Where corporate America's money went<a href="http://www.shutterstock.com/pic-155094362/stock-photo-cayman-arrow-on-the-beach.html?src=csl_recent_image-1">Pincasso</a>/Shutterstock

It’s always been a pretty simple arrangement for America’s superrich: Park your money in a country whose banks know how to keep a secret and then underreport your assets to the IRS. Without a way to independently verify how much money you have abroad, the taxman had to take your word for how much money you had stashed in a Swiss vault or in a sunny haven like the Cayman Islands. But as of yesterday, the US government will require foreign banks to report their American clients’ assets, or face 30 percent tax penalties on some offshore deposits.

The move is part of the Foreign Account Tax Compliance Act (FATCA), which was introduced in 2010. Since then, more than 80 countries have agreed to open their ledger books to the feds. After some complicated last-minute negotiations, even Russia and China have started to cooperate.

Companies and individuals have long used offshore banking to keep their taxes low: Last year, American multinationals kept an estimated $2 trillion (yes, with a “t”) abroad, according to a Bloomberg analysis. In recent years, tech companies have become some of the most enthusiastic offshore depositors. Between 2010 and 2013, Microsoft more than doubled its foreign stockpile to $76.4 billion, while Apple increased its pot abroad more than fourfold to $54.4 billion.

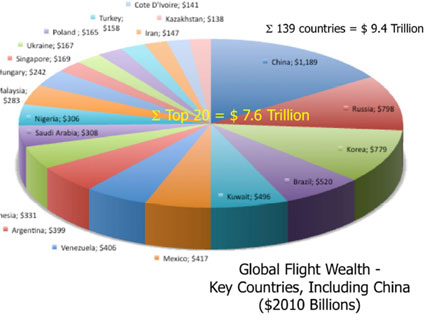

But while big US companies have stowed a massive pile of cash abroad, US banks hold even more money for foreign clients. According to Tax Justice Network, a British-based advocacy and research group, out of the $21 to $32 trillion kept offshore globally, about 22 percent is kept in the United States—a fact that’s not lost on countries complying with FATCA, some of whom are embracing the law because it means they’ll get to learn a few things about their own citizens’ holdings in the US.