<a href="http://www.flickr.com/photos/andrewmorrell/1110406084/">Andrew Morrell</a>/Flickr

Reihan Salam says that although Alan Simpson may have proven himself to be a moron when it comes to life expectancies and Social Security, we lefties shouldn’t laugh quite so hard:

But here’s the thing: what really matters in a pay-as-you-go system is the dependency ratio, i.e., the ratio of workers paying into the Social Security system to the number of Social Security beneficiaries…..The dependency ratio is the pressing issue, not increasing life expectancy per se. So while some of our friends poke fun at Alan Simpson, I’d suggest that the rest of us think through the implications of the changing dependency ratio.

At the risk of repeating myself endlessly on this topic: no, we don’t need to think through the implications of the changing dependency ratio. Or life expectancies. Or immigration rates. Or productivity levels. Or much of anything else.

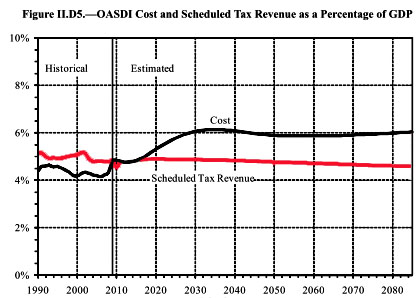

Why not? Because the Social Security trustees have already done that for us. If you want to argue with the trustees’ model, that’s one thing. Then you need to dive into the details. But most of us don’t want to do that. We accept their basic model, and once you accept their model then the solvency of Social Security boils down to precisely one thing: how much money is going in and how much money is getting paid out. That’s it. And here’s the chart that shows it:

This is the great thing about Social Security from a policy point of view: it’s pretty easy. It’s fundamentally a pure accounting exercise. By 20301, the income-outgo gap is about 1.5% of GDP, so all you have to do is pick and choose from a menu of options that gradually raise revenue and cut benefits by a combined total of 1.5% of GDP. That’s it. Your choices will depend a lot on your values and your priorities, but in the end the only thing you have to do is make sure the numbers add up. Simple.

POSTSCRIPT: Go ahead! Give it a try! This CBO report lists 30 options for you to choose from (summarized in Table 2 on page 33). They use the 75-year gap as their unit of account, rather than the annual gap, which they peg at 0.6% of GDP. So pick a basket of options that adds up to 0.6% and you’ve fixed Social Security. Congratulations!

1Actually, the trust fund makes up for the gap between 2015 and about 2040. So you only really need to close the gap after that. But eventually you have to come up with about 1.5% of GDP.