In a conversation with Dean Baker recently, I learned something interesting. This won’t be new to anyone deeply familiar with inflation statistics, but it was new to me. Maybe it will be new to you too.

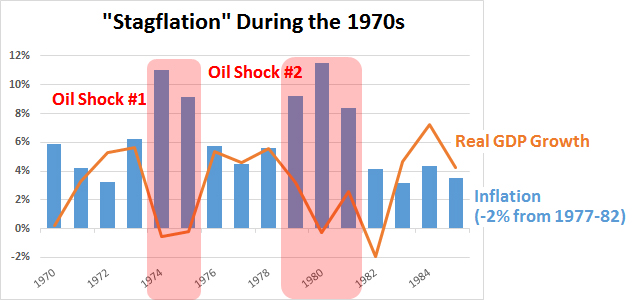

The general subject is the stagflation of the 70s, which ushered in supply-side economics and the Reagan era. More specifically, the issue is the measurement of inflation during part of this era. Housing costs are incorporated into the CPI by measuring rents, but prior to 1982 it was done by directly measuring the price of buying a house. In an era when interest rates were steady, this didn’t matter much, but when interest rates went crazy in the mid-70s it made a big difference, overstating inflation by about two percentage points. If you correct for this, and also take a look at exactly when the worst periods of stagflation occurred, you get this:

If you correct the inflation figures and account for the two oil shocks of the 70s, the period from 1970-85 looks remarkably steady. Inflation and GDP growth are both running at about 4 percent for nearly the entire time.

I don’t have the chops to relitigate this, but the question it raises is: Did stagflation ever even exist? Was there anything seriously wrong with the economy of the 70s other than a pair of oil shocks we had no control over? Would the economy have recovered normally after the second oil shock even if Paul Volcker hadn’t created a huge recession? Feel free to litigate in comments.

likely to be low (e.g., where workers report they do not have trade secrets), but the cost is still high to the worker.

likely to be low (e.g., where workers report they do not have trade secrets), but the cost is still high to the worker. are all that’s left to us, and the impact of these improvements

are all that’s left to us, and the impact of these improvements

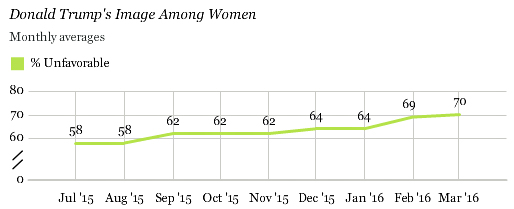

Jay Nordlinger is confused at the idea that if he doesn’t vote for Donald Trump,

Jay Nordlinger is confused at the idea that if he doesn’t vote for Donald Trump,

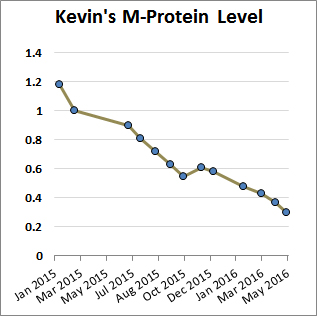

Everything is good news this month. My M-protein level continues to decline, which means the level of cancerous plasma cells in my bone marrow is declining too. I’m still a long way from zero, but heading in the right direction.

Everything is good news this month. My M-protein level continues to decline, which means the level of cancerous plasma cells in my bone marrow is declining too. I’m still a long way from zero, but heading in the right direction.