Over at the Washington Monthly, Phillip Longman rocks like it’s 2012 and relitigates the question of whether Rick Perry’s so-called Texas Miracle is fact or fiction. He concludes that it’s mostly fiction, and he makes a good case. Not a bulletproof case, but a good one. What’s more, to the extent that Texas really does have a strong economy, he says, it’s largely due to fracking, immigration from across the border, and a high birth rate. It’s not due to low taxes—at least, not for most Texans:

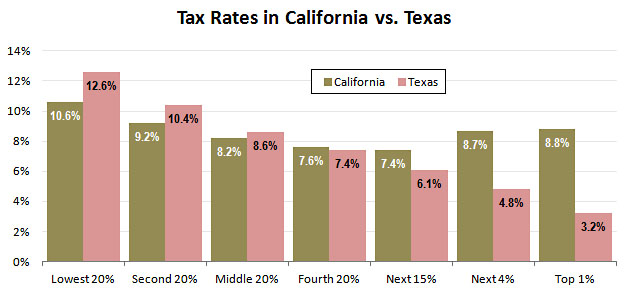

Oh yes, I know what you’ve heard. And it’s true, as the state’s boosters like to brag, that Texas does not have an income tax. But Texas has sales and property taxes that make its overall burden of taxation on low-wage families much heavier than the national average, while the state also taxes the middle class at rates as high or higher than in California….The top 1 percent in Texas have an effective tax rate of just 3.2 percent. That’s roughly two-fifths the rate that’s borne by the middle class, and just a quarter the rate paid by all those low-wage “takers” at the bottom 20 percent of the family income distribution. This Robin-Hood-in-reverse system gives Texas the fifth-most-regressive tax structure in the nation.

Middle- and lower-income Texans in effect make up for the taxes the rich don’t pay in Texas by making do with fewer government services, such as by accepting a K-12 public school system that ranks behind forty-one other states, including Alabama, in spending per student.

The chart below tells the tale (data here). Most Texans pay more in taxes than most Californians. But rich Texans pay a lot less. That’s great for rich Texans, but not so much for everyone else. For the middle class, Texas isn’t a low-tax/low-service state, and it’s not a high-tax/high-service state either. It’s the worst of all worlds: a high-tax/low-service state. Yee-haw!