Illustration: Bill MayerTHIS STORY IS NOT ABOUT THE origins of 2008’s financial meltdown. You’ve probably read more than enough of those already. To make a long story short, it was a perfect storm. Reckless lending enabled a historic housing bubble; an overseas savings glut and an unprecedented Fed policy of easy money enabled skyrocketing debt; excessive leverage made the global banking system so fragile that it couldn’t withstand a tremor, let alone the Big One; the financial system squirreled away trainloads of risk via byzantine credit derivatives and other devices; and banks grew so towering and so interconnected that they became too big to be allowed to fail. With all that in place, it took only a small nudge to bring the entire house of cards crashing to the ground.

Illustration: Bill MayerTHIS STORY IS NOT ABOUT THE origins of 2008’s financial meltdown. You’ve probably read more than enough of those already. To make a long story short, it was a perfect storm. Reckless lending enabled a historic housing bubble; an overseas savings glut and an unprecedented Fed policy of easy money enabled skyrocketing debt; excessive leverage made the global banking system so fragile that it couldn’t withstand a tremor, let alone the Big One; the financial system squirreled away trainloads of risk via byzantine credit derivatives and other devices; and banks grew so towering and so interconnected that they became too big to be allowed to fail. With all that in place, it took only a small nudge to bring the entire house of cards crashing to the ground.

But that’s a story about finance and economics. This is a story about politics. It’s about how Congress and the president and the Federal Reserve were persuaded to let all this happen in the first place. In other words, it’s about the finance lobby—the people who, as Sen. Dick Durbin (D-Ill.) put it last April, even after nearly destroying the world are “still the most powerful lobby on Capitol Hill. And they frankly own the place.”

But it’s also about something even bigger. It’s about the way that lobby—with the eager support of a resurgent conservative movement and a handful of powerful backers—was able to fundamentally change the way we think about the world. Call it a virus. Call it a meme. Call it the power of a big idea. Whatever you call it, for three decades they had us convinced that the success of the financial sector should be measured not by how well it provides financial services to actual consumers and corporations, but by how effectively financial firms make money for themselves. It sounds crazy when you put it that way, but stripped to its bones, that’s what they pulled off.

There’s more to say about how they accomplished this, but to understand just how extravagant the finance lobby’s power is, you need to understand some background first. There are a lot of places we could start: the election of Ronald Reagan and the beginning of the great era of financial deregulation. The collapse of Continental Illinois National Bank and Trust in 1984. The $100 billion bailout of the savings and loan industry. The Mexican crisis of 1994. The Asian crisis of 1997. But for our purposes, the best place to start is 1998. That was the year a hedge fund called Long-Term Capital Management imploded and very nearly took the global financial system down with it. It was, if you will, a dry run for 2008.

The Warning

At the time it was founded, LTCM was the biggest, most prestigious hedge fund ever created. The brainchild of John Meriwether, former head of bond trading at Salomon Brothers, it had two future Nobel Prize winners as partners, a staff of virtuoso traders and brilliant mathematicians, $10 million worth of fancy engineering workstations, and an initial capitalization somewhere north of $1 billion. It was the largest start-up hedge fund in history.

It was also one of the most successful. But LTCM didn’t make its money by doing anything so crude as betting on things like the rise and fall of the stock market. In fact, like most big hedge funds, LTCM paid very little attention to stocks. The Dow Jones average might get all the attention, but Wall Street pros know two things: The market for debt is far larger than the market for equities, and it provides far more fertile ground for mathematical manipulation and epic profits.

But clever mathematics alone isn’t enough to make Gatsbyesque fortunes. For that, you need to use leverage. You need to borrow other people’s money. Lots of it.

It’s easy to see why. A typical LTCM bet would start when someone noticed a spread that seemed a little out of whack. For example, two bonds might trade for slightly different prices even though they were nearly identical. So LTCM would go long in one bond and short in the other, essentially betting that the spread would narrow. Bond traders deal in basis points—hundredths of a percentage point—and a bet like this might depend on a spread of, say, 20 basis points narrowing to 10. That’s a nearly invisible movement, and on a million-dollar trade it nets you a grand total of $1,000. Hardly worth bothering with unless you make it a billion-dollar bet instead. That’s what LTCM did: It mastered a method that let it borrow huge sums of money practically for free and that turned thousand-dollar profits into million-dollar profits. Do that a few hundred times a year and you’re talking real money.

But leverage is a harsh mistress: It allows you to make lots of money when things go right, but it also allows you to lose lots of money very quickly when they don’t. And in 1998 things didn’t go right. Spreads that were supposed to narrow kept widening, and LTCM was forced to dip into its own capital to pay back the huge short-term loans it had taken out to leverage its bets. Losses kept mounting, creditors called in their loans, and eventually everything came crashing down.

But a funny thing happened on the way to the crash: The New York Fed stepped in and arranged a bailout. Almost all of Wall Street’s biggest firms participated, and they did so for one reason: The Fed convinced them that LTCM was too big to fail. An uncontrolled bankruptcy might set off a domino effect that could bring down dozens of banks. A few months later, an interagency report concluded, “The near collapse of LTCM illustrates the need for all participants in our financial system, not only hedge funds, to face constraints on the amount of leverage they assume.” It was a bipartisan judgment, signed by Fed Chairman Alan Greenspan and by Robert Rubin, Bill Clinton’s treasury secretary.

In any sane world, it would have been a call to arms. After all, LTCM was only worth a few billion dollars. If a relative minnow like that could pose a risk to the global economy merely through the use of profligate leverage, what might happen if a money-center bank worth 100 times as much did the same thing?

But we don’t live in a sane world. We live in a world where leverage—as well as Wall Street’s nearly endless stream of new contrivances for exploiting it—is largely controlled not by regulators or congressional committees, but by the finance lobby. And the last thing the finance lobby wants is constraints of any kind. So Wall Street promised solemnly to take the lessons of LTCM to heart and then got right down to the business of ignoring them. In fact it spent the next decade not merely blocking reform, but making things worse by lobbying relentlessly to expand leverage, complexity, regulatory forbearance, and risk.

Now if the aerospace lobby had told us after the 1986 Challenger disaster that the key to better performance was to turbocharge the engines and quit performing preflight inspections, everyone would have agreed that they were crazy. Yet that’s essentially what the finance lobby has done over the past decade, and in some weird way we were too mesmerized to recognize it. Within months of a near catastrophe caused by one of the industry’s brightest stars, the lobbyists were busily making certain that it would happen again—and that when it did happen, it would be bigger and more disastrous than ever.

Unleashing the Banks

It’s hard to directly observe any lobby at work—by nature, it’s not business typically done out in the open—but in the same way that a meteor leaves behind a crater that lets you know its size and force of impact, so does the finance lobby. Sometimes these are laws passed by Congress. Sometimes they’re tax breaks kept in place by friendly senators. Sometimes they’re rulings by the Federal Reserve. Sometimes they’re green lights from federal watchdog agencies. All of these are part of our story, but it starts with Congress, which left behind the two biggest craters of them all in 1999 and 2000, a little more than a year after the LTCM collapse. The first was the Financial Services Modernization Act. The follow-up was the Commodity Futures Modernization Act.

The FSMA was designed to tear down a Depression-era law, the Glass-Steagall Act, that had set up the FDIC to guarantee commercial bank deposits and put up a fire wall between commercial banking and investment banking. The idea behind the 1933 law was pretty simple: Commercial banks should use their government-backed funds only for reasonably safe activities. Investment banks could take more risks, but they were on their own if things fell apart.

But starting in the 1980s, that became increasingly intolerable to Wall Street. Commercial banks were sitting on an enormous pile of money that they were prohibited from investing in anything more interesting than business and home loans. So they lobbied Congress. They lobbied the Fed. They lobbied the Treasury. They lobbied tirelessly for 20 years, and finally, after spending $209 million in 1998 alone, they got what they wanted: The wall was torn down and they were free to gamble customers’ funds in any way they wanted. In essence they became the world’s biggest hedge funds. And if LTCM was too big to fail, suddenly Citigroup and JPMorgan Chase were way too big to fail.

By itself, this was dangerous enough. But then Congress made things even worse. In the previous decade the world of derivatives—swaps, futures, and options—had become ever more complex and lucrative. The finance lobby was eager to make sure they remained largely unregulated, and in 2000 the Commodity Futures Modernization Act granted their wish. Long-standing state laws against “bucket shops”—informal exchanges that allowed investors to gamble on securities they didn’t actually own—were preempted, and Wall Street was officially turned into a casino. Banks could literally bet on anything.

Like so much else about the finance lobby, this was a bipartisan binge. The FSMA is also known as the Gramm-Leach-Bliley Act, and it’s true that all three of those gentlemen were Republicans dedicated to the cult of deregulation. Alan Greenspan was a keen advocate too. But the law was passed by a big bipartisan majority in the House, signed into law by Bill Clinton, and had been eagerly supported by Treasury Secretary Robert Rubin.

By the time it was passed, however, Rubin was long gone. He had taken a top job at Citigroup, one of the banks that had lobbied hardest for the deregulation that would eventually be its downfall. Deregulation would help Rubin earn over $100 million in the following decade. Not bad.

The Paycheck Lobby

The finance lobby isn’t just banks. Technically it’s known as the FIRE lobby—Finance, Insurance, and Real Estate—and it includes basically anyone who makes money by handling money. That means big money-center supermarket banks, small community banks, Wall Street investment banks, insurance companies, mortgage brokers, hedge funds, credit card issuers, trade groups like the International Swaps and Derivatives Association, private equity firms, credit unions, and more. Some of them, like the hedge funds, didn’t lobby heavily for the big deregulation of 1999 and 2000, because they were already pretty lightly regulated. Instead, they lobbied for other things. Like protecting bigger paychecks.

Wall Street bankers may seem like a pretty well-off bunch, but when they decide that a million dollars doesn’t go as far as it used to, they leave and start up a hedge fund. Hedge fund managers typically get paid 2 percent of the value of the assets under their control plus 20 percent of the investment profits, and for a successful manager this can add up to tens or even hundreds of millions of dollars a year. Aside from market reversals, the only real threat to their riches is the IRS.

Their defense against the taxman is something called the carried interest rule, and it’s elegant in both its simplicity and its shamelessness: It simply declares their compensation to be capital gains, not ordinary income. That means it gets taxed at 15 percent instead of 35 percent.

At first, it’s hard to figure out how they get away with this. After all, capital gains are the profit you make on money of your own that you invest. But hedge fund managers invest other people’s money and get paid a piece of the action. By any customary definition, this is ordinary income, the same as a sports agent taking his 10 percent or a CEO whose bonus depends on performance.

But enough money can buy you a defense of the indefensible. “If you get Chuck Schumer on your side, you are okay,” one former SEC official told the New York Times, and that’s exactly what the finance lobby has done. The New York Democrat is a member of both the Senate Committee on Finance and the Senate Committee on Banking, Housing, and Urban Affairs, and he’s received so much money from Wall Street over the years—more than $14 million—that he actually shut down his personal fundraising efforts between 2005 and 2008. Since then he’s raised a staggering $284 million for the Democratic Senatorial Campaign Committee, which he headed until recently, and much of it has come from Wall Street. In June 2007 alone, when lobbying for the carried interest rule reached a fever pitch, employees of private equity firms contributed nearly $800,000 to the DSCC.

It was money well spent: Schumer agreed to support a repeal of the rule only if taxes were also raised on things like venture-capital and real-estate partnerships, a stand that guaranteed resistance from enough interest groups to let the hedge funds’ special treatment survive unscathed. A million-dollar investment had allowed the hedge fund industry to keep a billion-dollar loophole. Not a bad return.

A Flock of Scandals

Congress isn’t the only place that draws the finance lobby’s attention. When the Federal Reserve was created in 1913, it was designed to be an independent agency. But that only means that it’s technically independent from Congress and the president. It’s not independent from the finance lobby.

Just the opposite. The 12 regional Federal Reserve Banks—including the all-important branch in New York City—are governed by boards of directors dominated by bankers chosen by…the banks themselves.

That might explain why the Fed has dragged its feet addressing the scandal of overdraft fees on debit cards. And “scandal” isn’t too strong a word. The overdraft industry, which started only 16 years ago, has grown to nearly $40 billion. It’s one of the banking industry’s biggest honeypots.

How? Well, many people don’t realize that you can incur more than one overdraft fee in a single day, or that many banks deliberately reorder purchases to ensure that you pay the maximum number of fees. And while the Fed finally ruled that come July consumers must opt in to overdraft protection, it didn’t address the central flaw: Overdraft fees are essentially a form of loan sharking. Consider that the average overdraft amount is $17 and is paid back in five days. With the typical overdraft fee now around $35, this works out to nearly $2 in fees for every $1 borrowed, an effective annual percentage rate of more than 10,000 percent. Not even the Mafia has a vig like that.

And the only reason it’s legal is because in 2004 the Federal Reserve bowed to industry pressure and ruled that overdraft fees shouldn’t be classified as loans. Sure, it conceded, banks promote overdraft protection “in a manner that leads consumers to believe that it is a line of credit.” And the Fed politely encouraged them to shape up. But it didn’t actually require anyone to stop these practices. It was yet another multibillion-dollar cash cow protected by the finance lobby at the expense of consumers.

As recently as 40 years ago this would have been inconceivable. In 1968 Congress passed the Truth in Lending Act, which, among other things, regulated the disclosure of interest rates on consumer loans and prevented credit card companies from charging customers more than $50 if someone stole their card and ran up a big bill. The financial industry didn’t much like the new regulations, but the idea that banks should be required to watch out for both themselves and their customers was popular and widespread. The bill passed.

By the end of the 20th century, though, that sort of George Bailey attitude was gone. In fact, an effort to strengthen the Truth in Lending Act to regulate predatory lending failed four separate times between 2000 and 2003 thanks to tenacious resistance from the finance lobby. So what happened between then and now?

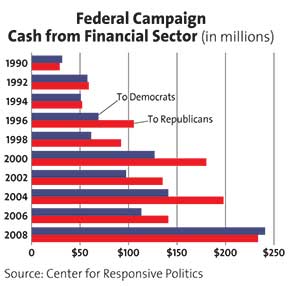

Money, of course. To get a better sense of just how much money, let’s take a virtual stroll down K Street and see what everyone is spending on the world’s second-oldest profession. It’s all laid out for us by OpenSecrets.org. The defense lobby? Pikers. They contributed $24 million to individuals and PACs during the last election cycle. The farm lobby? $65 million. Health care? We’re getting warmer. Health care was the No. 2 industry, at $167 million.

And the finance lobby? They’re No. 1, with a very, very big bullet. They contributed an astonishing $475 million during the 2008 election cycle. That’s up from $60 million almost two decades ago.

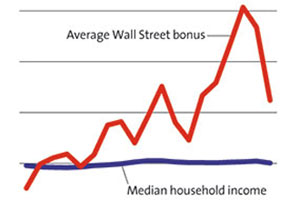

But this just pushes the question back a step: How can the finance lobby afford to spend so much more than anyone else? It feels silly to say that it’s because they have all the money—these are banks we’re talking about, after all—but that’s basically it. They have all the money. Princeton economics professor Hyun Song Shin laid it out last June in a paper that tracked the flow of money through various parts of the economy. Between 1954 and 1980 every sector he studied grew at roughly the same pace, increasing about tenfold. (See “The Securities Boom.”) But in 1980, after the great financial deregulation of the Reagan era began, his charts show a sudden discontinuity—while households, corporations, and commercial banks grew another tenfold between 1980 and 2008, the securities sector grew nearly a hundredfold.

This was the financialization of America, as Wall Street evolved from providing financial services to creating products—junk bonds, credit default swaps, subprime loan securitization, collateralized debt obligations—designed to allow Wall Street itself to prosper. By the height of the credit bubble between 2000 and 2007, the financial industry earned a staggering 40 percent of all corporate profits recorded in the United States, four times what they earned in 1980. Over the same period, average pay on Wall Street doubled, while bonuses at the top sextupled.

It was, depending on your perspective, either a vicious circle or a virtuous one. Deregulation produced vast profits, and those profits in turn provided the money to lobby for further deregulation. It was this ocean of money that allowed the financial industry to spend nearly $500 million on political contributions in just a single election cycle, and it was those contributions that helped keep so many flagrantly abusive—but profitable—practices alive and well. It was, for example, what allowed Big Finance to keep Congress from banning “universal default,” the small-print declaration on millions of credit card applications that banks could retroactively raise interest rates on consumers at any time for any reason.

It was why the FBI’s warnings of an “epidemic” of mortgage fraud as early as 2004 were completely ignored.

It’s why no one ever did anything about the multibillion-dollar abuse of the “yield spread premium,” a kickback paid to mortgage brokers for guiding their customers into higher-interest loans than they qualified for.

It was why the Fed ignored years of pleading from community groups to do something about abusive mortgage lending.

It’s why the credit card industry could afford to spend 10 years and $100 million lobbying for a punitive bankruptcy bill that, among other things, made it harder to write off credit card debt.

It’s why banks are paid fat subsidies to make government-backed student loans even though the Congressional Budget Office estimates taxpayers would save $80 billion over 10 years if the government made the loans outright.

It’s why Hawaii Sen. Daniel Akaka’s bill to require a warning to consumers about how long it takes to pay off a credit card balance if you make only the minimum payment was effortlessly swatted aside year after year.

It’s how the late Delaware Sen. William Roth (also the creator of the Roth IRA, another bank windfall) could get away with slashing tax audits on the superrich by doing nothing more than holding transparently comical hearings in 1997 and 1998 that portrayed IRS agents as jackbooted thugs who kicked down doors and held guns to young girls’ heads while forcing them to undress.

But there’s more to the finance lobby than just money and political influence. Their real power lies in the fact that they’ve so thoroughly changed our collective attitude toward financial regulation that sometimes they barely need to lobby in the traditional sense at all. That became obvious one spring day more than five years ago—or rather, it would have, had anyone paid attention.

Stockholm Syndrome

In April 2004 the SEC held a hearing. It was sparsely attended and quickly forgotten, but in 2008 Stephen Labaton of the New York Times got hold of an audio recording of the session and wrote an account of what happened.

The issue at hand was something called the net capital rule. Originally put in place in 1975, it set limits on how much leverage investment banks were allowed to carry on their books—limits that all five of Wall Street’s biggest investment banks wanted loosened. Goldman Sachs CEO Hank Paulson, later to become George W. Bush’s treasury secretary, had begun pressing for higher limits in 2000. Now, the SEC was considering doing just that.

The SEC meeting took place almost six years after the collapse of LTCM had dramatically demonstrated the systemic danger of unrestricted leverage. It came four years after a Fed staffer wrote a journal article clearly pointing out that banks were hiding more and more leverage. It came two years after the FDIC had passed a rule allowing banks to use complex hedges to effectively increase their leverage even more. It came at a time when the housing bubble was already heating up, the credit derivative market was exploding, and the Fed’s easy money policy was in its third consecutive year.

What’s remarkable, when you listen to that recording, is not that the banks got everything they wanted—of course they did. It’s that the new policy passed virtually without question. There was a single written dissent from an unknown risk management expert in Indiana, a couple of routine queries from one commissioner, and reassurances from staffers that the new rule posed no problems because the banks would police themselves. After less than an hour of desultory discussion, the new rule was in place.

In other words, very little lobbying was even required. After three decades of deregulatory fervor, it had simply become unnecessary. The SEC, like so many other government watchdogs, was by 2004 a thoroughgoing victim of regulatory capture, its appointees mostly Wall Street insiders with more sympathy for banks than for the public they were supposed to protect.

But the problem was bigger than just that. Unlike most industries, which everyone recognizes are merely lobbying in their own self-interest, the finance industry successfully convinced everyone that deregulating finance was not only safe, but self-evidently good for the entire economy, Wall Street and Main Street alike. It’s what Simon Johnson, an MIT economics professor and former chief economist for the IMF, calls “intellectual capture.” Considering what’s happened over the past couple of years, we might better call it Stockholm syndrome.

Like all the other products of the industry’s three-decade lobbying spree, the change to the net capital rule ended up in disaster when the overleveraged financial system nearly collapsed on itself. By October 2008, even former Fed chairman Alan Greenspan, one of the country’s biggest cheerleaders for self-regulation, was admitting the obvious: There was a “flaw” in the free-market worldview. “Those of us who have looked to the self-interest of lending institutions to protect shareholder’s equity, myself especially, are in a state of shocked disbelief,” he said in testimony before the House oversight committee.

If the case against self-regulation was strong then, it’s stronger now. Far from being chastened by last year’s meltdown, banks are back to their old tricks. The sliced-and-diced mortgage securities that caused so much trouble during the credit bubble are being re-sliced and -diced via something called a RE-REMIC (resecuritization of real estate mortgage investment conduit)—and business is booming. At Goldman Sachs, leverage in the first half of 2009 was at its highest level in its history. Even more astonishingly, the Wall Street Journal estimates that overall pay on Wall Street will rise to record levels in 2009, higher than at the height of the bubble. It’s as if the global collapse that nearly destroyed them has been completely forgotten.

So what happens next? Congress and the Obama administration have plans to re-regulate the financial industry, but you can’t undo 30 years of intellectual capture in a few months—especially when the reform effort is mostly in the hands of former finance executives. That’s evident in the fact that the simplest, most striking proposals for reining in bank behavior aren’t even getting a serious hearing. Former Fed chairman Paul Volcker, for example, suggests that commercial banks should simply be banned from securities trading altogether. They should go back to making loans and underwriting bonds, but leave the risky, leverage-heavy trading to hedge funds, where it’s fire-walled away from the plumbing of the overall banking system. Another former Fed chairman, Alan Greenspan, thinks we should break up big banks the same way we broke up Standard Oil 100 years ago. “If they’re too big to fail, they’re too big,” he said in October. Other economists have proposed a small tax on all financial transactions (perhaps a quarter of a percent or so), something that could reduce short-term speculation and help reduce the long-term deficit all at once.

But those reforms were never even considered. The problem isn’t that Obama administration officials don’t know where the real fault lines lie. Treasury Secretary Tim Geithner released a set of guidelines earlier this year that focused squarely on leverage, capital requirements, and regulation of the shadow financial system, not just on commercial banks. And a month later Obama economic adviser Larry Summers noted that our current deregulated system has produced economic crises like clockwork every three years. “Surely we cannot be satisfied with a system that misfires so seriously so frequently,” he said.

But Obama’s actual regulatory proposal didn’t reflect any of this sense of urgency. “We don’t want to tilt at windmills,” he explained last June—and there was little doubt which windmill he was talking about. Just a couple of months earlier the financial industry had won a stunning victory over a seemingly shoo-in administration proposal to modify bankruptcy laws for strapped homeowners—and they had not only won, they had managed to get billions in extra bailout money at the same time. That remarkable demonstration of raw power caught the Obama administration’s attention, so rather than risk another defeat it began compromising even before its proposal was introduced. Top bank executives and financial lobbyists were part of the planning from the start, and as a result mutual funds and hedge funds got away with only modest new limits, credit ratings agencies were left largely untouched, the most dangerous varieties of derivatives were left alone, almost nothing was done to reduce the size of the biggest banks, and additional powers were given to the Fed, which has shown repeatedly that it’s too close to Wall Street to ever regulate it effectively.

What’s worse, it’s not clear that even what’s left will ever see the light of day. One of the best parts of Obama’s proposal—and the scariest to bankers—was a new Consumer Financial Protection Agency that would regulate financial products the same way the Consumer Product Safety Commission regulates toasters. Even Alan Greenspan, perhaps humbled by the Fed’s failures under his watch, supported the idea. The Fed, he admitted, simply wasn’t likely to ever crack down on lending abuses.

Needless to say, the financial industry likes it that way, which is why the CFPA is the part of Obama’s plan they’ve been working the hardest to eviscerate. And where intellectual capture isn’t enough to do the job, there’s always money. After a brief dip in political outlays at the end of 2008, the financial industry spent $402 million in the first 10 months of 2009 on both lobbying and campaign contributions, enough to put them on track to break 2008’s record. Members of the House Committee on Financial Services alone received more than $8 million in industry contributions.

Whether the CFPA eventually survives is still up in the air, but the finance lobby scored a big victory almost immediately when Obama’s proposal went to Capitol Hill and was quickly stripped of its requirement that banks offer consumers “plain vanilla” products—things like standard 30-year fixed mortgages and low-interest, low-fee credit cards—in addition to their more convoluted options. A couple of weeks later banks with less than $10 billion in assets—a category that includes 98 percent of all US banks—were exempted from the CFPA’s scrutiny entirely. And proposals to regulate derivatives by forcing them to be traded on supervised exchanges, as stocks and commodity futures already are, were watered down as well.

How could all this happen so soon after the financial industry’s reckless behavior nearly caused a global meltdown? Ironically, it’s probably because the bailout was so successful. Without a sense of crisis to drive things, the political will to take on the industry has largely dissipated. Even after nearly destroying the world economy, the finance lobby is, still, simply too big to fight.