Jon Chait practically reads my mind today:

I decided to support Barack Obama pretty early in the Democratic primary, around spring of 2007. But unlike so many of his supporters, I never experienced a kind of emotional response to his candidacy. I never felt his election would change everything about American politics or government, that it would lead us out of the darkness. Nothing Obama did or said ever made me well up with tears.

Possibly for that same reason, I have never felt even a bit of the crushing sense of disappointment that at various times has enveloped so many Obama voters. I supported Obama because I judged him to have a keen analytical mind, grasping both the possibilities and the limits of activist government, and possessed of excellent communicative talents. I thought he would nudge government policy in an incrementally better direction. I consider his presidency an overwhelming success.

It took me longer than Jon to decide between Obama and Hillary Clinton, but otherwise this mirrors my reaction precisely. In a way, though, all it shows is that both Jon and I missed something in 2008. I simply never took seriously any of Obama’s high-flown rhetoric—Hope and change, Yes we can! You are the solution, etc.—dismissing it as nothing more than typical campaign windiness. From the first day, I saw Obama as a sober, cautious, analytic, mainstream Democrat: a little to the left of Bill Clinton and Jimmy Carter, but fundamentally right smack in the middle of American liberalism. He’d get a bunch of good stuff done, but on other stuff he’d either never support a progressive position in the first place (Afghanistan, cramdown, etc.) or else he’d support it but fail to get his program through Congress (Guantanamo, cap-and-trade).

Apparently, though, a lot of lefties really did buy the hype. Or so it seems. To this day, however, I wonder just how many of the people who are disappointed in Obama are liberals who took the campaign oratory seriously vs. moderates who are simply worn down by the long economic downturn and hesitant to give Obama another four years. Somebody ought to do a poll….

of the past half century, he comes out looking pretty good.

of the past half century, he comes out looking pretty good. Dan Drezner tips me off today to an essay by the soon-to-be irrelevant Niall Ferguson in the soon-to-be defunct Newsweek. In it, Ferguson decides to go public with his fever dreams of what an Obama White House might do to

Dan Drezner tips me off today to an essay by the soon-to-be irrelevant Niall Ferguson in the soon-to-be defunct Newsweek. In it, Ferguson decides to go public with his fever dreams of what an Obama White House might do to  said, but he did not put enough time and energy into his job. ‘He would have been better suited to be a small city or county lawyer,’ he said.”

said, but he did not put enough time and energy into his job. ‘He would have been better suited to be a small city or county lawyer,’ he said.” assume a climate future that resembles the past. But the reward to acknowledging climate reality will be (where local politicians aren’t climate deniers, and only there) urban areas that are far better designed to accommodate the new reality than they have been up to now.

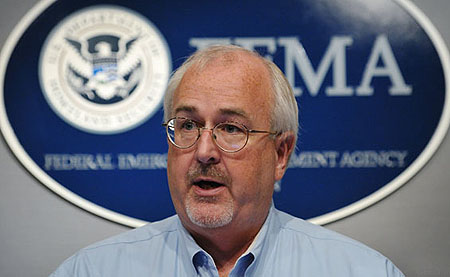

assume a climate future that resembles the past. But the reward to acknowledging climate reality will be (where local politicians aren’t climate deniers, and only there) urban areas that are far better designed to accommodate the new reality than they have been up to now. The FISA surveillance act had its day in court yesterday, but the subject was solely whether the act would ever have a real day in court.

The FISA surveillance act had its day in court yesterday, but the subject was solely whether the act would ever have a real day in court.