Today Adam Liptak gives us yet another reason to lament the financial meltdown in the newspaper industry. In the past, it was most often newspapers that filed lawsuits demanding access to information that had been placed off limits for one reason or another. But as their finances dwindle they can’t afford to file these kinds of suits as often, and other types of publishers don’t want to:

Consider the aftermath of a recent settlement in a lawsuit against Amtrak….As part of the settlement, the parties asked Judge Lawrence F. Stengel of Federal District Court in Philadelphia not only to vacate eight of his decisions in the case but also to “direct LexisNexis and Westlaw to remove the decisions” from “their respective legal research services/databases.”

The judge agreed, and the database companies complied.

“In the infrequent event that we are ordered by the court to remove a decision from Westlaw,” explained John Shaughnessy, a spokesman for the service, which is owned by ThomsonReuters, “we will comply with the order, deleting the text of the decision but keeping the title of the case and its docket number. We also publish the court’s order to remove so there’s a clear record of the action.”

In cases like this, newspapers have traditionally refused to cooperate. What’s more, they filed suits to keep this kind of information public not just out of concern for their business, but because their owners were genuinely obsessed with First Amendment rights. Newer businesses, conversely, tend to either have reason to cooperate with the government, or else think of these suits strictly from a perspective of whether they’re economically worth it. We’ve still got the ACLU, of course, but they can’t pick up all the slack. In the great power struggle between government secrecy and the public’s right to know, the demise of the newspaper industry is a victory for the bad guys.

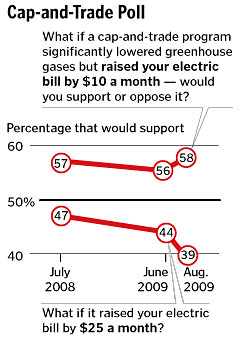

It’s simple and effective, and it works because there’s a kernel of truth to it. Cap-and-trade will increase energy prices modestly, and that means electric bills and gasoline prices will go up for some people1. And as the poll accompanying Fahrenthold’s piece shows, electric bills don’t have to go up much for majority support to crumble. At $10 per month nearly 60% favor cap-and-trade. At $25 per month, 60% oppose it.

It’s simple and effective, and it works because there’s a kernel of truth to it. Cap-and-trade will increase energy prices modestly, and that means electric bills and gasoline prices will go up for some people1. And as the poll accompanying Fahrenthold’s piece shows, electric bills don’t have to go up much for majority support to crumble. At $10 per month nearly 60% favor cap-and-trade. At $25 per month, 60% oppose it. Paul Krugman muses about why news outlets tend to cover the politics and horserace aspects of things like healthcare

Paul Krugman muses about why news outlets tend to cover the politics and horserace aspects of things like healthcare  come to about $4 billion, or the equivalent of about 15 percent annually, according to calculations compiled for The New York Times.

come to about $4 billion, or the equivalent of about 15 percent annually, according to calculations compiled for The New York Times. time for the military and diplomatic strategy it hopes can rescue the 8-year-old effort.

time for the military and diplomatic strategy it hopes can rescue the 8-year-old effort.