Here’s something to take our minds off politics for the next few hours as we await word from Florida about just how badly Mitt Romney and his George-Soros-Goldman-Sachs-New-York-Washington-establishment-money-power have crushed Newt Gingrich’s people power in today’s primary. It comes from a biography of Frances Perkins, FDR’s secretary of labor, and it’s a reporter’s description of her eyes:

Here’s something to take our minds off politics for the next few hours as we await word from Florida about just how badly Mitt Romney and his George-Soros-Goldman-Sachs-New-York-Washington-establishment-money-power have crushed Newt Gingrich’s people power in today’s primary. It comes from a biography of Frances Perkins, FDR’s secretary of labor, and it’s a reporter’s description of her eyes:

It is her eyes that tell her story. Large and dark and vivid, they take their expression from her mood. If she is amused, they scintillate with little points of light. If moved to sympathy or compassion, they cloud over. At the slightest suspicion of insincerity or injustice, they can become keen and searching.

I’m pretty much oblivious to people’s eyes. I could sit across from you for an hour in deep conversation and come away not even knowing the color of your eyes, let alone whether they scintillate or cloud over from time to time. So I am, sort of literally, a blind man when it comes to stuff like this.

So I turn to you, my faithful readers. Are descriptions like this for real? It’s part of the whole “eyes are the window to the soul” schtick, which has always seemed more poetic than verifiably factual to me, but what do I know? And another thing: if this is real, how does it happen? That is, what physiological mechanism makes eyes scintillate or cloud over?

Help me out, those of you with normal human perceptions. What’s the deal here?

POSTSCRIPT: And here’s a fascinating historical tidbit that I learned today. In 1938, suspecting that Perkins, the first female cabinet member, was a communist sympathizer, conservatives concocted a story that she wasn’t really American at all. Instead, she was supposedly a Russian Jewish immigrant who had lied about her real identity. Perkins eventually set the record straight in a letter outlining her genealogy, but there’s no mention of whether she also had to release a copy of her long-form birth certificate to quell the rumors.

It’s remarkable how history repeats itself, isn’t it?

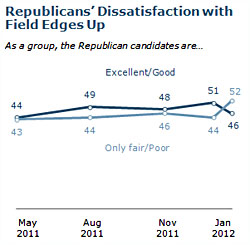

Apropos of my post this morning suggesting that Republicans unhappy with the current presidential field will come around,

Apropos of my post this morning suggesting that Republicans unhappy with the current presidential field will come around,  the GOP field is only fair or poor (52%) than did so in early January (44%).”

the GOP field is only fair or poor (52%) than did so in early January (44%).”

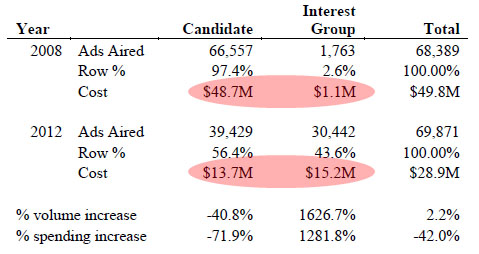

Jesse Eisinger and Chris Arnold report on

Jesse Eisinger and Chris Arnold report on  Aaron Carroll flags a study suggesting that spending a lot of time in front of a screen (TV or computer)

Aaron Carroll flags a study suggesting that spending a lot of time in front of a screen (TV or computer)