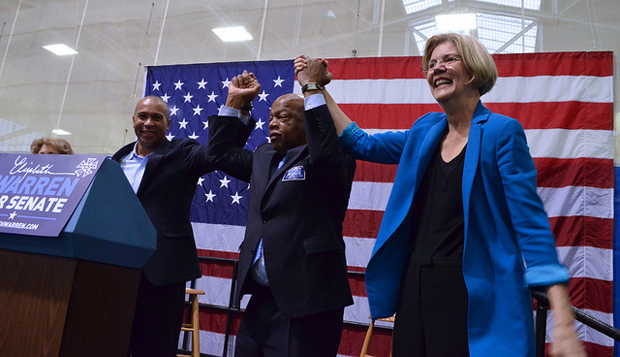

If Scott Brown really is thinking of running for Senate in New Hampshire next year, he has an odd way of showing it. In May, the former Massachusetts Republican senator will travel to Las Vegas to give a topic at the SALT Conference, an annual confab put on by the hedge-fund giant Skybridge Capital. His topic: The consequences of over-regulating hedge funds.

Although Brown touted his crucial vote for the Dodd–Frank Wall Street reform law during his re-election campaign against Sen. Elizabeth Warren, he was widely credited with watering the financial-reform legislation at the behest of Wall Street interests. Among other things, Brown used his position as a tie-breaker to loosen the regulations on how much control banks could have over hedge funds, and to make it easier for them to use federal bailout funds to bail out failing hedge funds. (He brought in more than $3 million in campaign donations from the financial sector during his two campaigns.) Sure enough, in March Brown took a new gig at Nixon Peabody LLC, a law firm that services large Wall Street shops. As a release from the company explained at the time, “Brown will focus his practice on business and governmental affairs as they relate to the financial services industry.”

The trip to Vegas looks like a sign he’s focusing on the job he has now, not the job he might want later.