<a href="http://www.shutterstock.com">Raymond Gregory</a>/Shutterstock

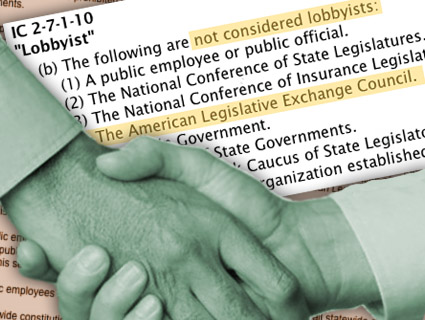

The American Legislative Exchange Council, the corporate-funded group that generates nearly a thousand pro-business model bills per year and feeds them to state legislatures nationwide, is holding its annual policy summit in the nation’s capital this week to meet with new state lawmakers and “prepare the next generation of political leadership.” This coincides with the release of a report showing that ALEC’s economic prescriptions are not good for the economy.

Each year, ALEC ranks the states on how tightly they adhere to the group’s policy recommendations—from personal and corporate tax rates, to public sector employment levels, to right-to-work laws—as a predictor of their economic growth. The study released Wednesday, by the Iowa Policy Project and Good Jobs First, two policy groups that promote economic growth at the state level, introduces those rankings to reality. It concludes: “A hard look at the actual data finds that the ALEC…recommendations not only fail to predict positive results for state economies—the policies they endorse actually forecast worse state outcomes for job creation and paychecks.” (Though the report is careful to maintain that though ALEC policies are correlated with less prosperous state economies, that doesn’t necessarily mean the policies caused economic decline.)

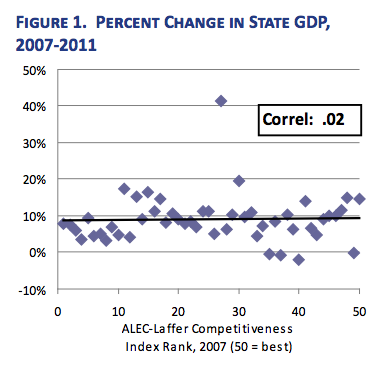

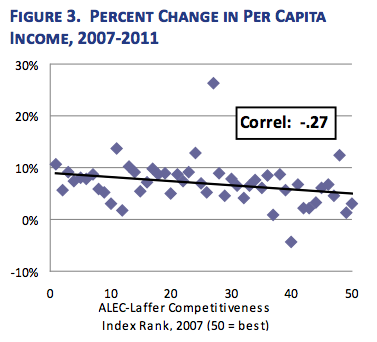

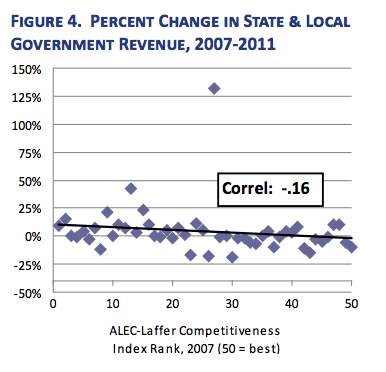

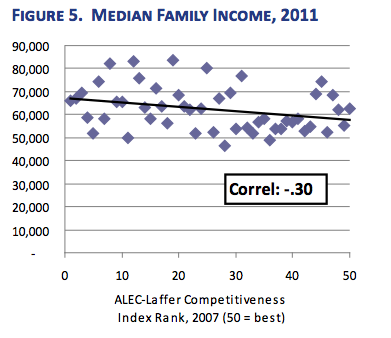

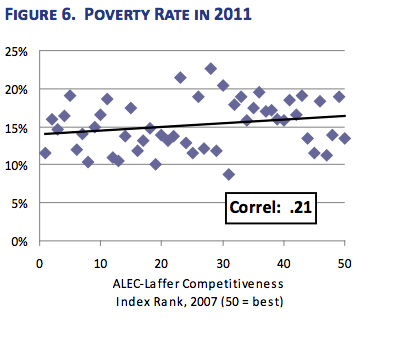

Let’s take a look. In six key measures of economic growth, ALEC’s “Economic Outlook Rankings” fail to coincide with the actual economic outlook of a state over time. On the horizontal axis we have all 50 states’ ALEC economic grades from 2007, when ALEC started its ranking system. The vertical axis shows the percent change in actual economic performance from 2007 until last year. If ALEC’s fortune-telling were correct , the plotted points would form an upward, rightward line, with a better score corresponding with a better economy. But what happens is pretty much the opposite:

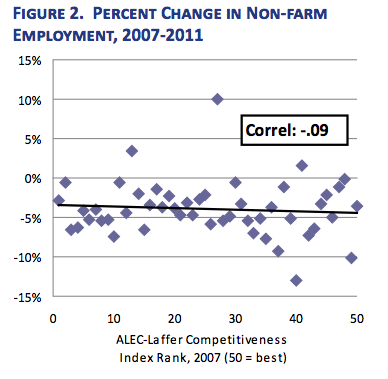

Note the downward slope:

Whoa, downward slope:

A better economy means higher incomes, means more tax revenue, right?

Aaaaand upward slope:

Instead of boosting states’ fortunes, the report finds that ALEC’s preferred policies seem to provide “a recipe for economic inequality, wage suppression, and stagnant incomes, and for depriving state and local governments of the revenue needed to maintain the public infrastructure and education systems that are the true foundations of long term economic growth and shared prosperity.”

Instead of boosting states’ fortunes, the report finds that ALEC’s preferred policies seem to provide “a recipe for economic inequality, wage suppression, and stagnant incomes, and for depriving state and local governments of the revenue needed to maintain the public infrastructure and education systems that are the true foundations of long term economic growth and shared prosperity.”