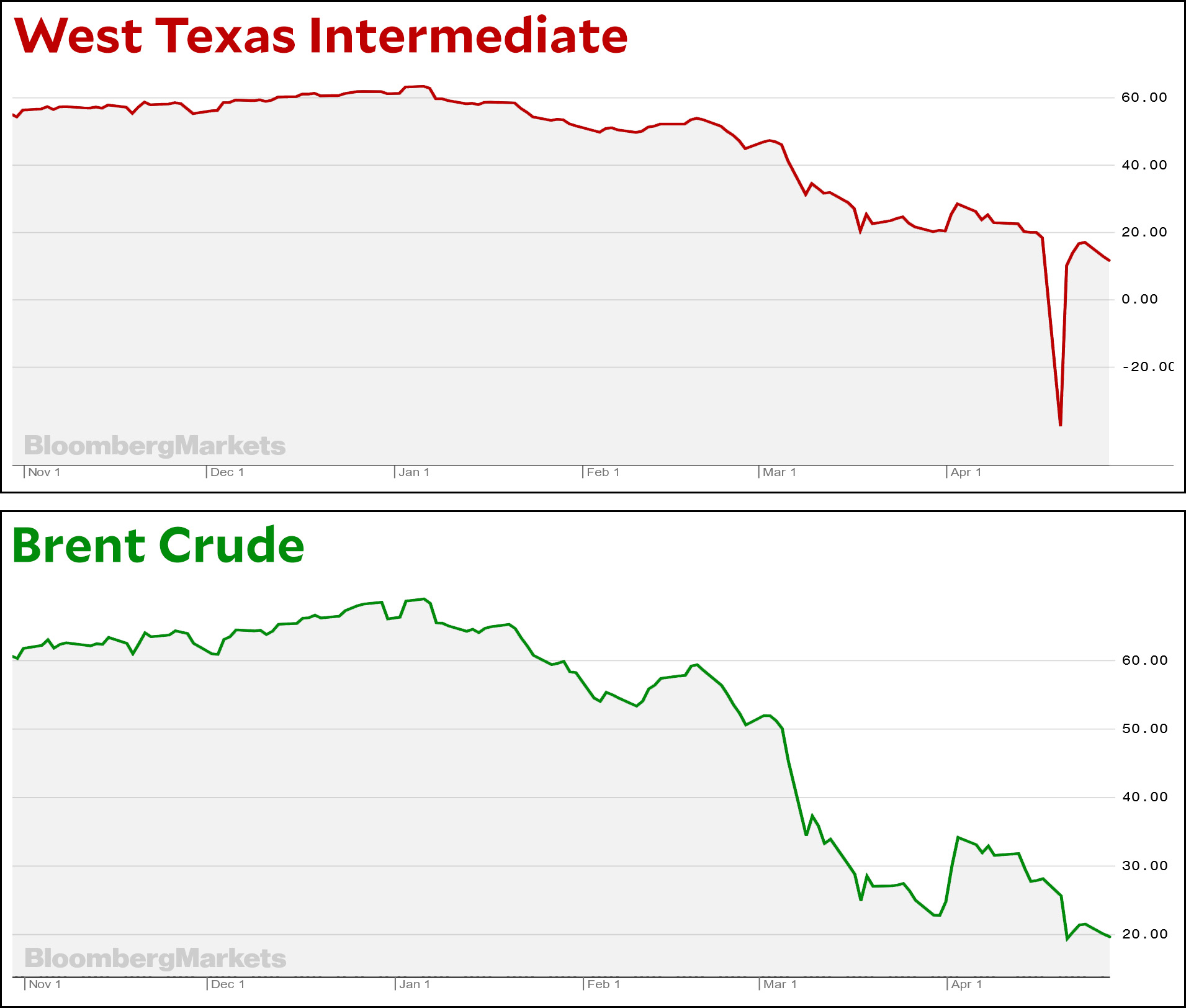

The press is yet again filled with stories about how the oil market is in chaos. “20 minutes that broke the oil market” blares Bloomberg about the March 20 WTI meltdown, even though it was really 20 minutes that broke one particular futures market for one particular grade of oil for delivery in one particular place. In any case, here is Bloomberg’s own chart of oil prices as of this morning:

Honestly, I don’t see anything that anyone should consider unexpected. Oil prices were primed to go down by squabbling between Russia and Saudi Arabia, and then, starting in March, reduced demand from COVID-19 sent them on a steady downward course. Since mid-March WTI has been dropping at a steady pace aside from a single day, while Brent’s downturn has been noisier but more moderate.

Obviously these are not good days for anyone who’s long oil, but there’s a big glut and reduced demand thanks to the coronavirus lockdowns. It’s hardly a big shock that oil prices are continuing to drop. Wake me up when crude goes down to a buck a barrel.