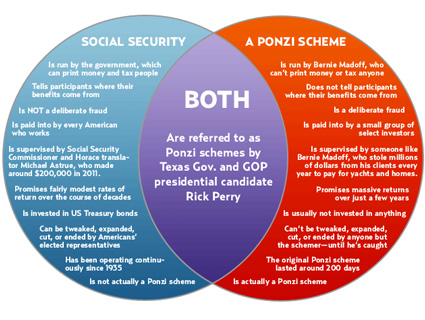

For the second consecutive Republican president debate, pizza mogul and talk radio host Herman Cain has suggested the “Chilean Model” as a way to fix Social Security. Never mind that it’s Medicare, not Social Security, whose runaway costs pose a long-term threat to the nation’s fiscal health—what the heck is the Chilean Model? And do we want it?

As it happens, we’ve been down this path before. It was 2005, and then-President Bush was floating a proposal to privatize Social Security—to ensure, he explained, that it would still be there for future generations. Bush turned to the Chilean model, which itself was a product of the Chicago School of Economics, brought to South America by economist Milton Friedman. Here’s how Barbara Dreyfuss explained it in a MoJo piece that year:

With labor’s political power in check, [former labor minister José] Piñera focused on privatizing the pension system. He saw as his biggest obstacle the “tenacious belief that Social Security could and should be an effective vehicle for the redistribution of wealth.” The new system, adopted in 1981, required all new workers to sign up for private pension accounts and offered financial incentives for those in the public retirement system to switch.

The transition was expensive and funded by slashing government programs, selling off state-owned industries, selling bonds to the new pension funds, and raising taxes. Privatization costs, which also included a government subsidy for workers unable to accumulate enough in their private accounts to guarantee a minimum income in retirement, averaged more than 6 percent of Chile’s gross domestic product in the 1980s and are expected to average more than 4 percent of GDP each year until 2037.

But while the reform’s supporters argue it has been a major success story, officials both inside and outside Chile now increasingly question whether the high costs and modest investment returns have doomed Piñera’s original promise: a decent retirement income for workers at a savings for the government. Last year, the World Bank, which until recently encouraged countries to privatize pensions, published a highly skeptical report on private retirement systems in Latin America; Truman Packard, one of the report’s authors, says the bank has told the Chilean government that it must spend more to subsidize the private system and “increase its role in preventing old-age poverty.”

The full piece is worth your time. Check it out.