Did you know that the richest 1% of Americans pay 21% of all taxes? That’s a lot! But do you know why they pay 21% of all taxes? It’s because they make 21% of all the income.

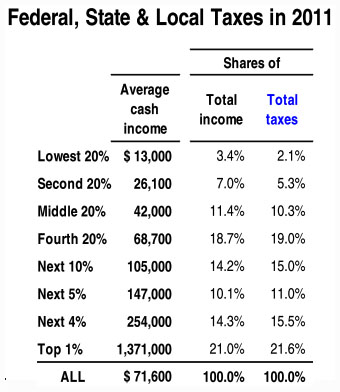

Suddenly that doesn’t seem all that unfair, does it? In fact, the rich are doing mighty well for themselves if we basically have a flat tax in America. And as it turns out, they are, and we do: the federal tax system is modestly progressive, but state and local taxes are modestly regressive. Add ’em all up and you end up with a pretty flat tax system. Here are the numbers for 2011 from Citizens for Tax Justice:

Click the link for information about tax rates. All told, Americans pay about 28% of their income in taxes.1 The poor and working class pay a bit less, but the entire top half of the income spectrum, from middle class to super rich, pays almost exactly the same rate, around 29-30% of their income. Not a bad deal for the wealthy.

1In case you’re curious, that’s about 24% of GDP. Roughly speaking, we pay about 15% of GDP in federal taxes and 9% of GDP in state and local taxes.