Via Matt Yglesias, here’s a fascinating little study in behavioral economics. It involves Social Security, which currently allows you to retire at age 62, but offers you a higher monthly payment if you retire later. For example, if you retire at 62, your monthly benefit might be $1,500, but if you delay a year, your monthly benefit might go up to $1,600. Given average lifespans, the total payout works out the same in both scenarios.

But what if you offered retirees a different deal? What if, instead of a higher monthly benefit, you offered them a lump sum payout if they delayed retirement? In the example above, if you delay retirement to 63, you’ll still  get $1,500 per month, but you’d also get a $20,000 lump sum payout. Delay to age 70 and you’d get a lump sum of nearly $200,000. How do people respond to that?

get $1,500 per month, but you’d also get a $20,000 lump sum payout. Delay to age 70 and you’d get a lump sum of nearly $200,000. How do people respond to that?

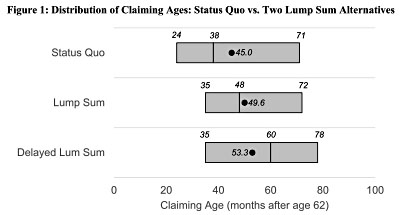

It turns out that they delay retirement—or they say they would on a survey, anyway. Under the current scenario, people say they’d retire at 45 months past age 62, or 65 years and 9 months. Under the lump sum scenario, the average retirement age is about five months later. (A third scenario with a delayed lump sum payout motivates people to retire even later.)

Would people do this in real life if they were offered these options? Maybe. And it would probably be a good thing, as Yglesias explains:

Since the benefits would be actuarially fair, this would not save the government any money. But since people would be working longer, the overall size of the economy and the tax base would be larger. That extends the life of the Social Security Trust Fund, and helps delay the moment at which benefit cuts or tax increases are necessary. The overall scale of the change is not enormous, but it’s distinctly positive and it’s hard to see what the downside would be.

This is hardly the highest priority on anybody’s wish list, but it’s an intriguing study. And it would certainly be easy to implement. Maybe it’s worth a try.