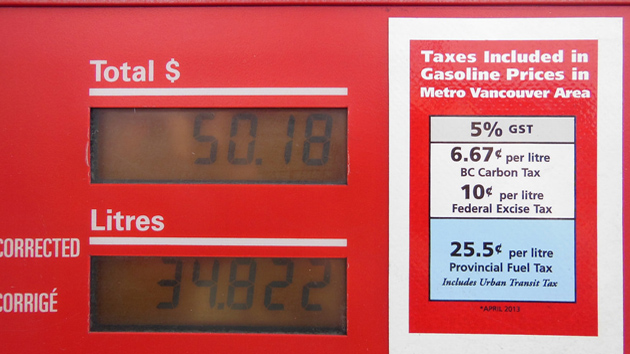

A gas pump in Vancouver, British Columbia displays the carbon tax.<a href="https://www.flickr.com/photos/48346846@N08/13391894013/">Steven Godfrey</a>/Flickr

Suppose that you live in Vancouver and you drive a car to work. Naturally, you have to get gas regularly. When you stop at the pump, you may see a notice like the one above, explaining that part of the price you’re paying is, in effect, due to the cost of carbon. That’s because in 2008, the government of British Columbia decided to impose a tax on greenhouse gas emissions from fossil fuels, enacting what has been called “the most significant carbon tax in the Western Hemisphere by far.”

A carbon tax is just what it sounds like: The BC government levies a fee, currently 30 Canadian dollars, for every metric ton of carbon dioxide equivalent emissions resulting from the burning of various fuels, including gasoline, diesel, natural gas, and, of course, coal. That amount is then included in the price you pay at the pump—for gasoline, it’s 6.67 cents per liter (about 25 cents per gallon)—or on your home heating bill, or wherever else the tax applies. (Canadian dollars are currently worth about 89 American cents).

If the goal was to reduce global warming pollution, then the BC carbon tax totally works. Since its passage, gasoline use in British Columbia has plummeted, declining seven times as much as might be expected from an equivalent rise in the market price of gas, according to a recent study by two researchers at the University of Ottawa. That’s apparently because the tax hasn’t just had an economic effect: It has also helped change the culture of energy use in BC. “I think it really increased the awareness about climate change and the need for carbon reduction, just because it was a daily, weekly thing that you saw,” says Merran Smith, the head of Clean Energy Canada. “It made climate action real to people.”

It also saved many of them a lot of money. Sure, the tax may cost you if you drive your car a great deal, or if you have high home gas heating costs. But it also gives you the opportunity to save a lot of money if you change your habits, for instance by driving less or buying a more fuel-efficient vehicle. That’s because the tax is designed to be “revenue neutral”—the money it raises goes right back to citizens in the form of tax breaks. Overall, the tax has brought in some $5 billion in revenue so far, and more than $3 billion has then been returned in the form of business tax cuts, along with over $1 billion in personal tax breaks, and nearly $1 billion in low-income tax credits (to protect those for whom rising fuel costs could mean the greatest economic hardship). According to the BC Ministry of Finance, for individuals who earn up to $122,000, income tax rates in the province are now Canada’s lowest.

So what’s the downside? Well, there really isn’t one for most British Columbians, unless they drive their gas-guzzling cars a lot. (But then, the whole point of taxing carbon is to use market forces to discourage such behavior.) The far bigger downside is for Canadians in other provinces who lack such a sensible policy—and especially for Americans. In the United States, the idea of doing anything about global warming is currently anathema, even though addressing the problem in the way that British Columbia has done would help the environment and could also put money back in many people’s pockets. Such is the depth of our dysfunction; but by looking closely at British Columbia, at least we can see that it doesn’t have to be that way.

British Columbia’s carbon tax was, by all accounts, a surprise at the outset. BC’s center-right Liberal Party, which introduced the policy, wasn’t exactly known at the time for its strong environmental track record. However, then-Liberal Premier Gordon Campbell was apparently much influenced by the business-friendly environmentalism of California’s then-governor, Arnold Schwarzenegger. The Liberals were also very friendly with economists, 70 of whom came out in 2007 with a letter calling for a “revenue-neutral carbon tax.” (For a very helpful in-depth history of the BC tax, see here.)

Environmentalists and the business community also chimed in with support, and sure enough, in February 2008, BC Finance Minister Carole Taylor formally introduced the tax. It would be set at an initial low rate of $10 per metric ton of CO2 equivalent emissions, and scheduled to increase $5 per year until it reached $30 per metric ton (which it did on July 1, 2012). The revenue would go straight back to taxpayers, and all BC residents would get a one-time payment of $100—dubbed a “Climate Action Dividend“—when the policy first launched. There is also a “Climate Action Tax Credit” from the carbon tax, paid to low income persons or families, who currently receive $115.50 for each parent and $34.50 per child annually.

Legislative passage was more or less assured, because the Liberals controlled the provincial government. But shortly after it kicked in, opposition ramped up. After all, the tax took effect in July 2008, just prior to the worst part of the economic collapse. The recession greatly dampened support for climate action, strengthening political claims that reining in emissions would further damage an already deeply wounded economy. Rather surprisingly, BC’s left-of-center New Democratic Party, known for championing environmental causes, seized the moment to campaign against the tax, calling instead for a cap-and-trade policy and using the slogan “Axe the Tax.” Premier Campbell, though, stood strongly in favor of his party’s creation, reportedly insisting, according to the Vancouver Sun, that “if they wanted to get rid of the tax they would have to get rid of him.”

Thus, the carbon tax survived an initial trial by fire, and the opposition softened. After all, after a few years with the tax in place (and the resulting tax cuts for BC residents getting larger and larger), any repeal of the policy would amount to a highly unpopular tax increase. “The party that I represent opposed the legislation at the beginning, and we’ve changed our point of view now to embrace it,” says Spencer Chandra Herbert, a British Columbia legislator from the New Democratic Party who is the official opposition voice on environmental issues. “And we’re actually raising questions about what’s next.”

The tax has actually become quite popular. “Polls have shown anywhere from 55 to 65 percent support for the tax,” says Stewart Elgie, director of the University of Ottawa’s Institute of the Environment. “And it would be hard to find any tax that the majority of people say they like, but the majority of people say they like this tax.”

It certainly doesn’t hurt that the tax, well, worked. That’s clear on at least three fronts: Major reductions in fuel usage in BC, a corresponding decline in greenhouse gas emissions, and the lack of a negative impact on the BC economy.

Quantifying the effects of BC’s carbon tax is somewhat complicated by its timing: The 2008-09 economic collapse reduced overall emissions across Canada, and indeed, across the world. Moreover, British Columbia is somewhat of a unique place in that the No. 1 source of electricity is actually carbon-free hydroelectric power, not coal or natural gas.

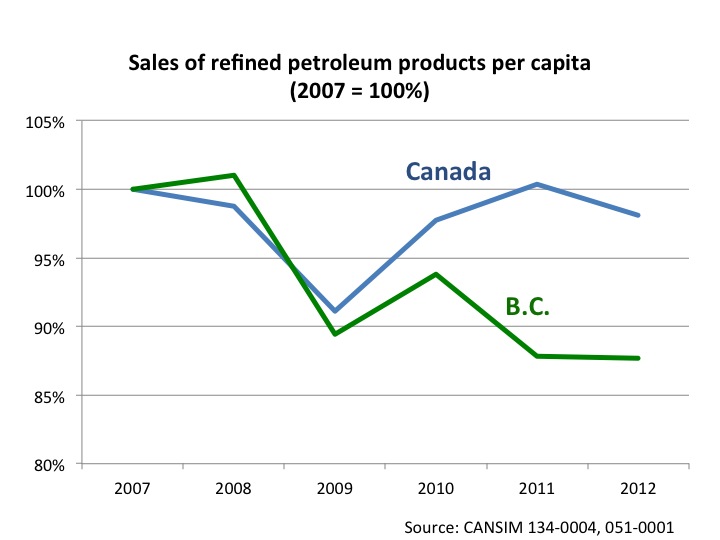

Therefore, the most likely place for the carbon tax to make an impact would be in sales of carbon-intensive fuels like gasoline and diesel. Sure enough, a recent analysis by Seattle’s Sightline Institute shows that BC’s sales of motor fuels and other petroleum products declined by 15 percent in just the first four years of the carbon tax, much more than in the country as a whole:

Yet another analysis, by the research and policy group Sustainable Prosperity, finds a similar result: A 17 percent per capita decline in fuel consumption in BC.

Then there are greenhouse gas emissions. Again, comparing BC to the rest of Canada is a little tricky. Elsewhere in the country, the recent shift from coal-fired power plants to natural gas has lowered emissions, but that change has not been felt as much in BC because of its heavy use of hydropower. However, if you centrally look at either emissions from fuel or the sale of fuels subject to the tax (gasoline, diesel, and so on), the Sustainable Prosperity and the Sightline Institute reports broadly agree that there has been a considerable decline relative to the rest of Canada.

What’s more, this happened even as BC’s economy fared just as well as Canada’s economy in general. “BC’s fuel use has gone down dramatically, and its economy has kept pace with the rest of Canada at the same time,” says the University of Ottawa’s Stewart Elgie, a coauthor of the Sustainable Prosperity report.

Overall, then, that’s not a bad record for a tax that is just five years old. “What it has done is reduced our carbon emissions, reduced our fuel consumption, and in that period our GDP and our population has gone up,” says Clean Energy Canada’s Smith. “So it’s quite impressive what it has done.”

Not everyone would agree, of course; on the national level, Canada’s ruling Conservative Party is strongly opposed to a carbon tax. In 2008 (when a national version of the tax was under consideration), the party argued that it would “plunge Canada into a recession.”

“Politically, our federal government has tried to make carbon taxation toxic, saying it’s a job killer,” adds the New Democratic Party’s Spencer Chandra Herbert. “BC’s experience has proven that it doesn’t have to be, and I would argue, it can lead to more jobs.”

CANADIANS AREN’T THE ONLY ones who could benefit from emulating BC’s policies—so would Americans. Scholarly research suggests that a national carbon tax in the United States could be at least as effective as the BC tax, both in reducing greenhouse gas emissions and in lowering income taxes (or, lowering the deficit).

Take, for instance, a recent study from Resources for the Future, a prominent environmental policy think tank, that modeled the economic impact of different carbon taxes. The study found that a very modest $30 per ton carbon tax (roughly equivalent to BC’s tax, but in US dollars) would yield about $226 billion in annual revenues. If paid directly back to every American, that would equal a rebate of $876 per year; but of course, this vast sum of money could be used for a variety of purposes, including to greatly reduce the federal deficit.

Meanwhile, the Resources for the Future study found that emissions reductions in the US by the year 2025 would be on the order of 15 percent, and the economic costs would be small: Effects on GDP range from mildly positive to mildly negative depending upon the particular scenario used.

The bottom line, then, is that BC’s experience provides an exclamation point at the end of the long list of reasons to like a carbon tax. Perhaps the leading one, in the end, is that it’s a far simpler policy option than a cap and trade scheme, and is, as Harvard economist and Bush administration Council of Economic Advisers chair N. Gregory Mankiw has put it, “more effective and less invasive” than the sort of regulatory approaches that the government tends to implement.

Indeed, economists tend to adore carbon taxes. When the IGM forum asked a group of 51 prominent economists whether a carbon tax would be “a less expensive way to reduce carbon dioxide emissions than would be a collection of policies such as ‘corporate average fuel economy’ requirements for automobiles,” assent was extremely high: 90 percent either agreed or strongly agreed. Yale economist Christopher Udry commented, “This is as clear as economics gets; provides incentives to find minimally costly ways to reduce emissions.”

“Totally basic economics!” added Stanford’s Robert Hall.

Since 2012, British Columbia has not raised the carbon tax further. Instead, the government agreed to freeze the rate as it is for five years. And no wonder: BC is now far ahead of most of its neighbors, and most of North America, in taking action to curtail global warming. Many policy watchers think the BC carbon tax still needs more strengthening, however, to ultimately set in place the kinds of emissions cuts needed. Smith would like revenue from further increases to be used to advance further carbon reductions, rather than for more tax breaks.

In the meantime, another question is whether any other provinces or US states, seeing BC’s success, will wade into these waters. For instance, as part of the Pacific Coast Action Plan on Climate and Energy, Washington state and Oregon have both pledged to join BC and California in putting a price on carbon emissions. (California already has a cap-and-trade program). The question is whether these states will decide that the far simpler (and more economically supported) carbon tax is the way to go.

In the meantime, BC can boast of the crown jewel of North American climate policy. “BC now has the lowest fuel use in Canada, the lowest tax rates in Canada, and a pretty healthy economy,” says the University of Ottawa’s Stewart Elgie. “It works.”