<a href="https://www.flickr.com/photos/afge/17036323278/in/photolist-rXrBnG-rVGULR-ri2TrY-scK667-rXzMNr-ri2NAq-seThUW-seZ6T4-rXsRVQ-seZ7Qz-riehzi-rXzM9R-rXzQTe-rVGYAp-seTfAs-rXsRzu-seZdrp-rXrG2w-ri2NDb-rXsU2d-riektz-seTgBA-sf31bk-seTm3j-scK2WS-rVGX7x-seTjJh-ri2Qty-rXsPkQ-rVGZrc-rXzPxD-rVGYiv-scK2ZC-rXrFy7-ri2QVf-riejU8-scK5yq-rXrDKs-sf355n-sf35pk-rXrHtE-rVH1pV-seTjby-rXrAXU-sf35a2-sf3482-rXrAU7-rXrEtm-seZaMB-3AhtXt">AFGE</a>/Flickr

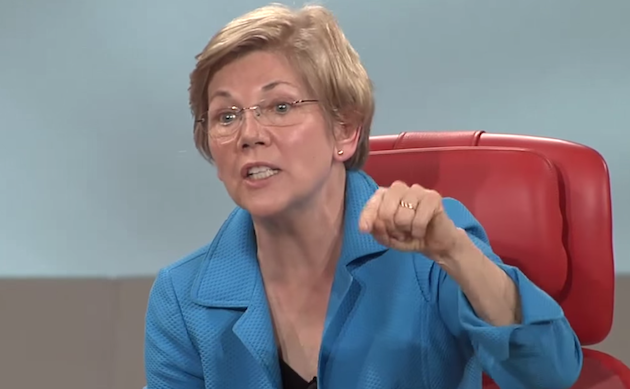

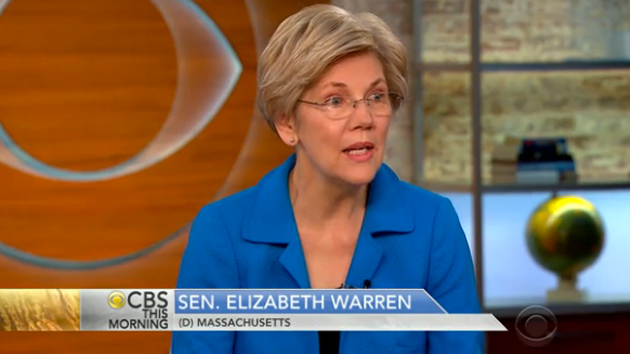

Jamie Dimon, the billionaire CEO of JP Morgan Chase, is concerned about Elizabeth Warren. He worries that the former Harvard Law bankruptcy professor and the senate’s loudest Wall Street critic might not grasp the complexities of high finance.

“I don’t know if she fully understands the global banking system,” Dimon said at an executive luncheon in Chicago on Wednesday.

Although he acknowledged that Warren had a few “legitimate complaints,” he ultimately doubts the Massachusetts senator understands his business.

This isn’t the first time the two have clashed. In her book “A Fighting Chance,” Warren wrote about a tense 2013 meeting in which Dimon expressed unhappiness with her ongoing work to strengthen financial regulations. When she eventually told him, “I think you guys are breaking the law,” Warren writes Dimon suddenly got quiet and responded, “So hit me with a fine. We can afford it.”

That’s for sure. JP Morgan Chase was one of five of the world’s largest banks hit with a total $5.7 billion fine after pleading guilty to global currency manipulation charges. Add to that, the $13 billion settlement it paid because of its funding of bad mortgages. Nonetheless, in the fourth quarter of 2014 alone, the company reaped in a $4.9 billion profit.

But Dimon proves to be far more benevolent than Warren may realize. On Wednesday, he kindly offered to sit down with the senator whenever she wants so he could explain Global Banking 101 to her—one transaction at a time.