since 1975, companies have gone from contributing more than 90 percent of their workers’ retirement funds to pitching in less than half. How? Mostly by switching from “defined benefit” pension plans to 401(k) and similar “defined contribution” accounts. In such a shift, employees typically lose about one-third of their benefits. Some other key differences:

Pension vs 401(k)

Company assumes risk of investing

In addition to wages

Benefit depends on your salary, work history

Guaranteed by federal government

Employer pays fees and expenses

Company must contribute unless plan shut down

Employee assumes risk

Taken out of wages

Benefit depends on stock market

No guarantee

Employee pays

Company can suspend contributions

at will

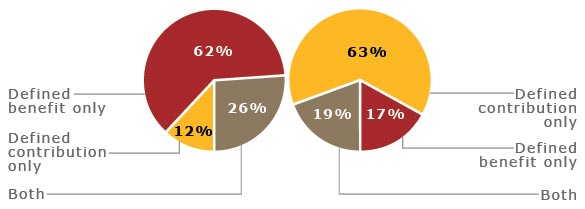

1983 vs 2007

Percentage of workers with retirement plans who had: