This story was produced through a collaboration with the Global Reporting Centre.

In the fall of 2020, reporters on three continents coordinated the release of an investigation they named Jersey Offshore. Their stories peeled back veils from the private world of offshore banking. Based on more than 350,000 documents leaked from inside a trust company called La Hougue on the Isle of Jersey, a British Crown possession in the English Channel, the coverage contains information rarely glimpsed by the public.

Amid the data, one document stood out for its candor. That was a memo dated July 6, 2000, from a La Hougue managing director offering a series of options by which the trust company might help a client move money offshore. In the eyes of experts who reviewed the memo, these options could confer significant tax write-offs, potentially pushing the boundaries of legality, and even flout the line between allowable tax avoidance and criminal tax evasion. The reporters who covered the leak came to refer to the document simply as “the 11 ways”—a memo that tantalizingly includes, on its opening page, a line warning the reader not to let it “fall into the wrong hands.”

Well, it did.

We’re presenting the 11 ways here so you can peek into offshore money movement, and so you can bone up on the financial principles at play when reading the Jersey Offshore coverage. But we’re also surfacing this particular memo simply because it’s the sort of thing you never see: a customer-facing document obtained in a big offshore data leak, quoting dollar amounts that few people ever hold in their hands at one time.

In short, it lets you imagine yourself as a member of the global 1 percent looking to outsmart your own government. That’s quite the fantasy, for most of us.

So just lean into it for a minute.

Let’s say you’re pretty damn rich. And you’ve decided you’re through paying taxes. The expense, the stress, the humiliating fair share of it all. You’re already a practiced tax avoider and are now open to the idea of employing a trust company in an offshore tax haven to take things to the next level. But you don’t feel comfortable googling “how to dodge taxes” from your work computer. And it’s not as if fellow big shots review their offshore tax havens on Yelp. Getting started is the hard part.

Here, then. Allow us to slide the 11 ways across your spacious desk made of unethically sourced Amazonian hardwoods. You can’t exactly dial up La Hougue these days, if you ever wanted to: The firm, a word-of-mouth operation even in its heyday, hasn’t operated in Jersey since 2007, when the company’s principals left the little island (and the hassles of newly attentive regulators) to launch a company in Panama. That notoriously permissive tax haven nonetheless revoked their license in 2015. As of January 2021 there is in the British Virgin Islands yet a third company, with secret registered ownership, called La Hougue Trustees Limited. Numerous calls to the BVI Financial Services Commission went unanswered. The author of this memo did not respond when the Jersey Offshore reporters reached out for comment. So we can’t tell you whether these methods are still in play somewhere.

We can, at least, get your wheels turning, thanks to the whistleblowers who leaked this document, among thousands of others, to the reporters. Think of it as a menu for a discerning capitalist like yourself to see options that could be available to you, now that you’ve amassed the kind of riches that not even the government, your family, your ex-spouses, or your business partners ought to be able to access—or even know about.

You’ll note that each of the 11 ways applies an essential premise. We’ve broken them down below and grouped them accordingly so you can better see the patterns at work. Each of the options offers some sort of contrived business deal by which you move money into an anonymous offshore account. And here’s where the genius lies: They design those deals to give you some sort of tax break, whether via false deductions or phony expenses or by artificially erasing your capital gains.

The result for you is a win-win. Well, a win-win so long as neither you nor anyone you care about ever uses roads, hospitals, courts, or any other public good funded by tax dollars. “Only the little people pay taxes,” Leona Helmsley famously said, and she did 19 months in federal prison, so you know she really meant it.

So, yeah, speaking of. You’re no doubt wondering: If you follow these ways to the letter, will you, in fact, be committing a crime? The answer depends on your country’s or state’s laws against evading taxes and defrauding the government. It’s worth noting that putting money in an offshore account is not, in itself, illegal. Making business deals that confer tax advantages is also not, in itself, against the law. But actions that include deliberate deception or obvious bad faith—like when you undertake a business deal solely to avoid paying taxes—are likely to pique the interest of government investigators and tax authorities. And because several of these ways appear to describe what many countries may consider fraud, they could, in fact, invite a knock at your door from people carrying briefcases and badges.

We ran the memo past a couple of tax-specialist law professors (one in California; one in British Columbia, Canada) to get their analysis of the proposals as they appear on the pages. Their consensus: This document is unusually candid—truly the sort of thing you could go your whole career as a tax professional without seeing in print—and, if carried out as written, describes potential unlawful acts under US and Canadian tax laws.

Granted, those rules have tightened in the two decades since the memo. Yet even for its time, they argue, these were brazen.

“I can say that some of these strategies were intended to be arguably effective under Canadian tax law (i.e., creatively avoid Canadian taxes) as the law stood in 2000, when the memo is dated,” writes Geoff Loomer, a law professor at the University of Victoria, in British Columbia, in an email. Loomer studies tax policy and formerly practiced tax law with a major Canadian law firm. “There are other, more concerning transactions proposed here. Some of them involve transactions that would arguably (indeed, almost certainly) constitute ‘shams’ as understood in Canadian tax law. Finally, there are transactions suggested here that in my view involve tax evasion, i.e., deliberate non-compliance with Canadian law.”

So you can make a case for the legality of some of the methods, sure. Yet that may prove difficult if authorities press you. Omri Marian, a law professor and the economic director of the graduate tax program at the University of California, Irvine, School of Law, took a look at the document and replied almost immediately: “I have to say I’m not sure what else I can add other than ‘WTF’? (you can quote me on that). How stupid (or confident nothing will ever happen to you) do you have to be to put this in writing? No, it is not legal. None of it is. Nothing here would withstand even a semi-serious scrutiny from the IRS. In fact, it seems clear that the entire memo is built on the assumption that tax authorities will not be able to discover the true nature of the proposed transactions, which makes the entire thing a criminal endeavor under US law.”

But wait, before you get cold feet, we should note that none of the principals of La Hougue has been charged with crimes related to what’s outlined in this document. And that there are some further nuances at play here. It is routine, of course, for people to “avoid” taxes—that is, to minimize their tax bill within the bounds of the law. Tax lawyers, Marian says, typically examine the law for tiny seams and nooks where they intend to make bold arguments that actions taken or financial deals made on behalf of a client are within the letter of those laws.

What stunned Marian about the 11 ways, in that context, is their brute force.

“I will say that some of the transactions there, under different circumstances, may pass muster,” he says. “I can think of, I don’t want to say legitimate, but I can think of transactional structures that may actually work. The IRS may not like it, but it’s definitely not criminal. And even if it’s not legal, well, worst case is you’re going to get some civil penalties associated with it and you’re going to pay some back taxes.

“But when you outline in such a manner that these are basically fake fees, that there are no real services that are being provided, and you lay out your intention to basically defraud the government in terms of what is the nature of the transaction? I mean, honestly, I’ve never seen anything like that.”

More of Marian’s and Loomer’s analysis will appear below with the specific methods. For the aspiring aggressive tax-avoider, their fine print could present a bit of a buzzkill. A pessimist (one of the little people, perhaps?) may view the 11 ways as charades, as unethical facades. You might rather think of them simply as options for your cover story. Because, if anyone ever turns your name up in a data leak, you’re going to need one.

OFFSHORING STRATEGY: Pay yourself

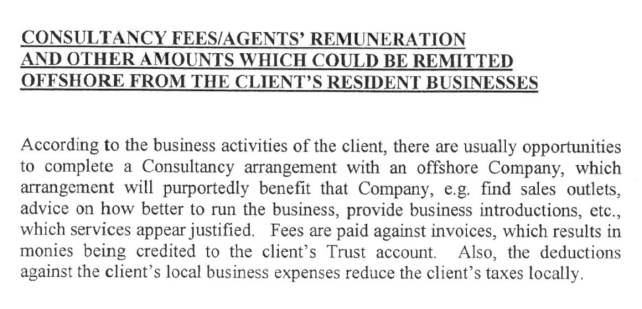

Have your domestic business pay your offshore business. You’re flush with money you’d like to move offshore, so La Hougue is offering two simple methods. The first uses consultancy fees. Hire an offshore company to do some fake consulting for your business (who knows what consultants do anyway, right?). Your payments go to your offshore account, and you get to write off the fees as an expense. The second way invites you to deposit money into your account under false pretenses, in amounts small enough to duck anti-money-laundering disclosure laws.

Method No. 1

How it works: You get set up with an offshore company that you hire as a business consultant. They could be reading you mojito recipes on speakerphone for all you care—they’re just there to bill you. Once you pay them, your money goes into your offshore account, and the cost becomes a tax write-off for your business.

And the fine print: This is the method Marian could imagine structuring in a legit fashion were it not for the passages where, as he puts it, “you lay out your intention to basically defraud the government.”

Loomer concurs that this method is full of landmines. “A Canadian taxpayer running a business can pay deductible fees to a related non-resident person,” he says. “But there are all kinds of concerns here. If fees are paid for an actual business purpose, you would have to consider Canada’s transfer pricing rules and controlled foreign affiliate rules. If the services are fake, this is a textbook example of a ‘sham.’” That is, a transaction entered strictly to avoid tax, which may or may not fall outside the law.

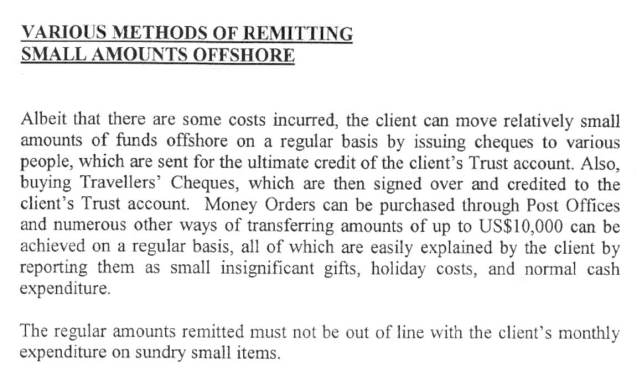

Method No. 2

How it works: You, you’re the generous sort, right? You like taking care of people, after all. So let’s make sure you take care of Numero Uno while you’re at it. For this method, you write checks or hand over business-related money orders to your offshore trust account. They should be tax-free so long as you report them as “gifts,” “holiday costs,” or “normal cash expenditures.” If your local tax authorities don’t penalize generosity, take advantage of their understanding. Just be sure to keep the gifts below $10,000 to avoid the reporting threshold under US law.

And the fine print: “As someone that deals with sophisticated transactions as part of my everyday job, this actually is the one that stood out for me,” Marian says of this method. “The simplicity and the audacity of simply cheating about the nature of payments—this is just plain fraud. This is just plain cheating. I mean, there is nothing sophisticated about it. It’s just plain lying about what you are doing.

“Canadians are allowed to move capital around—that’s fine. But the plan here is clearly to avoid the reporting requirements for transfers of $10,000 or more, and presumably to earn future investment income on that capital without reporting the income. That is straight-up tax evasion.”

OFFSHORING STRATEGY: Invest in guaranteed failures

Lose your money on bad loans or bad investments (but not really). Tax authorities reward the bold by letting them write off certain losses on loans and investments. After all, you took a shot and it didn’t hit—no need to pay twice on that. So you can lucratively lose six-figure sums by lending to and investing in companies that never show a profit (or even care to earn one). Then you get to write off the planned losses at tax time.

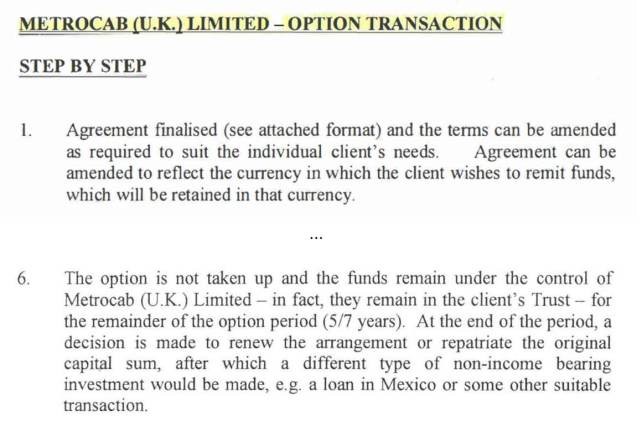

Method No. 3

How it works: You buy options in a taxi cab company La Hougue controls, called Metrocab (U.K.) Limited, paying it for the right to buy its stock at a certain price. (The Metrocab method is laid out in full here.) But you never exercise the options and later write off their cost as a loss. The money you pay for the options goes into your secret offshore account.

Under La Hougue, as it happened, Metrocab kept losing value, so clients’ decision not to exercise the options was plausible.

And the fine print: “The Metrocab option appears to have been structured to avoid Canada’s non-resident trust rules and offshore investment fund rules,” Loomer says of this method. “With the limited information we have, it looks like this could have been an ‘aggressive tax avoidance’ strategy. It is not obviously tax evasion.”

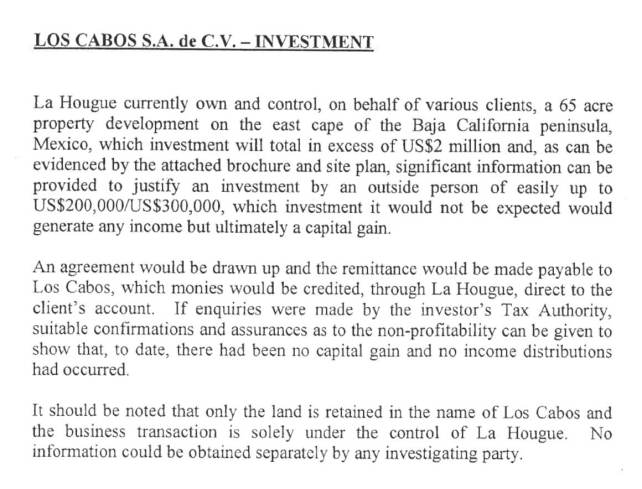

Method No. 4

How it works: La Hougue owns 65 acres in Baja California, Mexico, for which it seeks investors, purportedly to develop the property. You, knowing the land will not in fact be developed, throw money (the letter suggests up to $300,000) into the “investment.” That money simply goes into your La Hougue account. If anyone audits you, La Hougue will furnish documents to show that you’ve in fact made no money off the property and owe no taxes.

And the fine print: “One of the many defenses that taxpayers have, when they’re prosecuted for tax crimes, is something along the lines of ‘I didn’t do it, it was my tax adviser. I didn’t know it was going on. I don’t have the sophisticated knowledge of the intricacies of tax,’” Marian says of this method. “Making an investment in one entity, and my account is credited for the same amount in some trust—it’s very clear that the entity is a shell. You cannot say that you honestly do not understand that this is what you are doing.”

“If a Canadian client is actually investing in a Mexican property via an offshore trust, Canada’s non-resident trust rules could apply. If the purported investment is a smokescreen, then again we’re looking at a ‘sham,’” says Loomer.

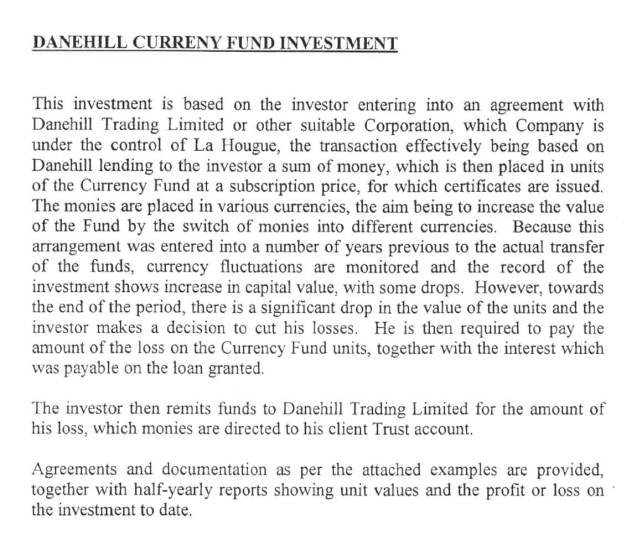

Method No. 5

How it works: In this bogus deal, you take out a loan from a company under La Hougue’s control and place it in a currency fund that arranges for your investment to show a net loss over time. When you cut your losses and repay the loan, plus interest, those payments go into your La Hougue account.

And the fine print: Loomer likens this method to the Metrocab option, saying it “appears to have been structured to generate investment returns offshore and to have those returns avoid Canada’s non-resident trust rules and offshore investment fund rules.” The result is likely to fall somewhere between “creative compliance” and “aggressive avoidance.”

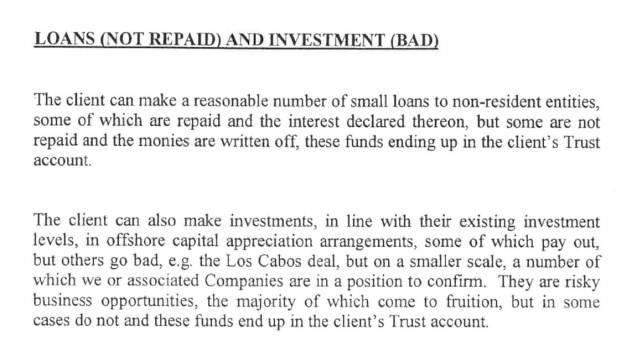

Method No. 6

How it works: You make some supposedly risky bets, loaning or investing money to business entities that, ultimately, La Hougue controls. Some of those appear to pay off, mainly to give cover for the losses. It doesn’t really matter—the money you claimed to loan or invest ends up in your trust account. And you get to write off those “failures.”

And the fine print: “When you read a title that says ‘loans not repaid,’ I mean, obviously, from a substantive point of view it’s not a loan,” Marian says. “So under tax law it will not qualify as a loan. What we’re saying is, ahead of time, we know there’s not going to be a loan, or we know we’re not going to repay this. I don’t know what to say. It’s outrageous, A, to do something like that, and B, to put it on paper.”

“A loan that everyone knows from the beginning is not going to be repaid…is not a loan.” Loomer says. “Even if it technically was a loan, Canada has debt forgiveness rules that could apply.”

OFFSHORING STRATEGY: Hide your assets

Bury your money…or never take possession of it in the first place. These include some more convoluted schemes, but they enable you to pull a tricky move—namely, to sell real estate while minimizing your tax exposure and maybe even keeping the title. A simpler way to stow your winnings? Have people who owe you money send that payment directly into your account, so you never have to declare it.

Method No. 7

How it works: Get a mortgage from an offshore lender, secured by a property you own. Pay back only the interest for a couple of years on your way to defaulting on the mortgage. The lender forecloses and takes the property’s title, moving it offshore. The mortgage’s principal (maybe 70 percent of the property’s value) you move offshore separately. The result: You’ve effectively used offshore funds to move the title of your property offshore.

And the fine print: “So we know there’s going to be a mortgage with a foreclosure, this is another twist on” bogus loans, Marian says. “Outrageous.”

“This is a more convoluted version of the sham loan,” Loomer says. “I don’t see how this can work.”

Method No. 8

How it works: You hide your ownership of a property by appearing to sell it offshore, and for a price that softens your tax bill. First, sell the property to a client-controlled offshore buyer for less than top price (thus reducing taxes on the gains). The sale is discounted because you retain for the building’s occupants a peculiar lease, one that permits the seller to choose to occupy the building for a month a year. The uncertainty there means cheaper rent, which makes the sale of the building less valuable. The upshot: You’re taxed on lesser gains and you’ve now moved the title offshore.

And the fine print: “This is also cheating,” Marian says. “There are many ways that the IRS can address this. There are code sections that are specifically aimed to prevent people from doing it. Here they are explicit: You are going to sell it to yourself not for the true value, but for a reduced value than you would’ve sold to third parties.”

“To whom is the client selling this property? A company that the client controls?” asks Loomer. “Canada has rules that deem transactions between non-arm’s-length persons to occur at fair market value.”

Method No. 9

How it works: Someone owes your business money? Your first instinct is going to be to invoice them. Instead, keep the payment off the company books by having them deliver payment to your offshore account. This works best for one-off payments and in foreign transactions, so your local tax authority doesn’t know about it.

And the fine print: “This is deliberate non-compliance with Canadian law,” Loomer says. “A Canadian resident must report all of his/her/their worldwide income and we have ‘constructive receipt’ rules that say, essentially, if you have a legal right to some payment that would be income to you, but you redirect it to a third party to benefit them or you, then the income is still yours. This method appears to be designed to flout the constructive receipt rules and to keep the evidence hidden. I have no idea if any Canadian residents decided to implement this strategy, but if they did it was a bad decision!”

OFFSHORING STRATEGY: Pay fake penalties

Owe your money to a third party (who is, in effect, you by another name). This is not for the faint of heart, but if you can produce a contract that says you owe money—why, that becomes a business expense. Never mind that this supposed lender is just another company set up and controlled by La Hougue, so you’re not “arm’s length” from it. Quite the contrary, in fact.

Method No. 10

How it works: Basically you pay a made-up penalty to get out of a made-up contract when you sell a property. Let’s say you have a building you’re about to sell for a profit. La Hougue helps you produce a contract that says A) an offshore third party has an existing option to buy the building (at a lower price than your pending sale); and B) you now owe the option-holder a penalty for canceling that contract to take the higher price. The penalty eats into your apparent profit from selling the building, thus potentially lowering your tax bill, depending on your jurisdiction. In any event, the contrived penalty payment heads to your offshore account.

And the fine print: “It’s a fake penalty and you pay it basically to yourself,” Marian says. “Which is not really a penalty.”

OFFSHORING STRATEGY: Sell your company to yourself

Sell off part of your business (to a secretive entity you happen to control). The benefits are obvious: If you don’t appear to own the business, you don’t have to pay taxes on its profits. And if you’re able to leverage secret ownership to stiff your other business partners, well, that’s not a bad day’s work, either.

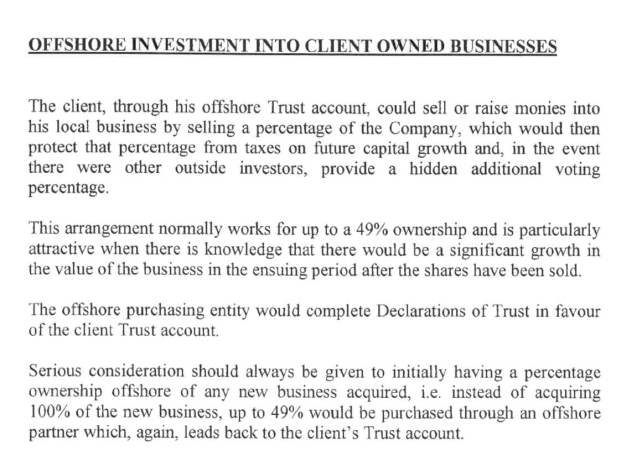

Method No. 11

How it works: You sell a portion of your company (up to 49 percent) into the control of either your own trust account or another offshore entity that holds it for the benefit of your offshore account. This arrangement allows you to shield yourself from taxes on that portion of the company and potentially to conceal that ownership from your business partners. Alternatively, if you’re buying a company, La Hougue recommends having an offshore partner (one that you control or one that has committed to rep your trust account) acquire up to 49 percent of it at the time of purchase, to frontload your sneaky moves.

And the fine print: “Seems pretty fraudulent to me,” Marian says. “It seems explicitly aimed at misrepresenting to other investors who really owns the company. I’d suspect the idea is to do the same for tax authorities—to misrepresent who owns the company in the case of a sale. That way capital gains that should be taxed remain untaxed.”

“Assuming the original shareholder is Canadian, the initial sale of shares would result in a capital gain (or loss) that would be taxable in Canada under standard rules, unless the plan was to rely on a spousal rollover or similar rule.” Loomer says. “Future increases in value of the shares are not taxable based on the increase alone, but if and when the shares were sold, the ‘offshore purchasing entity’ would have to recognize a capital gain at that time. That gain would likely be taxable in Canada through the controlled foreign affiliate or non-resident trust rules.”

The Global Reporting Centre’s work on this project was generously supported by the TRACE Foundation and the University of British Columbia. European Investigative Collaborations led the reporting partnership for the multinational Jersey Offshore investigation. You can find those works collected here.

Credits:

Writing—Sam Eifling and Calyn Shaw

Editor—Peter Klein

Producers—Britney Dennison and Andrew Munroe

Illustrator—Kathleen Fu

With editing and research by Tommy Craggs and Daniel Moattar of Mother Jones

Blank map of Europe by maix via Wikimedia Commons, used under CC BY-SA 3.0 / Cropped from original and colored