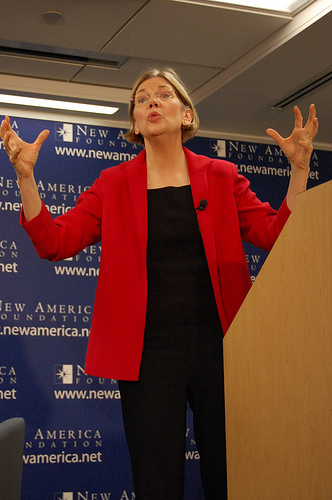

Flickr/<a href="http://www.flickr.com/photos/newamerica/4434873617/">New America Foundation</a>

Add this name to the GOP’s wish list of Democratic legislation targeted for rollback or repeal if John Boehner, Mitch McConnell, and the rest win back the House, Senate, or both: the new Bureau of Consumer Financial Protection.

On the heels of consumer advocate Elizabeth Warren’s nomination to get the consumer bureau up and running, Sen. Richard Shelby (R-Ala.) said yesterday he’d “revisit” the financial regulatory reform bill passed by Congress in July if Republicans wrest back control of Congress after November’s midterm elections. A powerful conservative voice on financial issues, Shelby set his sights on the consumer bureau, an organization he’s long opposed. He said at a Reuters conference that the “consumer agency bothers me most.” He added, “I thought the creation of it and the way it was created was a mistake.”

This isn’t the first time Republicans have threatened to uproot already-passed legislation. For months, the party has said it plans to attack Democrats’ historic health care reform bill, attacking various pieces if they can’t repeal it outright. Sen. Orrin Hatch (R-Utah), for instance, has offered a new law that would nullify the requirement in the bill that employers offer health insurance to workers or pay a penalty, a centerpiece mandate in the law. GOPers also want to reverse cuts made to Medicare and blunt the effect of a new agency that would identify cost-cutting opportunities within Medicare.

So it’s not at all surprising Republicans are going after Obama’s other major legislative accomplishment. For them, the creation of the consumer bureau, an independently funded outfit housed within the Federal Reserve, was bad enough; appointing Warren, a polarizing figure disliked by the financial services industry, only deepened the opposition. Said Shelby, “I believe she’s got a big ax to grind and she’s sharpening that ax. I don’t think that you need somebody in a position like that with all these preconceived ideas and I believe she has a lot of them.”

All of the GOP’s bluster is, for now, just that. But if they really do intend to chip away at the Dodd-Frank financial reform bill, it will be an exercise in sheer hypocrisy (not that that’s unheard of in either party). After all, Republicans consider themselves the party of the people, looking out for the ordinary Joe. Well, that’s exactly who the consumer bureau was created to protect, cracking down on predatory mortgage lenders, check cashers, and more.

What’s more, GOPers have complained that the uncertainty surrounding the financial reform bill’s passage and implementation is a cause for the economy’s sluggish recovery. Employers don’t know how the dust will settle, the thinking goes, so they’re sitting on cash and not hiring. By that logic, trying to repeal or roll back the bill will only extend that uncertainty—and this time, Republicans will only have themselves to blame.