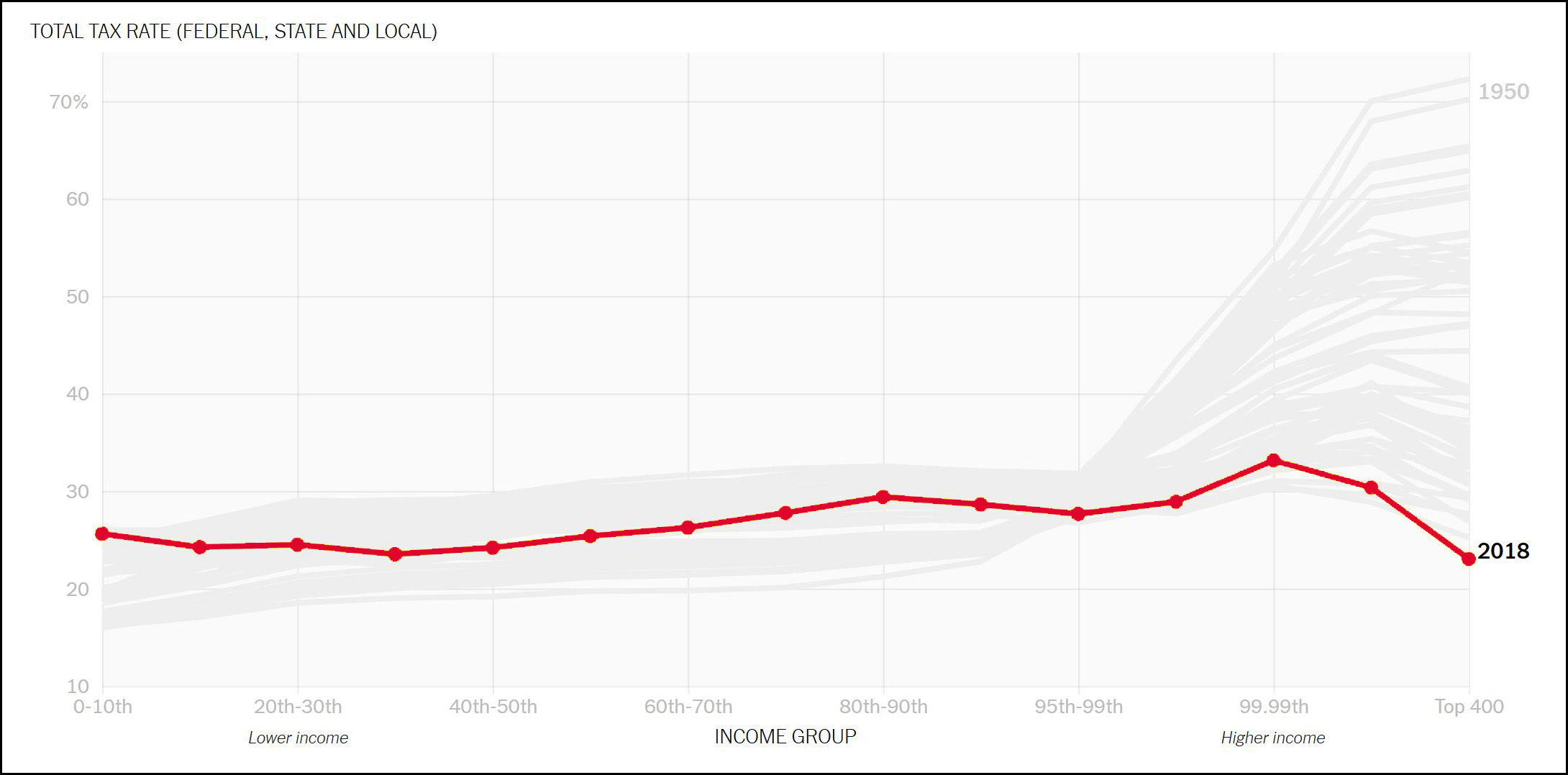

David Leonhardt presents us with a chart today based on data from a new book by Emmanuel Saez and Gabriel Zucman. It shows the effective total tax rate for all income levels in the United States. This includes all state, federal, and local taxes:

The effect of the latest Republican tax cut shows up in the 2018 line: the very richest Americans now pay a total effective tax rate of 23 percent. The poor and the middle classes, by contrast, pay about 25 percent. As you can see, the tax rate for the rich has been dropping steadily for half a century.

The federal income tax code, of course, remains progressive. But it’s no longer progressive enough to make up for payroll taxes and local sales taxes, which have always been regressive. As a result, conservatives have finally reached their dream of a flat tax by stealth. It makes you feel all warm and fuzzy inside, doesn’t it?