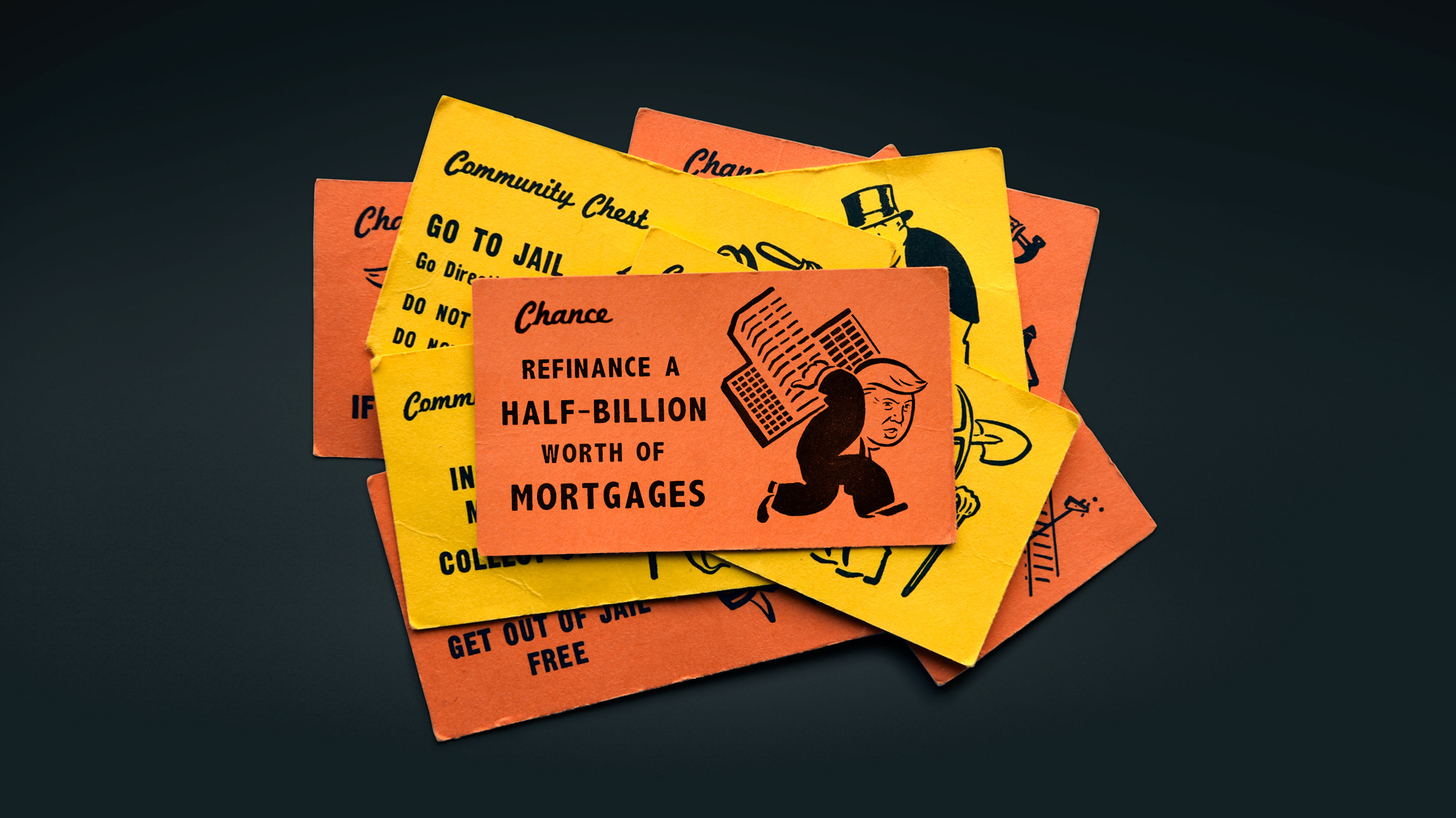

Win or lose in November, one thing won’t change for Donald Trump: Over the next few years, his company must settle a series of whopping debts. Before the end of a theoretical second term, his company will have to refinance—or, in a far less likely scenario, pay off—nearly a half-billion dollars in loans linked to some of his most prized assets, including Trump Tower. These debts are maturing at a perilous moment for Trump, whose hotels and resorts have been plagued by declining revenues. And that was before the coronavirus pandemic pummeled the hospitality industry in general and the Trump Organization in particular, forcing the full or partial closure of most of its hotel and resort properties.

On financial disclosure forms, Trump has reported holding 14 loans on 12 properties. At least six of those loans, representing about $479 million in debt, are due over the next four years. Some are guaranteed by Trump himself, meaning a creditor could come after his personal—not corporate—assets if he defaults. If he holds onto the White House, the refinancing of these debts could take his conflicts of interest to absurd new heights. How will the public know if these deals are on the up and up or whether Trump is receiving sweetheart terms from a bank that wants an in with the president? And what might a lender desire in return for helping Trump out of a financial jam?

Trump’s biggest creditor is Deutsche Bank, which in the late 1990s took a gamble on the real estate developer whose history of corporate bankruptcies made him untouchable by most other lenders. Although Trump and the Frankfurt-based bank pulled off several profitable deals, eventually Deutsche’s commercial lending division learned the hard way one reason why other banks considered him persona non grata: If pushed by his creditors on payments, Trump shoves back. In 2008, after he defaulted on a loan for his Chicago hotel and condo development, he filed a multibillion-dollar suit accusing Deutsche Bank and others of contributing to the recent financial meltdown, which he blamed for his inability to repay the loan.

Nevertheless, Deutsche’s private banking division, which caters to wealthy clientele, continued to lend to Trump, giving him $125 million, spread over two loans, to finance the purchase and renovation of his Doral golf resort in 2012. Both are floating rate loans, meaning the interest rate fluctuates based on market conditions, which lending experts say usually indicates they are interest-only loans. If so, Trump probably hasn’t paid down much if any of the principal and will owe something close to the whole $125 million when the loans come due in 2023.

In 2014, Trump took out a separate floating loan from Deutsche’s private bank to bankroll the development of his luxury hotel in Washington, DC. The balance of this $170 million debt is payable in 2024. That year, Trump will also owe Deutsche between $25 million and $50 million in connection with his Chicago hotel and complex.

Trump has received additional loans from a company named Ladder Capital, a financial firm that specializes in bundling commercial debt into mortgage-backed securities. Companies like Ladder are often lenders of last resort for people and companies that, for one reason or another, have difficulty obtaining money from traditional banks (ahem, Trump). Such firms are willing to take risky bets because they securitize the debt and pass the responsibility for it on to investors. Trump has two Ladder loans due over the next several years: a $100 million interest-only mortgage on Trump Tower and a roughly $13 million loan against Trump Plaza. The Trump Tower loan is up in September 2022.

Trump’s large, interest-only loans are not unusual for big real estate developers, who, unlike your typical homeowner, are not seeking to pay off the mortgage on their properties. It is common for developers to take out new interest-only loans as the old ones come due, in some cases using a property’s rising value to extract more cash. Trump, for example, has long had a mortgage on Trump Tower, never paying it off and periodically increasing the loan’s size when he refinances.

But under present circumstances—with Trump a lightning rod for controversy, the economy faltering, and his company not faring well—it may not be easy for Trump to convince either Deutsche or Ladder to refinance.

Suffering from its own shaky finances and a series of scandals—involving interest-rate rigging, money laundering, and other unsavory practices—Deutsche has experienced a rocky few years. Its ties to Trump have compounded its woes, making it a magnet for subpoenas from congressional committees, as well as a New York City grand jury, seeking Trump’s financial records.

Even before Trump was elected, Deutsche executives soured on the relationship, turning down Trump’s request for a $10 million-plus loan in early 2016, the New York Times reported. They worried, among other things, how it would look if Trump defaulted and the bank had to pursue the assets of the US president. His most recent financial disclosure no longer lists brokerage and savings accounts at Deutsche’s private bank, suggesting he’s no longer a client.

Nancy Wallace, a real estate finance professor at University of California, Berkeley’s Haas School of Business, says the scrutiny that Deutsche Bank has faced may scare off other banks. “I think any bank I can think of in the United States would have exactly the same response: He is toxic. Exposing yourself to that kind of oversight under the current regulatory reality, for lenders who are large enough to provide capital to him, is just a nonstarter.”

Mike Offit, a former Deutsche Bank executive who was one of Trump’s bankers in the 1990s, predicts that if Trump remains in office, Deutsche will give him short-term extensions until he’s out of office. But it won’t do so happily.

“They just have to do the easy thing, which is extend it,” Offit says. “It’s even more trouble if they try to foreclose on the president. Good luck with that. That’s the way they’re going to put themselves back in the news every day.” (Deutsche Bank declined to comment on whether it would extend or refinance Trump’s loans.)

Commercial lending experts say a firm like Ladder Capital, which relies on a more cold-blooded financial calculus, might be more amenable to lending to Trump again. But with his business taking a sharp hit to its revenues for possibly years to come due to the pandemic, Trump might not like the terms, which could be less favorable than those of his original loans. (Ladder did not respond to questions from Mother Jones. Neither did the Trump Organization, the company’s outside ethics adviser, or the White House.)

Kevin Riordan, a longtime real estate finance executive and director of Rutgers University’s Center for Real Estate, says that Ladder prospered in its previous dealings with Trump—but he notes that the economics have changed. Ladder and its competitors in the commercial mortgage-backed securities (cmbs) industry can only lend if there’s a market for real estate bonds, which could dry up during a financial crisis. “This is a whole different ballgame today,” he says. He adds that in recent years the cmbs industry largely ceased financing golf courses—because they are seasonal businesses, they are not considered a safe bet.

“The world has changed a lot since 2012, and I think the Trump Organization is ill-suited for this new world,” Wallace says. “That’s not to say there’s not some private equity firm out there that would be very tempted if he was willing to pay a very high coupon.”

Private equity firms specialize in taking advantage of bad situations—buying properties and debt that most Wall Street firms won’t touch. It’s not that they’re unaware of the risks; the terms of the deals they strike are often designed to ensure they get their money back, one way or another. And they will not hesitate to come after a delinquent borrower—perhaps even a president.

“There are so many opportunistic lenders out there. All of them would do this stuff,” Offit says, noting that hedge funds might also do business with Trump. “They would lend to Ted Bundy. They don’t care.”

In any scenario, Trump’s soon-to-be-due loans are an unprecedented ethical minefield, rife with potential conflicts of interest and the possibility of corruption. “It’s highly disconcerting,” says Virginia Canter, chief ethics counsel at the watchdog group Citizens for Responsibility and Ethics in Washington and a former ethics lawyer at the Treasury Department and Securities and Exchange Commission. “I’m sure in some ways the best thing that could happen is that he not win reelection.”