Sen. Sherrod Brown (D-Ohio)—one of the most vocal opponents of Obama’s tax deal—has changed his mind and will now support the bill. Brown, one of the most liberal members of the Senate, was one of a small handful of Senators who voted against moving the tax bill forward on Monday. But he’s since flipped his position and will support its final passage in a vote scheduled to take place in the Senate on Wednesday afternoon, according to a press statement from his office.

Brown told the Washington Post that “he changed his mind after speaking with his minister and reading letters from constituents who are struggling to find jobs in his hard-hit home state.” His office added that Brown had “fought to improve the bill” by filing amendments that would attempt to rein in Chinese currency manipulation, provide clean energy manufacturing tax credits, and extend health care tax credits to the unemployed. It’s unclear whether Brown’s amendments stand any chance of passage, but the move gives him a means of expressing his desire to reform the legislation in light of his reversal.

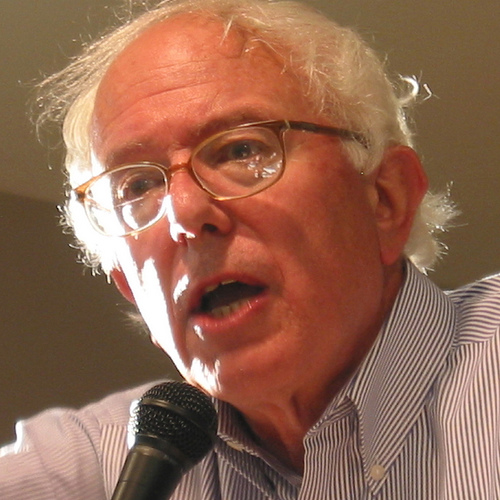

On Friday, Brown had even joined Sen. Bernie Sanders (I-Vt.) during his “filibuster” of the legislation, together with Sen. Mary Landrieu (D-La.)—who also later decided to support the legislation. He told the Post that he voted against moving the bill forward “to send a message to the House that there are allies here.” But Brown’s decision to vote for its final passage will undermine the House liberals’ already weakening hand. Even so, a handful of defiant House members are still fighting to alter and offer up amendments to major pieces of the legislation, like the estate tax and payroll tax provisions. But, as Brian Beutler reports, there are growing indications that the House Democratic leadership won’t be willing to whip up support for those changes at this point.