Richard B. Levine/Levine Roberts via ZUMA

The WeWork saga is nearing an end:

SoftBank Group Corp. won approval from WeWork’s board to take control of the troubled co-working startup, in a deal that would hand co-founder Adam Neumann nearly $1.7 billion and sever most of his ties with the company….The deal is expected to value the company at about $8 billion, a far cry from what it was expected to fetch in an initial public offering earlier this year and even less than the $47 billion at which a January investment from SoftBank pegged its worth.

This whole thing is even crazier than it looks. For starters, the outside world has known for years that WeWork’s business model was nuts. The Wall Street Journal made that clear two years ago and there were plenty of hints years before that. The company was a nothingburger propped up by the mad stylings of Adam Neumann.

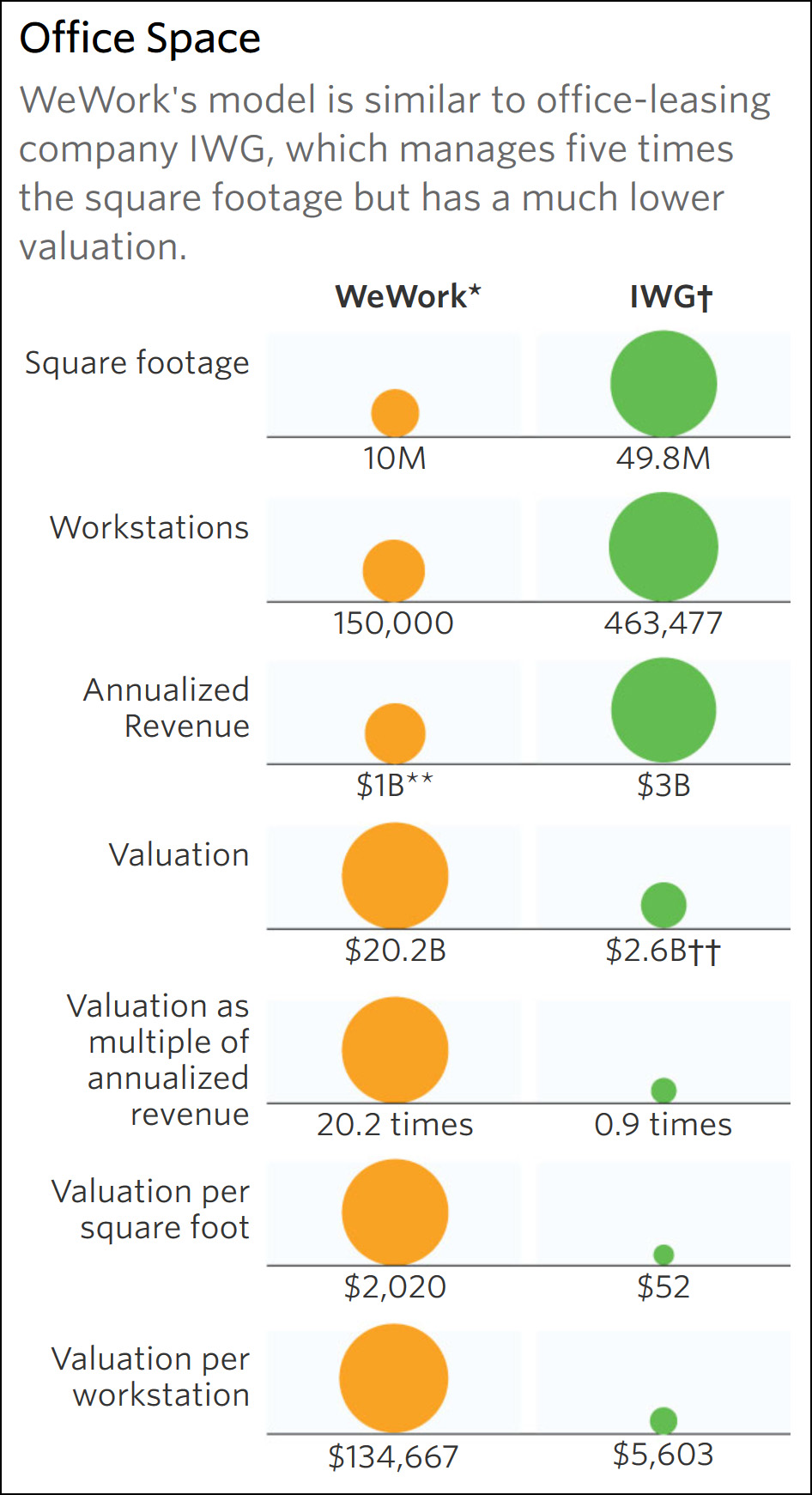

What’s even crazier is that SoftBank must have known this all along. It’s one thing for the outside world to be fooled, but Softbank was a major investor. They must have seen the books. They must have known about Neumann’s sketchy insidery deals. They must have known there was nothing really special about yet another office leasing company, even if it did “activate the space” and appeal to millennials. Space is space.

So how is it that within the span of ten months, SoftBank reduced its valuation of WeWork from $48 billion to $8 billion? Was their January valuation all just part of the scam?

And here’s another little nugget to chew on: even now, on a revenue basis, WeWork is valued at more than 5x the level of IWG, its stodgy old competitor that does pretty much the exact same thing they do. Even after all the revelations of the past few weeks, WeWork still looks plenty overvalued.