Ezra Klein is arguing today with Peter Suderman and Reihan Salam about conservative support for the individual mandate. The question is: why have conservatives flip-flopped? Why did they mostly support it 20 years ago but now unanimously agree that it’s the biggest threat to economic liberty since Das Kapital? Pure cynicism? Motivated reasoning? A genuine change of heart?

My answer: none of the above. Back in 1993, I’d say that Republican preference ordering on healthcare reform looked roughly like this:

So what’s a Republican to do? The answer is obvious: choose whichever option is the best one available at the time. If Clinton’s plan looks like it might pass, you support the next best alternative: private insurance with a mandate. If private insurance with a mandate is on offer, you once again support the next best alternative: nothing. There’s not really anything mysterious about this. You don’t need to resort to cynicism, motivated reasoning, or even a genuine change of heart to explain it. You merely need to realize that political actors — both liberals and conservatives — will always fight for the best deal they can get. If you offered me Obamacare, I’d take it, but that doesn’t mean I’d give up fighting for what I really want. Likewise, after conservatives defeated Clintoncare, I wasn’t surprised that they didn’t just rest on their laurels, but kept on fighting for what they really want

Suderman suggests that something similar has happened with Democrats and mid-90s proposals for premium support as a way of reining in Medicare spending. I think his case is a little weak here — premium support never really had much liberal support in the first place, and the version on offer recently by Paul Ryan that Democrats opposed bore little resemblance to the original proposal anyway — but he still has a point. And the explanation for the liberal shift is much the same as it was for conservatives and the mandate.

This is politics, and there’s nothing really very shocking about it. If you can cut a deal, that’s great, but you shouldn’t expect that either side will take it as the final word. In fact, you should expect just the opposite: that both sides will continue fighting to change the deal in their own favor.

As it happens, I think that Paul Ryan’s most recent version of premium support for Medicare isn’t too bad. Given where we are right now, I could imagine it being one side of a negotiation that produces something decent. But even if we came to an agreement, I’d pretty shortly be out there promoting a genuine national healthcare plan that would make it obsolete. Would that be treachery on my part? Of course not. It would just mean I took my half a loaf and then dived right back into campaigning for the other half. Would anyone else do differently?

POSTSCRIPT: None of this means that hypocrisy doesn’t play a role in the politics of the mandate. As Adam Serwer notes today, Antonin Scalia is probably Exhibit A here.

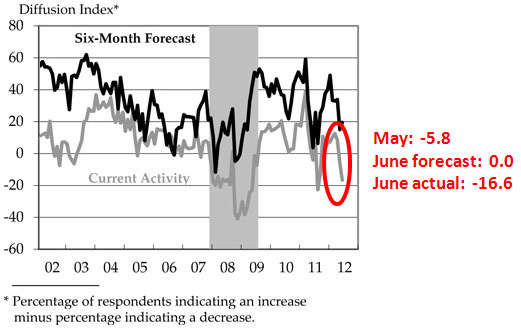

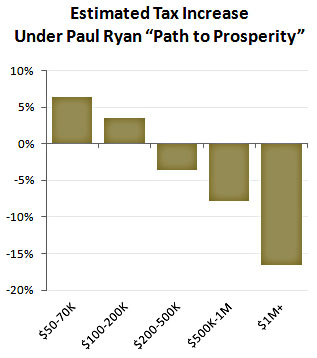

The Joint Economic Committee released an analysis today of the

The Joint Economic Committee released an analysis today of the