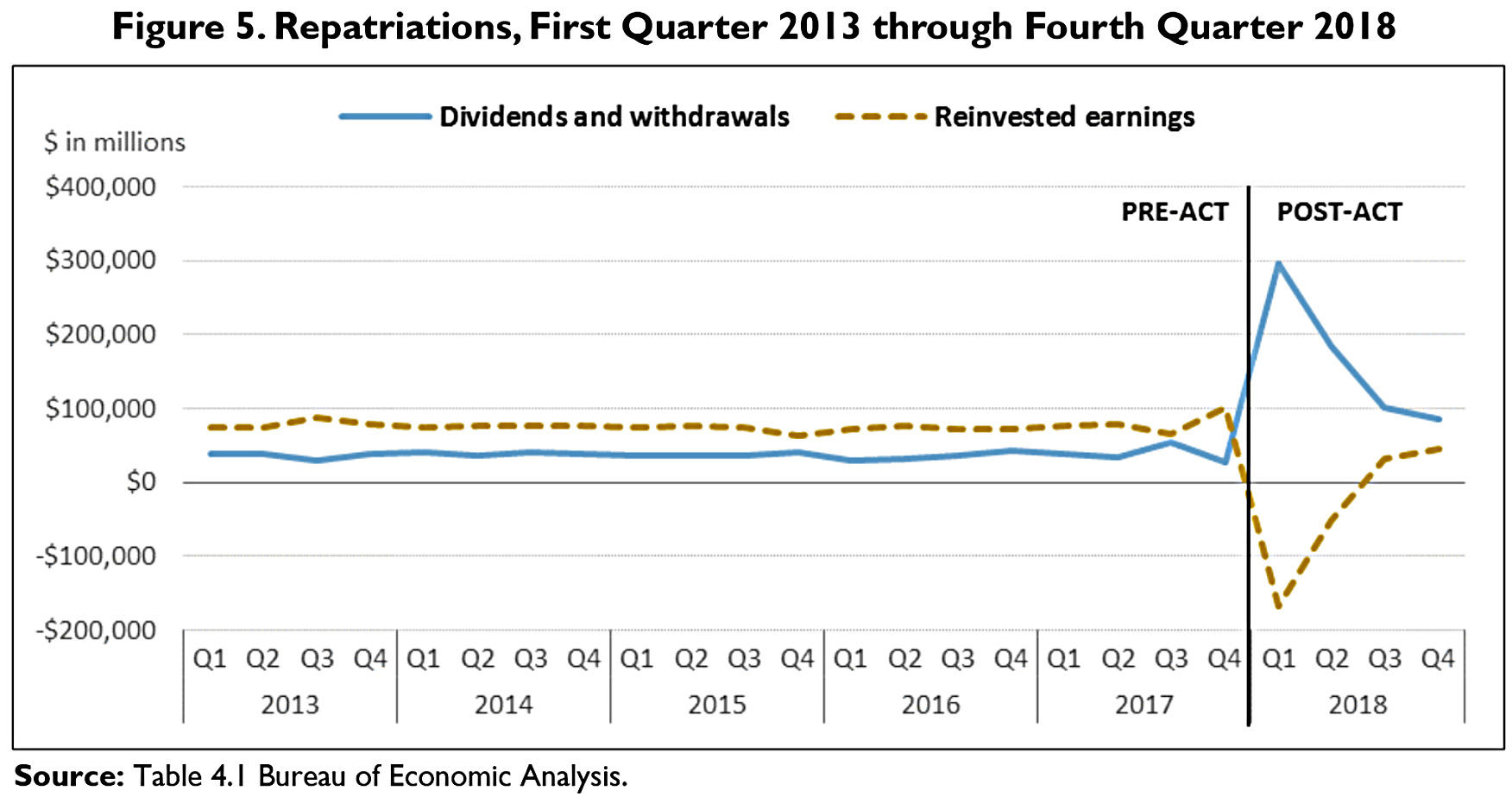

Companies repatriated more than a half-trillion dollars (blue line), but reinvested earnings actually turned negative for a couple of quarters before returning to the same level as before. End result: bupkis. Nice work, Republicans.

Of course, none of the Republican arguments in favor of the tax act were offered in good faith anyway, so it’s hardly a surprise that it had little to no effect on the economy. As the report puts it, “Fiscal stimulus is limited in an economy that is at or near full employment.” The real goal of the tax act was to reduce the taxes of corporations and rich people. Rep. Chris Collins explained things elegantly: “My donors are basically saying, ‘Get it done or don’t ever call me again.'”

So they got it done. Now their donors are happy and will continue contributing money to Republican candidates. What’s not to like?