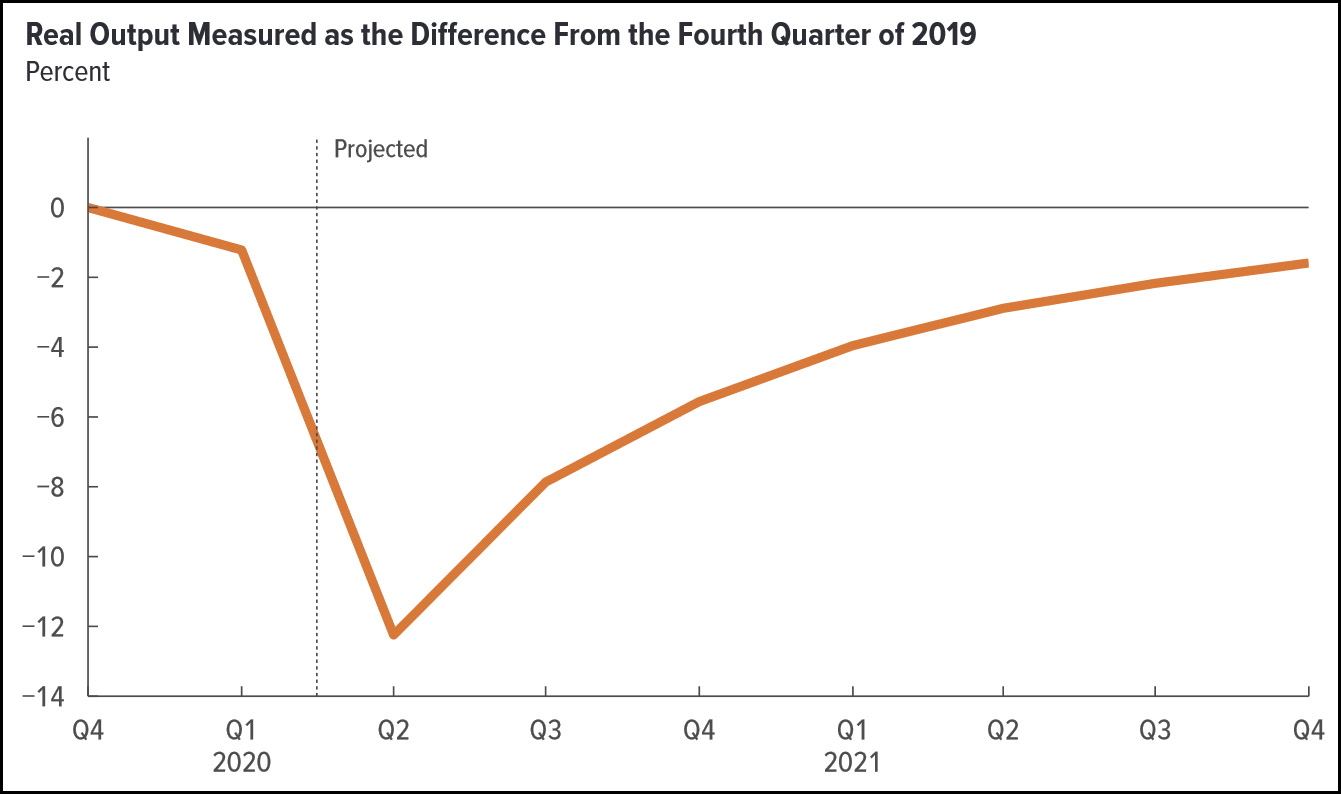

The Congressional Budget Office has produced a forecast of economic growth that takes the COVID-19 pandemic into account:

By the end of 2021, rapid growth means we’re about 1.5 percent below the level we’d be at without the pandemic. Obviously that’s not great, but it’s not too bad either. So how long does it take to make up the rest of the difference?

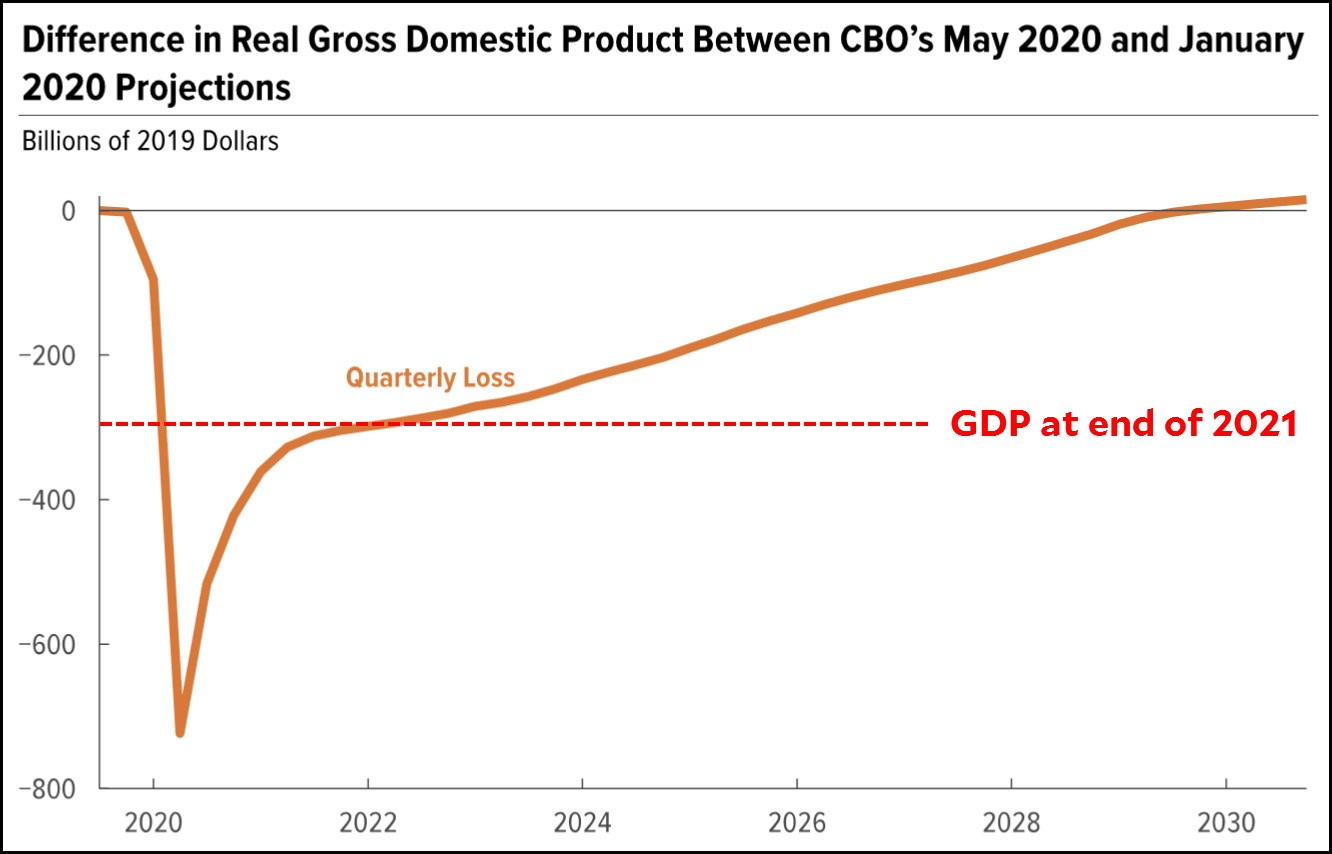

We don’t get back fully to normal until 2029. (Note that this chart is in dollars. $300 billion is equal to 1.5 percent of GDP.)

Now, the economists at the CBO are good, but there are plenty of other good economists out there too. What’s more, this is an unusually hard forecast to do. This one shouldn’t be taken as gospel unless it gets widely confirmed. It’s also worth noting that this forecast assumes COVID-19 is on the wane and the economy will steadily open up throughout the year. This is, obviously, far from a certainty.

All that said, if you believe a forecast like this then it’s pretty obvious how to respond: with a lot more spending. There’s not a whole lot left that monetary policy can do, and there’s no reason we should have to wait until 2029 for full recovery.

Job 1, as always, is to get the virus under control, since there will be no recovery at all without that. Job 2 is another big spending bill this year and probably yet another one next year. We can argue about what to spend the money on (aid to states, aid to small businesses, infrastructure, etc.), but there shouldn’t be much argument that it needs to done. This is no time to start clutching our pearls over the deficit.