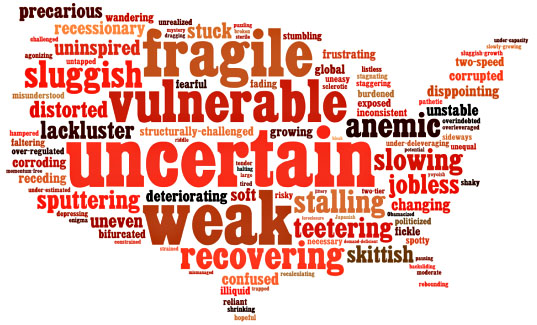

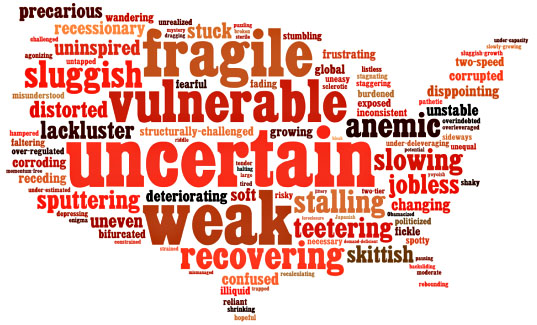

Every quarter, the Kauffman Foundation surveys a set of economics bloggers about the state of the economy. The full report for the third quarter is here. The summary is below. It seems about right to me.

Every quarter, the Kauffman Foundation surveys a set of economics bloggers about the state of the economy. The full report for the third quarter is here. The summary is below. It seems about right to me.

We got Inkblot a new area rug to tear to shreds this week, this time in bright olive green. Sets him off well, don’t you think.1 (Naturally we do all our interior decorating with cat complementing in mind.) On the right we have — what? Let’s call it experimental catblogging. Domino has a sound she makes that means, “Get down on the floor and play with me.” She made it this morning, so I got down on the floor and played with her. This time, however, I had my camera, so I stretched out my arms and took some pictures of her playing with my head. This is one of her favorite activities. Pretty lucky for me, no?

1And very presidential too. He’s thinking of using this color for the Oval Office carpet after he wins election next year.

Chad Orzel talks to his daughter about the process of creating art:

Chad Orzel talks to his daughter about the process of creating art:

She went on to explain that the car had been inside the marker, but then she took the top off the marker, and put it on the paper, and the car came out. Which is pretty impressive. She’s just about to turn three, and she’s already got the Artist-as-conduit-for-something-external line of patter down. I look forward to the next time we get out the Play-Doh, when she’ll explain how she looks at a blob of it and then takes away all the bits that aren’t an elephant.

Perhaps she could give John Boehner some pointers on how to write a debt ceiling bill. I envision two alternatives:

Either one of those would be better — and more family friendly — than my advice.

Tyler Cowen points today to John Hussman saying something that’s been in the back of my mind for a long time but never quite made it onto the blog:

Here in the U.S., [debt held by the public] amounts to about 60% of GDP and rising, due to recent budget deficits of about 10% of GDP annually. This is presently manageable since so much of that debt is of short-maturity and is being financed at very low interest rates.

….Still, it’s precisely that short average maturity that makes the debt problematic from a long-run perspective, because it can’t be inflated away easily. In the event of sustained inflation, the debt would have to be constantly refinanced at higher and higher yields. Contrary to the assertion that the U.S. can easily inflate its debts away, it is clear that sustained inflation would create enormous risks to our long-run fiscal condition by driving interest costs to an intolerable share of revenues. At that point, any shortfall in GDP growth or government revenues would result in a rapid spike in debt-to-GDP (as Greece and other peripheral European nations are experiencing now). Prior to embarking on an inflationary course, the first thing a government would want to do is dramatically lengthen the maturity of its debts.

This is true, isn’t it? I keep hearing repeatedly, from tea partiers and assorted tea party leaners, that the real danger we’re running isn’t that the United States will literally default on its debt in the future, but that it will try to inflate away its debt. Sort of a soft default, if you will.

But that’s not even possible, is it? The vast bulk of U.S. debt matures in three years or less, which means that a bout of inflation would simply raise the cost of borrowing. Virtually all debt holders would roll over their holdings long before inflation had any serious effect on them and the government would gain nothing. On an inflation-adjusted basis, the new debt issued would be about as expensive as the old debt.

So where does this whole “inflating away the debt” meme come from? Is it just the gold bugs, or is it coming from somewhere else too? What’s the deal?

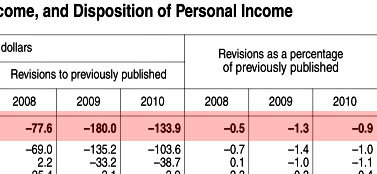

GDP grew last quarter at a rate of 1.3%. That’s pretty sluggish. What’s worse, as Matt Yglesias points out, GDP for the previous three years was revised substantially downward at the same time. So to summarize:

GDP grew last quarter at a rate of 1.3%. That’s pretty sluggish. What’s worse, as Matt Yglesias points out, GDP for the previous three years was revised substantially downward at the same time. So to summarize:

To address this, our current plan is to shut down the government and produce economic chaos for no reason whatsoever. Thanks, tea party!

There’s a fair amount of armchair psychoanalyzing here, but Bruce Bartlett has an interesting theory today about why President Obama continually thinks that pre-emptive compromise will bring Republicans to the table: it’s because he never had the pleasure of negotiating with either the Soviet Union or Big Labor, a pair of opponents who could very quickly disabuse presidents of the idea that nice guys finish first:

Consequently, Obama has really been caught flat-footed by the Tea Party era Republican Party. He believed it would respond positively if he offered

it half a loaf on just about every issue.

For example, some 40 percent of the 2009 stimulus legislation consisted of tax cuts even though his economic advisers knew that they would have almost no stimulative effect….Obama offered Republicans another half-loaf by putting forward a health reform plan almost identical to those that they and conservative groups such as the Heritage Foundation had proposed in the 1990s….Last December, he caved in to Republicans by supporting extension of the Bush tax cuts even though there is no evidence that they have done anything other than increase the deficit….Foreseeing that Obama lacked leverage in the debt negotiations that everyone knew were coming, I tried to give him some by explaining why the 14th amendment to the Constitution gave him the authority to disregard the debt limit if the Treasury runs out of cash, as it will next week….But on July 7, the Treasury Department publicly ruled out the idea.

….I think if Obama had the sort of experience that Cold War presidents had in dealing with the Soviet Union or that corporate executives and union leaders had in negotiating labor contracts he wouldn’t have been so naïve about the Republicans, who have never hidden the fact that their only objective is defeating him next year regardless of the cost. It’s not too late for Obama to play hardball, but I fear that it is just not in his nature.

Maybe there’s something to this — though I’d note that neither Bill Clinton nor George W. Bush had any experience with communists or union leaders either. My biggest objection, though, is that I’m not sure it would have mattered. If Obama had negotiated with nerves of steel, would he have gotten better deals throughout his presidency? I don’t think so. Unlike labor bosses and Soviet bosses, who could be pressured because there were things they wanted that a president could provide, Republicans — and especially tea party Republicans — want nothing that Obama can feasibly give them. If Obama had been tough as nails, they would have followed a path of total obstruction and nihilism anyway. Maybe some details here and there would have changed, but on the whole it just wouldn’t have made any difference.

So I guess I’m open to this idea, but not sold on it. Tougher negotiation with centrists in his own party might have moved the needle a bit, but I doubt that Obama ever had any real leverage over Republicans. So, since banging his shoe on the lectern wouldn’t have worked, he decided to give compromise a try. It didn’t work, but I’m not sure he really lost anything by it.1

1And electorally, it might still be a winner. Obama believes that his reelection depends on votes from independents, and he further believes that independents react well to a conspicuous display of reasonableness. He might be right.

Rep. John Boehner (R-Ohio), the Speaker of the House, addresses the nation about the debt ceiling crisis on Monday, July 25.<a href="http://www.flickr.com/photos/speakerboehner/5979329260/in/photostream">Speaker Boehner</a>/Flickr

It’s no surprise that political partisans tend not to like each other. Generally, though—with obvious and famous exceptions aside—the level of personal hostility on Capitol Hill has usually been kept down to manageable levels.

Until now. To a degree rarely seen in the past, Republican policymaking lately seems to have been driven at least as much by pure political venom as it has by ideology or interest-group pressure. House Speaker John Boehner certainly gets this. When he was trying to whip his troops into line to vote for his debt ceiling bill on Wednesday, his pitch was simple: “President Obama hates it. Harry Reid hates it. Nancy Pelosi hates it. Why would Republicans want to be on the side of President Obama, Harry Reid, and Nancy Pelosi is beyond me.” That was enough for conservative firebrand Rep. Allen West (R-Fla.). Boehner’s plan wasn’t perfect, he said in a Facebook post, but “the fact Pelosi, Reid and Obama hate it doggone makes it perfect enough.”

And it’s not just the debt ceiling. Take cap-and-trade legislation to reduce carbon emissions. As recently as 2008, plenty of Republican leaders were for it. John McCain backed cap-and-trade, and so did Tim Pawlenty. Newt Gingrich even cut a commercial with Nancy Pelosi where he declared to the world that “our country must take action to address climate change.”

But then Democrats introduced an actual cap-and-trade bill, and in the blink of an eye it got tarred as “cap-and-tax” and opposition became practically a litmus test for movement conservatives. Republicans couldn’t run away fast enough. Gingrich’s recent attempt to disown his own words was almost poignant, while Pawlenty’s groveling has been all but cringe-inducing. “I just admitted it,” he said. “I don’t try to duck it, bob it, weave it, explain it away. I’m just telling you, I made a mistake.”

In recent months this has metastasized into all-out war as House Republicans have bombarded a pending appropriations bill with amendments to roll back environmental rules:

Although inserting policy changes into appropriations bills is a common strategy when government is divided as it is now, no one can remember such an aggressive use of the tactic against natural resources.…The unusual breadth of the attack, explained Rep. Mike Simpson (R-Idaho), is a measure of his party’s intense frustration over cumbersome environmental rules.

“Many of us think that the overregulation from EPA is at the heart of our stalled economy,” Mr. Simpson said, referring to the Environmental Protection Agency.

Simpson’s suggestion that the EPA is responsible for our parlous economic condition could hardly have been suggested seriously. It’s just filler, the kind of thing that gurgles up from the recesses of a politician’s mind because they have to say something when a reporter asks what’s going on. Grist writer David Roberts gets closer to the truth when he points out that Republicans are even going after a Bush-era regulation that prevents the Defense Department from using fossil fuels that are dirtier than petroleum. The catch? Even the Pentagon doesn’t want this rule repealed. “Repeal or exemption could hamper the department’s efforts to provide better energy options to our warfighters,” wrote Elizabeth King, assistant secretary of defense for legislative affairs.

No matter. Republicans want it repealed anyway. Why? Ideology is probably part of it, as is fealty to coal interests. But that’s not the whole story. Repealing it just because it’s something Democrats like seems to be part of it too. Welcome to the modern Republican Party.

The big news tonight is that John Boehner has shelved plans to vote on his debt ceiling proposal. Why? Because he couldn’t round up enough Republicans to vote for it. A hardcore rump of tea party nihilists is now treating him the same way that he’s treated President Obama for the past few months: rejecting every deal offered, regardless of how good it is or how much harm rejection will do to the country.

It would be easy to shed crocodile tears about this, but there’s really nothing here to gloat about. It’s just undiluted bad news if Congress refuses to raise the debt ceiling. Whether D-Day comes on August 2nd or — thanks to better-than-expected tax receipts — a few days after that, hardly matters.  We’re not only headed for unprecedented fiscal chaos when it comes, but we’re taking a real risk of throwing the country back into recession too. Granted, that’s the Armageddon scenario, and things might not turn out that badly in the end. But I’d just as soon not take the chance. Our economy is just too fragile to risk it.

We’re not only headed for unprecedented fiscal chaos when it comes, but we’re taking a real risk of throwing the country back into recession too. Granted, that’s the Armageddon scenario, and things might not turn out that badly in the end. But I’d just as soon not take the chance. Our economy is just too fragile to risk it.

But it’s possible — barely — that there’s some good news here. If Boehner can’t get the tea partiers in the House to support his proposal, and if Harry Reid can’t find 60 votes in the Senate for his, then pretty shortly they’ll figure out that there’s only one way to pass something: forge a compromise that can get substantial support from both Democrats and non-tea-party Republicans. Such a compromise is almost certainly available, and all it takes to get there is for Boehner to be willing to admit the obvious: the tea partiers just aren’t willing to deal, period. They want to burn the house down so they can build something better from the ashes. They’re insane.

So walk away from the tea partiers. Instead, strike a deal that a hundred non-insane House Republicans and 20 or 30 non-insane Senate Republicans can support. Add that to a majority of the Democratic caucus and you’re done. You’ve saved the country.

It won’t be as a good a deal as Republicans could have gotten a month ago. What’s more, it would take some guts from Boehner, who might very well be jeopardizing his speakership if he does this. But it will save the country. Surely that’s still worth something?

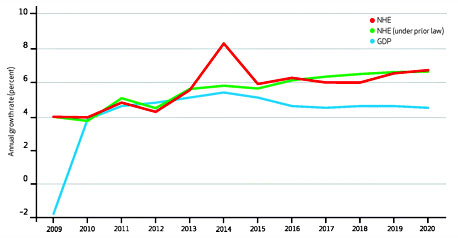

CMS is a government agency that has long offended my OCD sensibilities because it stands for Centers for Medicare & Medicaid Services and really ought to be called CMMS. But today I’ll link to them anyway. They’ve completed a new projection for total national health expenditures through 2020, and it’s shown in the chart on the right. The green line shows the old projection and the red line shows the new projection after passage of the 2009 healthcare reform act. Basically, they  expect a one-year spike in spending growth in 2014, when most of the law takes effect, followed by slightly lower growth for most of the rest of the decade.

expect a one-year spike in spending growth in 2014, when most of the law takes effect, followed by slightly lower growth for most of the rest of the decade.

So how does that work out? For the decade as a whole, CMS projected an annual growth rate of 5.7% pre-reform compared to 5.8% post-reform. To put that into dollars, it means that in 2020 our total spending on healthcare will be about $40 billion higher than it would have been without healthcare reform. So what do we get for that money?

In 2014, the Affordable Care Act will greatly expand access to insurance coverage, mainly through Medicaid and new state health insurance exchanges which will facilitate the purchase of insurance. The result will be an estimated 22.9 million newly insured people.

….Out-of-pocket spending is projected to decline by 1.3 percent as the number of people with insurance coverage increases and many services formerly paid for out of pocket are now covered by insurance….The newly insured are expected to consume more prescriptions because of substantially lower out-of-pocket requirements for prescription drugs.

Not bad for only $40 billion! 23 million more people will be covered, out-of-pocket spending will decline, and prescription drugs will be more widely available. All for less than $2,000 per person, which is a considerable bargain.

The White House, of course, thinks that ACA will reduce costs more than CMS suggests. You can read their argument here. But even if it doesn’t, CMS is projecting a mighty small price for something that’s going to benefit so many.

Joe Klein admits today that he loves himself some good old-school Democrat bashing, but he’s just not up for it these days:

Joe Klein admits today that he loves himself some good old-school Democrat bashing, but he’s just not up for it these days:

And so, here we are. Our nation’s economy and international reputation as the world’s presiding grownup has already been badly damaged. It is a self-inflicted wound of monumental stupidity. I am usually willing to acknowledge that Democrats can be as silly, and hidebound, as Republicans — but not this time. There is zero equivalence here. The vast majority of Democrats have been more than reasonable, more than willing to accept cuts in some of their most valued programs. Given the chance, there was the likelihood that they would have surrendered their most powerful weapon in next year’s election — a Mediscare campaign — by agreeing to some necessary long-term reforms in that program. The President, remarkably, proposed raising the age of eligibility for Medicare to 67.

The Republicans have been willing to concede nothing. Their stand means higher interest rates, fewer jobs created and more destroyed, a general weakening of this country’s standing in the world. Osama bin Laden, if he were still alive, could not have come up with a more clever strategy for strangling our nation.

I don’t think that most Republicans, or even most tea partiers, actively want the American economy to tank. At the same time, an awful lot of them sure don’t seem to care very much. They’re more focused on getting Obama out of the White House, and the truth is that a little bit of economy tanking makes that goal a little easier to achieve. And so, here we are.