In 1733, James Oglethorpe established Georgia as a haven for the “worthy poor” to work off their debts. If he’d only known that nearly 275 years later, the entire United States would be a giant debtor’s colony, one nation in the red, subject to compound interest, indentured to Citibank.

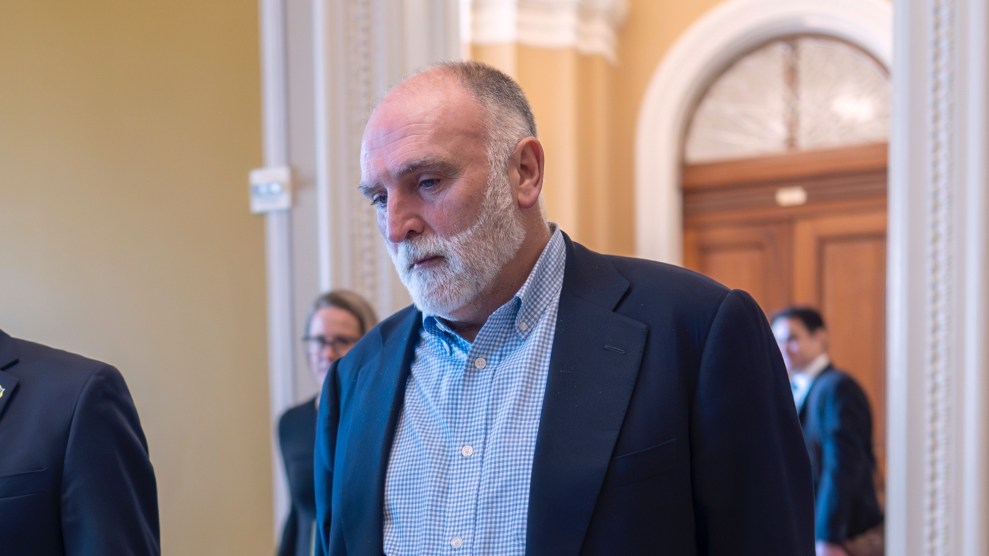

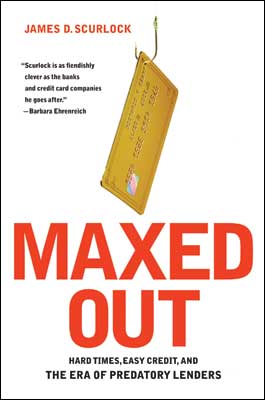

This is the bleak financial landscape explored in Maxed Out, an enlightening tour of America’s dangerous love affair with easy credit. James Scurlock, a Wharton grad who blew his inheritance on a Boston Market franchise, is an engaging guide to the corporate numbers games and the personal side of financial ruin. As he tours the country filming a documentary (just released under the same title), he meets collection agents, personal finance gurus, families with kids or moms who killed themselves to avoid credit card bills, and Dee Hock, the aptly named visionary who realized Visa could get away with charging 18 percent interest. He also elicits some frightening admissions from people in the credit business, such as the mortgage broker who explains how he helps clients lie about their incomes so they can “afford” $400,000 homes, knowing that the banks turn a blind eye to such tricks.

This kind of enabling by financial professionals infuriates Scurlock. Back in the day, lenders protected clients from loans they couldn’t handle. Today, they aggressively market debt as a product—not a liability, but a lifestyle choice. The rules of sound finance have become so twisted that the industry has nothing but contempt for its “good” customers: Low credit card balances actually hurt your credit rating, and if you’re one of the lucky few who can pay off your bills each month, you’re what’s known in the biz as a “deadbeat.”