Illustration: Mirko Ilić

Myth #1

Energy Independence Is Good

On February 1, 2006, Prince Turki al-Faisal, Saudi Arabia’s ambassador to Washington, arrived at the White House in a state of agitation. The night before, in his State of the Union address, President Bush had declared the United States to be “addicted to oil, which is often imported from unstable parts of the world.” He had announced plans to “break this addiction” by developing alternatives—including a multibillion-dollar subsidized ramp-up of biofuels—and had boldly stated that by 2025, America could cut imports from Gulf states by three-quarters and “make our dependence on Middle Eastern oil a thing of the past.” “I was taken aback,” Prince Faisal later told cnn, “and I raised this point with government officials.”

Two years on, anyone who’s been to a gas station or a grocery store knows the prince had very little to worry about. Despite supposedly bold initiatives such as last year’s Energy Independence and Security Act, America is no freer from foreign oil: Since 2006, imports have remained steady at about 13 million barrels every day, while the price for each of those barrels has jumped by $30. And though federal efforts to encourage biofuel production have significantly boosted output, our heavily subsidized ethanol refiners now use so much corn (closing in on a third of the total crop) that prices for all grains have soared, sparking inflation here at home and food riots abroad.

Okay, so maybe ethanol’s critics are right, and turning food into fuel isn’t the smartest way to wean ourselves from imported oil. But the deeper lesson here isn’t that Washington backed the wrong weapon in the war for energy independence, but that most policymakers—and Americans generally—still think “energy independence” is a goal we can, or should, achieve. Nine in ten voters say the country is too dependent on foreign crude. Every major presidential hopeful formulated some kind of strategy for energy liberation (Rudy Giuliani unveiled his at a nascar race), and between 2001 and 2006 the number of media references to “energy independence” jumped by a factor of eight.

And on the surface, the argument seems solid. Imported oil, some 60 percent of the oil we use, exposes our economy and politics to stresses halfway around the world (bin Laden calls it “the umbilical cord and lifeline of the crusader community”). It also increases our already massive trade imbalance, which must be corrected by ever-greater federal borrowing, and funnels tens of billions of dollars to the likes of Saudi Arabia, Russia, and Venezuela—countries that are unfriendly and, in some cases, actively anti-American. What’s not to like about energy independence?

In a word, everything. Despite its immense appeal, energy independence is a nonstarter—a populist charade masquerading as energy strategy that’s no more likely to succeed (and could be even more damaging) than it was when Nixon declared war on foreign oil in the 1970s. Not only have we no realistic substitute for the oceans of oil we import, but many of the crash programs being touted as a way to quickly develop oil replacements—”clean coal,” for example, or biofuels—come at a substantial environmental and political cost. And even if we had good alternatives ready to deploy—a fleet of superefficient cars, say, or refineries churning out gobs of cheap hydrogen for fuel cells—we’d need decades, and great volumes of energy, including oil, to replace all the cars, pipelines, refineries, and other bits of the old oil infrastructure—and thus decades in which we’d depend on oil from our friends in Riyadh, Moscow, and Caracas. Paradoxically, to build the energy economy that we want, we’re going to lean heavily on the energy economy that we have.

None of which is exactly news. Thoughtful observers have been trying to debunk energy independence since Nixon’s time. And yet the dream refuses to die, in no small part because it offers political cover for a whole range of controversial initiatives. Ethanol refiners wave the banner of independence as they lobby Congress for massive subsidies. Likewise for electric utilities and coal producers as they push for clean coal and a nuclear renaissance. And it shouldn’t surprise that some of the loudest proponents of energy liberation support plans to open the Arctic National Wildlife Refuge and other off-limits areas to oil drilling—despite the fact that such moves would, at best, cut imports by a few percentage points. In the doublespeak of today’s energy lexicon, says Julia Bovey of the Natural Resources Defense Council, “‘energy independence’ has become code for ‘drill it all.'”

Yet it isn’t only the hacks for old energy and Archer Daniels Midland who are to blame. Some proponents of good alternatives like solar and wind have also harped on fears of foreign oil to advance their own sectors—even though many of these technologies are decades away from being meaningful oil replacements.

Put another way, the “debate” over energy independence is not only disingenuous, it’s also a major distraction from the much more crucial question—namely, how we’re going to build a secure and sustainable energy system. Because what America should be striving for isn’t energy independence, but energy security—that is, access to energy sources that are reliable and reasonably affordable, that can be deployed quickly and easily, yet are also safe and politically and environmentally sustainable. And let’s not sugarcoat it. Achieving real, lasting energy security is going to be extraordinarily hard, not only because of the scale of the endeavor, but because many of our assumptions about energy—about the speed with which new technologies can be rolled out, for example, or the role of markets—are woefully exaggerated. High oil prices alone won’t cure this ill: We’re burning more oil now than we were when crude sold for $25 a barrel. Nor will Silicon Valley utopianism: Thus far, most of the venture capital and innovation is flowing into status quo technologies such as biofuels. And while Americans have a proud history of inventing ourselves out of trouble, today’s energy challenge is fundamentally different. Nearly every major energy innovation of the last century—from our cars to transmission lines—was itself built with cheap energy. By contrast, the next energy system will have to contend with larger populations and be constructed using far fewer resources and more expensive energy.

So it’s hardly surprising that policymakers shy away from energy security and opt instead for the soothing platitudes of energy independence. But here’s the rub: We don’t have a choice. Energy security is nonnegotiable, a precondition for all security, like water or food or defense. Without it, we have no economy, no progress, no future. And to get it, we’ll not only have to abandon the chimera of independence once and for all, but become the very thing that many of us have been taught to dread—unrepentant energy globalists.

Myth #2

Ethanol Will Set Us Free

What’s wrong with energy independence? Let’s start with the sheer physical enormity of replacing imports. Even if we limit the discussion to oil (and America buys boatloads of foreign natural gas, electricity, and even coal), the job is far more daunting than many liberationists—or environmentalists—want to believe.

If we distilled our entire corn crop into ethanol, the fuel produced would displace less than a sixth of the gasoline we currently guzzle, and other candidates, like hydrogen, are even more marginal. The challenge isn’t simply quantity, but quality. Oil dominates the energy economy, and especially the transportation sector (which is 95 percent dependent on crude), in part because no other fuel offers the same combination of massive energy density and ease of handling. As author Richard Heinberg has observed, enough energy is contained in a single gallon of gasoline to replace 240 hours of human labor—considerably more than oil’s likely rivals.

And because oil is relatively easy to produce, the energy “investment” needed to exploit that massive energy content is small. On average, an oil company burns the energy equivalent of 1 gallon of oil to produce 20 gallons of oil. In other words, oil’s energy return on energy invested is quite high. By contrast, the return for oil’s declared alternatives is quite low. For example, hydrogen, once considered a natural successor to oil, is so tricky to refine and handle that, by one study, a gallon of hydrogen contains nearly 25 percent less energy than was consumed producing it. As for ethanol’s energy return, scientists are debating whether it’s slightly positive or altogether negative.

Oil’s qualities were unbeatable when it cost $25 a barrel, and even at $100, it still has a critical advantage. Because it was generated ages ago and left for us in deep underground reservoirs, oil exists more or less in a state of economic isolation; that is, oil can be produced—pumped from the ground and refined—without directly impinging on other pieces of the world economy. By contrast, many of oil’s competitors are intimately linked to that larger economy, in the sense that to make more of an alternative (ethanol, say) is to have less of something else (food, sustainably arable land).

Granted, oil’s advantages will ultimately prove illusory due to its huge environmental costs and finite supply. But oil’s decline won’t, by itself, make alternatives any less problematic. Higher oil prices do encourage alternatives to expand, but in a world of finite resources, these expansions can come at substantial cost. Because good U.S. farmland is already scarce, every additional acre of corn for ethanol is an acre unavailable for soybeans, or wheat, whose prices then also rise—a ripple effect that affects meat, milk, soft drinks…. And for the record, to make enough corn ethanol to replace all our gasoline, we’d need to plant 71 percent of our farmland with fuel crops.

To be fair, ethanol can be produced in a way that is less disruptive to the food economy. Cellulosic ethanol, for example, is made from wood chips, crop detritus, and other organic waste. And in Brazil they make ethanol from sugarcane—a process a third as energy intensive as corn ethanol’s. But cellulosic ethanol, though quite promising, is not yet commercial, while Brazilian ethanol is, well, Brazilian: It’s effectively barred from our market by a 54 cents per gallon tariff, which U.S. lawmakers defend on the grounds of energy independence, but which coincidently leaves corn ethanol, with its massive federal subsidy, as pretty much the only game in town. So much corn is now going to biofuel that the food and energy markets are effectively linked, an unprecedented coupling that not only disrupts global food security but also undermines corn ethanol’s usefulness as an oil replacement.

The ripple effect of energy alternatives isn’t confined to the economic sphere. As eager farmers have expanded their corn crops (U.S. farmers planted more acres in 2007 than anytime since World War II), they’ve tilled land not suited for intensive agriculture, exacerbating erosion and other environmental problems. Corn is also the most chemically intensive commercial grain crop; runoff attributable to the ethanol boom is causing oceanic dead zones and pesticide-laden groundwater.

Ethanol is an easy target, but the sad truth is that all of the ballyhooed alternatives carry at least some environmental or other external costs. Wind requires vast amounts of land; solar-cell manufacturing is chemically intensive. Nuclear energy is steeped in safety and security concerns. And although the United States could fuel its entire car fleet with a synthetic gasoline made from abundant coal, syngas is even more ecologically challenged than oil. Industry likes to trumpet potential technologies to capture and sequester coal’s carbon dioxide, but the federal government has cut research funding. And as Severin Borenstein, an economist at the University of California-Berkeley, points out, even if we do find climate-friendly ways to turn coal into fuel, that’s only one end of the process: “We’re still going to be burning that fuel in cars and thus releasing all that CO2 out the tailpipe.”

Such problems drive home a critical flaw in the paradigm of energy independence—namely, that energy isn’t a zero-sum game anymore. We can no longer look at the energy economy as a constellation of discrete sectors that can be manipulated separately; everything is tied together, which means that fixing a problem in one part of the system all but invariably creates a new problem, or a whole series of problems, somewhere else.

Myth #3

Conservation Is a “Personal Virtue”

By now it should be clear not only that energy independence is prohibitively costly, but that the saner objective—energy security—won’t be met through some frantic search for a fuel to replace oil, but by finding ways to do without liquid fuel, most probably through massive increases in energy efficiency.

This isn’t a popular idea with Dick Cheney, who before 9/11 famously said that “conservation may be a sign of personal virtue, but it is not a sufficient basis for a sound, comprehensive energy policy.” Nor among traditional energy players, who desperately want to find something to sell us if oil becomes untenable—and don’t really care if that something is hydrogen or ethanol or pig manure. But for the rest of us, the logic of conservation is pretty hard to argue with. Better energy efficiency is one of the fastest ways to reduce not only energy use, but pollution and greenhouse gas emissions: According to a new study by McKinsey & Company, if the United States aggressively adopted more efficient cars, factories, homes, and other infrastructure, our CO2 emissions could be 28 percent below 2005 levels by 2030. And saving energy is almost always cheaper than making it: There is far more oil to be “found” in Detroit by designing more fuel-efficient cars than could ever be pumped out of anwr. And because transportation is the biggest user of oil—accounting for 7 of every 10 barrels we burn—any significant reduction in the sector’s appetite has massive ramifications. Even the relatively unambitious 2007 energy bill, which raises fuel-economy standards from 25 mpg to 35 mpg by 2020, would save 3.6 million barrels a day by 2030. And if we persuaded carmakers to switch to plug-in hybrids, we could cut our oil demand by a staggering 9 million barrels a day, about 70 percent of our current imports.

Such a shift would impose massive new demand on an electric grid already struggling to meet need, but plug-in hybrids actually stretch the grid’s existing capacity. Charged up at night, when power demand (and thus prices) are low, plug-in hybrids exploit the grid’s large volume of unused (and, until now, unusable) capacity. Such “load balancing” would let power companies run their plants around the clock (vastly more cost-effective than idling plants at night and revving them up at dawn); as important, it would substantially boost the grid’s overall output. According to the Department of Energy, with such load balancing, America’s existing power system could meet current power demands and generate enough additional electricity to run almost three-quarters of its car and light-truck fleet. That alone would be enough to drop oil consumption by 6.5 million barrels a day, or nearly a third of America’s current demand.

Granted, this switch to electric-powered cars wouldn’t be free. Seventy percent of America’s electricity is made from high-carbon fuels like natural gas and especially coal, which is why the power sector emits 40 percent of all U.S. carbon emissions. Just 8.4 percent comes from renewable sources, and most of that is environmentally dubious hydroelectric; wind, solar, geothermal, and biomass together supply 2.4 percent, and despite rapid growth, their share of the power market will remain small for decades. Even so, an electric or plug-in hybrid fleet is still probably the most environmentally plausible path away from oil. Why? Because kilowatt for kilowatt, turning fossil fuels into electricity in massive centralized power plants and then putting that juice into car batteries is more efficient than burning fossil fuels directly in internal combustion engines, and thus generates fewer CO2 emissions per mile traveled. (Our existing fleet generates a third of America’s CO2 emissions.) The doe found that replacing three-quarters of the U.S. fleet with plug-in hybrids would cut vehicle CO2 emissions by 27 percent nationwide—40 percent or more if the country’s power system were upgraded to match California’s low-carbon grid. And once the new fleet is in place, there is nothing stopping us from upgrading our power sources to truly renewable systems.

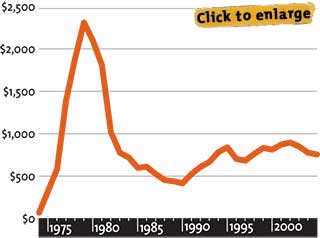

Federal Funding for Renewable-Energy R&D

$ millions, in 2005 dollars

Seeing Green

Where the clean-energy money is—and isn’t

Dept. of Energy solar budget, 2008: $168 million

Venture capital investment in solar, 2006: $264 million

Dept. of Energy renewable-energy budget, 2008: $1.7 billion

Venture capital investment in renewable energy, 2006: $2.4 billion

Federal ethanol subsidies, 2006: $6 billion

Federal coal subsidies, 2006: $8 billion

Federal oil and gas subsidies, 2006: $39 billion

Worldwide investment in renewable energy, 2007: $71 billion

Myth #4

We Can Go It Alone

Given America’s reliance on imported oil, it seems safe to assume that if we succeeded in getting such dramatic reductions, whatever sacrifices we’d made would be more than compensated for by our new immunity to the nastiness of world oil markets. Let Saudi Arabia cut its production. Let Hugo Chávez sell his oil to China. Such maneuvers no longer matter to Fortress America.

And yet, no country can really hope to improve its energy security by acting alone. True, cutting our own oil use would bring great things here at home, everything from cleaner air and water to lower noise pollution. But we’d be surprised by how little our domestic reductions changed the rest of the world—or improved our overall energy security.

The first problem, once again, is the small-planet nature of energy. America may be the biggest user of oil, but the price we pay is determined by global demand, and demand is being driven largely by booming Asia, which is only too happy to burn any barrel we manage to conserve or replace. Second, any shift to alternatives or better efficiency will take years and perhaps decades to implement. The U.S. car fleet, for example, turns over at a rate of just eight percent a year. That’s as fast as consumers can afford to buy new cars and manufacturers can afford to make them, which means that—even in a fantasy scenario where the cars were already designed, the factories retooled, and the workers retrained—it would still take 12 years to deploy a greener fleet.

Most forecasts fail to acknowledge how slowly such changes could actually occur. Sure, if the United States could cut its oil consumption overnight by 9 million barrels, or 6.5 million barrels, or even 3.6 million barrels, it would have a staggering impact on oil prices. But barring a global depression, demand won’t ever drop so rapidly; instead, our demand reductions will be incremental and thus effectively canceled out by the expected demand growth in other, less efficiency-minded countries like China. Berkeley’s Borenstein, for example, estimates that the 3.6 million barrels the United States would save by 2030 under the 2007 energy bill will be more than offset by growth in demand elsewhere. Put another way, we could all squeeze into smaller cars and still be paying $4 for a gallon of gasoline.

To be sure, energy security isn’t defined solely by cheap energy, and in fact, a great many enviros and energy wonks like oil at $100 a barrel, as it seems to be the only thing keeping more of us from buying Hummers. But high prices are killing our other energy-security objectives. High prices mean that money is still flowing into rogue states. High oil prices also imply tight oil markets, prone to massive price swings that are painful for consumers and make it virtually impossible for companies and governments to forecast their future energy costs—and so correctly gauge how much to invest in next-generation energy technologies. And no matter how clean and carbon free the United States becomes, if China and India are still burning massive volumes of oil we haven’t done much to improve long-term security of any kind.

The only way to achieve real energy security is to reengineer not just our energy economy but that of the entire world. Oil prices won’t fall, evil regimes won’t be bankrupt, and sustainability won’t be possible—until global oil demand is slowed. And outside of an economic meltdown, the only way it can be is if the tools we deploy to improve our own security can be somehow exported to other countries, and especially developing countries.

Energy globalism doesn’t mean that every new energy gadget or fuel we invent has to work in Beijing or Burkina Faso. It does, however, suggest that our current energy strategy, tailored primarily to our own markets and our own technical capabilities, will be next to useless in an energy economy that is increasingly global—and that at least some of our energy investments should be compatible with regions where natural resources are strained, governments are poor, and consumers don’t have access to home-equity lines of credit.

Myth #5

Some Geek in Silicon Valley Will Fix the Problem

So, what kinds of technologies would qualify under this more global strategy? Although corn and even cane ethanol are dubious—arable land in most of the developing world is already far too scarce—cellulosic ethanol has definite potential. Plug-in hybrids are probably too expensive for most Third World consumers, but have possibilities in the megacities of Asia and Latin America.

In the near term, however, the most practical energy export will be efficiency. China is so woefully inefficient that its economy uses 4.5 times as much energy as the United States for every dollar of output. This disparity explains why China is the world’s second-biggest energy guzzler, but also why selling China more efficient technologies—cars, to be sure, but also better designs for houses, buildings, and industrial processes—could have a huge impact on global energy use and emissions.

As a bonus, such exports would likely be highly profitable. Japan, whose economy is nine times as energy efficient as China’s, sees enormous economic and diplomatic opportunities selling its expertise to the Chinese, and America could tap into those opportunities as well—provided technologies with export potential get the kind of R&D support they need. Yet this isn’t assured. You may have read that the volume of venture capital flowing into energy-technology companies is at a record high. But much of this capital is flowing into known technologies with rapid and assured payoffs—such as corn ethanol—instead of more speculative, but potentially more useful, technologies like cellulosic ethanol.

Once upon a time, America compensated for investor reluctance with gobs of federal money. But though President Bush routinely promises to spend more on alternative energy, little new money has appeared; federal spending on solar research, for example, is well short of that in the Clinton years, and the $148 million Bush pledged for solar back in 2006 was, in inflation-adjusted terms, less than half of what we spent annually in the 1970s. Other technologies suffer as well. Senator Richard Lugar, an Indiana Republican who has long argued for a global approach to energy security, notes that despite Bush’s stated support for cellulosic ethanol, the Energy Department’s “glacial implementation” of R&D loan guarantees has turned off potential investors. “The project is moving forward,” Lugar says, “but critical time was lost.”

Myth #6

Cut Demand and the Rest Will Follow

Given America’s tectonic pace toward energy security, the time has come for tough love. Most credible proposals call for some kind of energy or carbon tax. Such a tax would have two critical effects. It would keep the cost of oil high and thus discourage demand, as it has in Europe, and it would generate substantial revenues that could be used to fund research into alternatives, for example, or tax credits and other incentives to invest in the new energy technologies.

To be sure, higher fuel taxes, never popular with voters, would be even less so with gasoline prices already so high. Indeed, many energy wonks are still bitter that President Bush didn’t advocate for a fuel tax or other demand-reduction measures in the aftermath of 9/11, when oil prices were relatively low and Americans were in the mood for sacrifice. Bush “could have gotten any set of energy measures passed after 9/11 if he had had an open and honest dialogue with America about how bad things were,” says Edward Morse, an energy market analyst and former State Department energy official.

Instead, Bush urged Americans to…go shopping. Seven years later, with oil prices soaring and the economy hurting, swaying the electorate will take a politician who is politically courageous, extraordinarily articulate—and willing to dispense with the sweet nothings of energy independence.

And higher energy taxes are just the first dose of bitter medicine America needs to swallow if it wants real energy security. For no matter how aggressively the United States cuts oil demand both at home and abroad, it will be years and perhaps decades before any meaningful decline. The 12-year fleet-replacement scenario outlined above, for example, assumes that efficient new cars are being mass-produced worldwide and that adequate new volumes of electricity can be brought online as the fleet expands—assumptions that at present are wildly invalid. A more reasonable timetable is probably on the order of 20 years.

During this transition away from oil, we will still need lots and lots (and lots) of oil to fuel what remains of the oil-burning fleet. If over those 20 years global oil demand were to fall from the current 86 million barrels a day to, say, 40 million barrels a day, we’d still need an average of 63 million barrels a day, for a total of 459 billion barrels, or almost half as much oil as we’ve used since the dawn of humankind.

And here we come to two key points. First, because the transition will require so much old energy, we may get only one chance: If we find ourselves in 2028 having backed the wrong clusters of technologies or policies, and are still too dependent on oil, there may not be enough crude left in the ground to fuel a second try. Second, even if we do back the right technologies, the United States and the world’s other big importers will still need far too much oil to avoid dealing with countries like Iran, Saudi Arabia, and Russia—no matter how abhorrent we find their politics.

In one of the many paradoxes of the new energy order, more energy security means less energy independence.

Myth #7

Once Bush Is Gone, Change Will Come

No presidential candidate has indicated he or she will raise energy taxes or sit down in oil talks with Tehran. All have ties to a self-interested energy sector, be it coal, ethanol, or nukes. And even after the election, energy security is so complex and requires such hard choices that any president, and most members of Congress, will be sorely tempted to skirt the issue in the tried and true manner, by pushing for a far more palatable “energy independence.” As Senator Lugar so choicely put it, “The president will have advisers who will be whispering cautions about the risks of committing the prestige of any administration to aggressive energy goals. Those advisers will say with some credibility that a president can appear forward-looking on energy with a few carefully chosen initiatives and occasional optimistic rhetoric promoting alternative sources. They will say that the voting public’s overwhelming energy concern is high prices for gasoline and home heating, and that as long as the president appears attentive to those concerns they can cover their political bases without asking for sacrifices or risking the possible failure of a more controversial energy policy.”

Lugar, a veteran pol, is no doubt correct about the pressures the next president will face. What we can only hope is that by the time he or she is chosen, the signals from an overheating energy economy will have reached a point where platitudes no longer suffice—where it is possible to embark on a “controversial energy policy,” to ask voters to make sacrifices, and above all, to push America, the champion of globalization, out of a posture of self-absorption and into a stance that is genuinely and sustainably global—at which point the Saudi ambassador really would have something to worry about.