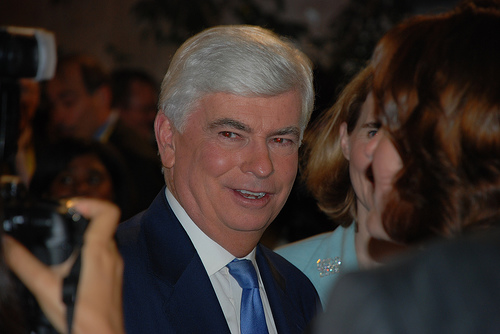

Mike Konczal makes an intriguing—and troubling—point about how much Sen. Chris Dodd’s potential financial reform bill could end up resembling the House GOP’s little known financial bill from last year. Case in point: a new consumer protection agency.

The House GOP’s bill envisioned a watered-down Office of Consumer Protection placed within a new consolidated regulator called the Financial Institutions Regulator. The OCP would have to jump through a number of hoops to pass new consumer-related rules, would create a new consumer protection hotline, and would report to Congress on consumer-related issues. And in a sign of the OCP’s insignificance, its leader would be handpicked by the heads of existing regulators, like John Dugan of the Office of the Comptroller of the Currency and Sheila Bair of the FDIC. The likenesses between the GOP’s consumer plan and Dodd’s—which would put a regulator within the Fed or Treasury—are striking, Mike says:

Someone in the basement of a more senior regulator, who will need the permission of the banking regulators to do anything, and whose actions will entirely be subject to their review. Actually I’m not sure if the Senate bill will be this strong—nobody has mentioned having a dedicated hotline in the Senate bill.

Now, to be fair, Dodd says he’s going to push hard for an “independent” consumer agency—one that might be housed in the Fed or Treasury but would have a presidentially appointed leader, independent budget, and rulewriting and enforcement power. If that’s the case, then that’s a significant difference between Dodd and the House GOP.

Mike adds that the bankruptcy code changes suggested by the GOP sound an awful lot like those leaked out of the Senate’s talks, as does the (lack of) derivatives reforms. Ultimately, we have to wait until Monday to see how much Dodd’s bill looks like the House GOP’s. But if, come next week, it does, we’re in for a war if and when the Senate and House, who passed a relatively tough bill in December, try to merge their two financial reform bills later this year.