<a href="http://www.shutterstock.com/cat.mhtml?lang=en&search_source=search_form&version=llv1&anyorall=all&safesearch=1&searchterm=mansion&search_group=#id=89116057&src=E0cjKa4kSjDXZM-7FYqIaA-1-0">Ernest R. Prim</a>/Shutterstock

It’s a metaphor for the lopsided economic recovery: Data out from the Census bureau Tuesday shows that new single-family homes are getting bigger, while new rental apartments are shrinking.

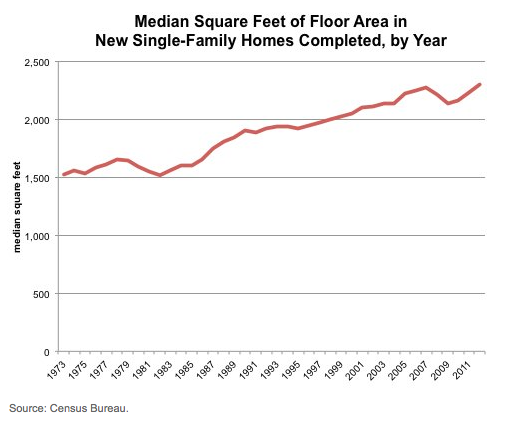

Construction of new homes plummeted as the 2007 financial crisis hit. Residential housing construction is barely coming back to life, but as the New York Times‘ Economix blog reports in a post titled “The Return of the McMansions,” the new homes being built are ballooning in size. Think the 90,000 square foot manse timeshare billionaire David Seagal and his wife Jackie designed pre-crisis, with 30 bathrooms, ten kitchens, and an ice rink. Ok, they’re not all that big. The average size of new single-family homes climbed to 2,306 square feet last year, the largest average home size since the government started keeping track in 1973. The Times has this graph:

The average number of bedrooms and bathrooms per home is also at record levels. Last year, 41 percent of new homes had at least four bedrooms, and 30 percent had at least three bathrooms.

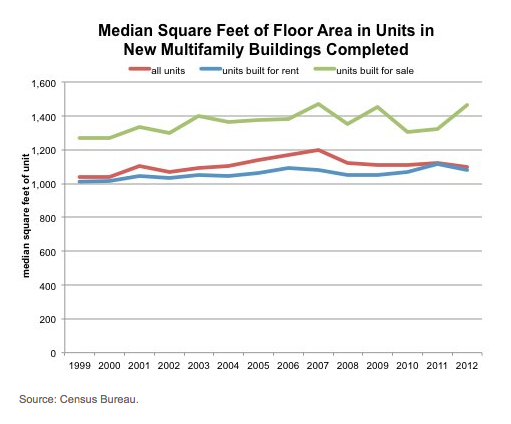

When it comes to new rental units, the opposite is true. The average square footage of new units in multi-family buildings decreased between 2011 and 2012. In 2011, 62 percent of new rental units were under 1,200 square feet, and 17 percent were 1,400 square feet or larger. In 2012, those numbers had changed to 64 percent under 1,200 square feet, and 16 percent above 1,400 square feet. (The percentage of apartments in the mid-range, remained steady.) See here:

The divergence in square footage aligns with the nature of the economic recovery. A new report released by the Federal Reserve earlier this week shows that most of the wealth recovered since the recession has gone to well-off white people. The Fed says that about 62 percent of the wealth Americans have regained since the economy bottomed out has been through the recovery of the stock market. And 80 percent of stock wealth is held by the rich—people with income in the top 10 percent.

Many younger and minority Americans have not experienced any recovery at all, and some are still losing wealth. Hence the need for more shoebox apartments.