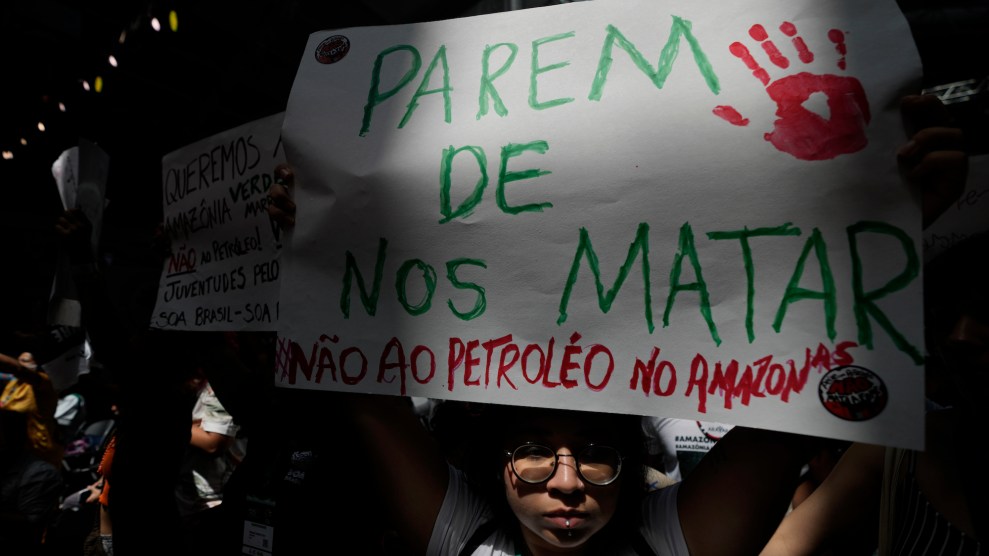

A demonstrator holds a sign that reads: "Yes to life, no to the mine," during a protest against a mining contract between First Quantum Minerals of Canada and Panama's government over the Cobre Panamá copper mineArnulfo Franco/AP/Canada's National Observer

This story was originally published by Canada’s National Observer and is reproduced here as part of the Climate Desk collaboration.

The battle between a Canadian mining company and Panama over one of the richest copper-gold mines in the Americas is headed to international arbitration—exposing Canada’s double standard when it comes to promoting free trade in the Global South.

Late in 2023, the Supreme Court of Panama unanimously ruled that the agreement to mine Cobre Panamá, controlled by Toronto’s First Quantum Minerals, was unconstitutional. Beset by a generational, popular backlash against the mine, the government of Laurentino Cortizo accepted the court decision and the legislature banned new mining.

Not everyone celebrated. Cobre Panamá provides about five percent of GDP for this tiny nation of just over four million, and supplies thousands of jobs. The open pit mine, set amid the Mesoamerican Biological Corridor that connects wildlife across Central America and southern Mexico, is also an important source of copper needed in vast quantities to realize the clean-energy transition. Before he resigned in the wake of the court ruling, Panama’s Trade minister Frederico Alfaro predicted the decision would reap economic chaos, unemployment, and not least, an onslaught of “international claims from investors.”

The latter is now in play. First Quantum, the main investor in the mine, announced it intends to take Panama to international arbitration for alleged breach of the Free Trade agreement finalized by Canada’s Harper government in 2013. Its Panamanian subsidiary has launched separate arbitration over the alleged failure to honor the 2023 concession agreement (approved by Panama in October, and ruled unconstitutional in November). At least three additional mining investor suits against Panama, including one by Toronto-based Franco-Nevada, have also suddenly emerged.

Panama and the companies must now enter the clandestine world of Investor State Dispute Settlements (ISDS)—a little-known global system designed to settle disputes between foreign investors and sovereign nations. In taking a dispute to ISDS, a foreign investor seeks to enforce commitments made by a nation through a law, treaty or contract. Cases are typically settled by three ISDS adjudicators—not judges but private-sector lawyers—where the investors select one, the nation chooses another, and a third is agreed on by both. The dispute is then settled by a binding ruling, which can include compensation awards to investors.

Gus Van Harten, a law professor at York University’s Osgoode Hall and author of four books on ISDS, says First Quantum will try to use the arbitration process to prove Panama’s Supreme Court breached the Canada-Panama free trade agreement. If the mine is shuttered, the company wants compensation for the billions it claims to have invested until this moment, and likely much more. “The big ticket item will be the claim of lost future profits, which will go into a very large number, billions, maybe more.”

Van Harten doesn’t think it will be easy for First Quantum to make its case. “When you are attacking a country’s decisions emanating from the Supreme Court, you better have a damn good argument.”

First Quantum did not respond to calls for this story.

The stakes are enormous, nonetheless. If a country loses at arbitration, there is no escape. Van Harten says the international ISDS system, unlike most lax-on-consequence international law, “doesn’t have teeth—it has fangs. Once you get the award, [the investors] can basically shop that award around across different countries, looking for assets of the state, and then you can chase and attack those assets to make good on the award.”

Parties can go after development bank loans and virtually anything else. Argentina had one of its navy ships seized while docked in Ghana, on behalf of a US hedge fund. Van Harten says the treaties are written very favorably for the protection of foreign investor assets, and are more generous than anything you would see in domestic law protecting property rights. “This is property rights for foreign investors, on steroids.”

Recent history speaks to the power of the ISDS system wielded by Canadian mining companies, which account for a disproportionate number of these cases due to Canada’s dominance of international mining. A joint venture led by Toronto’s Barrick Gold Corporation took Pakistan to the World Bank’s International Center for Settlement of Investment Disputes in 2011 after the latter refused to issue a mining permit for Reko Diq, one of the world’s largest undeveloped copper-gold deposits. In 2019, three private arbitrators ordered Pakistan to pay Barrick’s Australian subsidiary about US $5.8 billion in compensation and a separate arbitration decision reportedly brought the total award up to US $11 billion.

These staggering awards—equal to 40 percent of Pakistan’s total foreign cash reserves at the time—included compensation for expected future profits, even though the investment by the joint venture in 2011 was only about $220 million. Pakistan ultimately allowed the mine to proceed, and Reko Diq, which Barrick 50 percent owns, will begin construction in 2025.

Jennifer Moore, an associate fellow with the Institute For Policy Studies, says big ISDS awards “can impose a chill on the actions of regulators and governments to properly implement the decisions that have been made in the interest of people and the environment.”

Moore says the prospect of payouts and loss of sovereignty is prompting some resource-rich countries—including Brazil, South Africa and Indonesia—to step back or opt out completely from treaties and contracts with ISDS provisions. Meanwhile, European countries have withdrawn en masse from the EU’s multilateral Energy Charter Treaty, while Canada recently hailed the elimination of ISDS, in the latest renegotiation of North American Free Trade Agreement, as a victory for Canadian sovereignty.

“[ISDS] has cost Canadian taxpayers more than $300 million in penalties and legal fees,” said then-finance minister Chrystia Freeland in 2018 as Canada announced the renegotiated deal. “ISDS elevates the rights of corporations over those of sovereign governments. In removing it, we have strengthened our government’s right to regulate in the public interest, to protect public health and the environment.”

Even with this awareness, Moore says Canada’s respect for regulation in the public interest does not extend beyond its own borders: “Canada continues to promote the inclusion of ISDS in its trade agreements around the world, in order to shore up the interests of Canadian-based corporations, very well knowing what the implications of that are.”