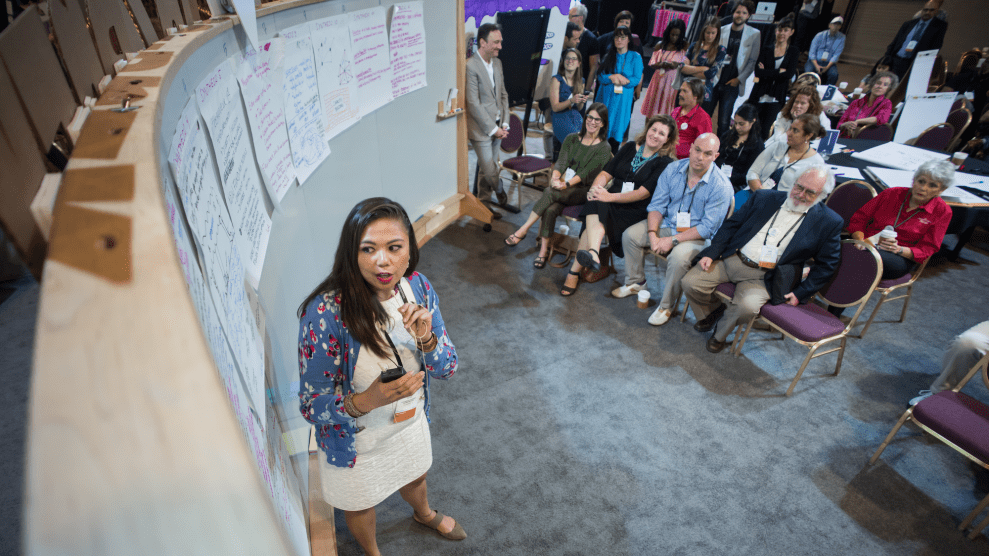

Estelle Reyes from the Los Angeles Cleantech Incubator leads the session during the 2017 ESHIP Summit.The Kauffman Foundation

This content was written by Randi Druzin, and paid for by The Kauffman Foundation; it was not written by and does not necessarily reflect the views of Mother Jones' editorial staff. See our advertising guidelines to learn more.

Amanda DoAmaral had left her job as a teacher in Oakland, California, and moved in with her mother to pursue her dream of starting her own business, when she came across Beta Boom, a startup accelerator based in Utah. After providing a $40K investment, this accelerator program set her on the road to success. Two years later, Fiveable is a thriving social learning platform that makes test preparation resources and support accessible to students across the country.

“I’ll never forget the moment I discovered this accelerator,” says DoAmaral. “I thought, ‘Someone will give an entrepreneur like me money to build a business?’ I was amazed.”

About 83 percent of entrepreneurs are reportedly unable to obtain bank loans or venture capital. While some can rely on personal or familial wealth to get their businesses started, many people don’t have these resources. However, a handful of fortunate entrepreneurs are able to secure capital from alternative funding sources, like crowdfunding, competitions, and accelerator programs that provide access to mentorship and investors. Incubators—collaborative initiatives that equip entrepreneurs with workspace, seed funding, mentoring, and training—are another option.

The success of such initiatives underscores the notion that more innovative models of financing should be developed. This is especially true of areas of the country where women and people of color tend to be underrepresented among entrepreneurs.

Amanda DoAmaral presenting at Gener8tor’s Demo Day.

“We’ve spoken to thousands of entrepreneurs across the nation, and we know that the system to access capital for new businesses is broken, especially for women, people of color, and those living in rural communities,” says Jason Wiens, policy director for entrepreneurship at the Ewing Marion Kauffman Foundation in Kansas City. “We need to rebuild that system—better. We’ve developed both America’s New Business Plan and the Capital Access Lab to support new policies and approaches that allow more entrepreneurs to turn good ideas into businesses.”

When DoAmaral started her journey in early 2018, she was dismayed by what she saw, in terms of funding options. “To get financing through traditional institutions like banks, you need to have money or connections,” she says from her office in Milwaukee. “It’s hard to get a traditional investor to have faith in your business until you’ve already gained some traction.”

DoAmaral was feeling discouraged until she discovered Beta Boom, which invests in startups headed by women and people of color. “They gave me a shot because I had a lot of passion,” she continues.

Less than a year later, she secured $100K in financing from Gener8tor, an accelerator based in Wisconsin. “It was more money than I had ever seen,” she recalls. “But the most valuable part of that acceptance was the validation that we were on to something.”

Having applied for “every pitch competition and program [she] could find” and securing funding from a handful of nontraditional sources, DoAmaral made a few strides in pursuit of her goal, which eventually attracted the attention of venture capitalists. Twenty Seven Ventures, a VC firm specifically focused on ed tech startups, gave her $50K in September 2019.

A month later, she was the co-winner of a pitch competition for technology startups at a festival in Milwaukee and walked away with around $200K. One of the firms behind that event, Northwestern Mutual’s Cream City Venture Capital, later led a round of funding backed by eight investors. DoAmaral secured nearly $700K, which she used to expand her team and update the existing digital content while creating more.

The Fiveable platform enables student-teacher collaborations via livestream reviews, games, and interactive community discussions. Just last year, it supported nearly 1.5 million students nationwide as they prepared for the 2020 Advanced Placement (AP) exams, and under Fivable’s tutelage, 92 percent of them were able to earn passing scores. In addition to upwards of eight employees, the ed tech startup has grown to include over 50 teachers creating and streaming educational content.

According to DoAmaral, the COVID-19 health crisis has been like “a lightning strike” for the education technology industry, given how its repercussions have forced schools to adopt remote learning. From February to March, Fiveable’s enrollment reportedly increased 500 percent, coinciding with when the World Health Organization first declared the viral outbreak a pandemic.

Emphasizing her professional achievements as hard-won, DoAmaral has overcome much adversity throughout her journey. During the autumn of 2019, her company was in such dire straits, she couldn’t afford to pay her employees, including the teachers who had been tutoring Fiveable students. However, her staff continued to stand by her, and eventually she was able to reward their loyalty when she secured more funding.

Despite these setbacks, DoAmaral says there is a lesson at the core of her experiences. “A lot of women and women of color think they will be able to get funding for their startups only when they achieve a certain level of success,” she says. “But the reality is, entrepreneurs can get funding before getting to that level. There is no metric you have to hit. There are no rules. It is a Wild West.”

Erica Plybeah, founder of the cloud-based software application MedHaul.

The challenges faced on DoAmaral’s entrepreneurial path are not uncommon for other businesswomen of color. Erica Plybeah, the founder of the cloud-based software application MedHaul, encountered similar obstacles while seeking funding from traditional sources when she was starting out.

“To get a bank loan or venture capital early on, you have to clear so many hurdles,” Plybeah says, noting that the process can become so labor-intensive, it eats up the time one would need to actually build their business.

Plybeah says it’s even more challenging for people of color because the institutions require more due diligence, and applicants are at a disadvantage if they don’t have connections. “When going to networking events, investors will literally talk to every single entrepreneur in the room except the Black one,” she told Epicenter Memphis. “After the 40th event where no one talks to you, you’re just over it. It’s discouraging and disheartening.”

Much like DoAmaral, Plybeah launched MedHaul, which connects hospitals and clinics with credentialed transportation providers, with financing from other sources. In early 2017, she submitted a concept to the Memphis Medical District Collaborative Operation Opportunity business plan competition, which “was designed to help solve operational problems within the city’s medical district,” according to nonprofit organization Epicenter Memphis. As one of two winning finalists, Plybeah was awarded $20K as well as support and training from Epicenter, which connects entrepreneurs to capital, programming, customers, and talent. Plybeah was then accepted into the FedEx-sponsored Epicenter Logistics Innovation Accelerator, and received $50K in initial seed capital for her business.

“I was able to bootstrap and make that $70K last for two years,” says Plybeah, who had a decade of experience in the health care sector prior to developing MedHaul.

This year, Plybeah participated in Morgan Stanley’s Multicultural Innovation Lab, which targets tech startups with founders who are women and people of color. Additionally, she was one of 12 applicants chosen for the Google for Startups Accelerators’ Black Founders program, a three-month digital accelerator for tech startups. Working directly with Google experts, Plybeah gets to address technical challenges and find outside investment opportunities, all with the intention of nurturing and enhancing MedHaul’s growth.

Over the last three years, MedHaul has increased its employee base, all of whom work together to match patients with the best ride service able to cater to their needs while also allowing hospitals to book and pay for the rides directly. Since MedHaul’s inception, thousands of rides have been booked—and the future continues to look bright.

Drawing on her own experience, Plybeah urges other entrepreneurs not to get discouraged during the early stages of their entrepreneurial pursuits. “Entrepreneurs tend to blame big banks, venture capital firms, and other financial institutions for not getting the money they need to launch their businesses, but there are other options. You have to do your research and reach out to the right sources,” she says. “Don’t chase an opportunity if you are not a good fit.”

Still, there might come a day when women of color won’t be forced to find alternative sources of funding to start their businesses. Big financial institutions are starting to recognize the untapped potential of these entrepreneurs. In a recent interview, Carla Harris, vice chair and managing director of Morgan Stanley, acknowledged that less than 4 percent of venture capital dollars go to companies founded by women, and less than 2 percent go to people of color. “That is a huge market inefficiency,” Harris told Forbes, “and whenever there’s a market inefficiency, there’s a commercial opportunity.”