Over at The Corner, Ramesh Ponnuru recommends a post by Alan Reynolds of Cato:

A recent Washington Post column by Ezra Klein dreamed up a new excuse for the conspicuous failure of Obama’s so-called stimulus plan. Klein argues that the stimulus of federal spending has been offset by the “anti-stimulus” of fiscal austerity by state and local governments.

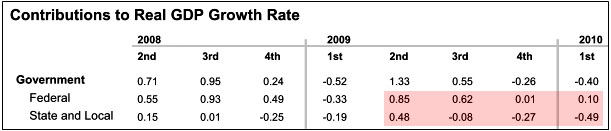

….But it is easy to identify each sector’s direct contribution to the overall growth rate of real GDP from a St. Louis Fed publication, “National Economic Trends.” State and local government spending was rising during the first three quarters of the recession, and the drop in the fourth quarter of 2008 accounted for just 0.25% of the 5.37% annualized decline in GDP. In the first quarter of 2009, state and local spending subtracted just 0.19% from real GDP, but federal spending subtracted more (0.33%) due to cuts in defense spending. Government obviously made only a minor contribution to the 6.4% drop in overall GDP.

….The table shows that government spending on goods and services had nothing to do with the recovery (transfer payments don’t contribute to GDP). As a matter of simple accounting, the state and local sector has been a very minor negative force — scarcely comparable to the Fed’s inaction in 1930-32.

This is a very peculiar argument. If you cut through the fog of words, here’s the table from the St. Louis Fed report that Reynolds is relying on:

The stimulus bill passed in February 2009 and presumably started taking effect in the second quarter of 2009 and beyond (red shaded area). Add up the numbers and they show that federal spending was responsible for 1.58 percentage points of GDP growth during that period while state spending was responsible for -0.36 percentage points of GDP growth. Look at just the three most recent quarters and it’s even worse: 0.73 points of growth from the feds and -0.84 points from the states. In other words, it’s exactly what Ezra said: the federal stimulus has been largely offset by declines in state spending.

Now, it’s true that federal spending in general has a fairly small impact on total GDP. But that’s because when you remove transfer payments the federal government only accounts for about 15% of total spending. The rest is private sector. There’s nothing mysterious about this.

I dunno. Maybe I’m missing something. I’m not sure that this is a very illuminating way to judge the effect of the stimulus on GDP in the first place, but to the extent that it is, it backs up Ezra completely: the federal stimulus has been largely counteracted by state cutbacks, just like he said.