Felix Salmon has a good rundown of Chris Dodd’s proposed regulatory reforms, and overall he finds them considerably better than the proposals that came out of the Treasury. But on one point he thinks Dodd has it wrong:

Felix Salmon has a good rundown of Chris Dodd’s proposed regulatory reforms, and overall he finds them considerably better than the proposals that came out of the Treasury. But on one point he thinks Dodd has it wrong:

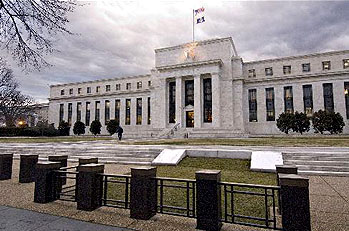

The Agency for Financial Stability is the agency charged with monitoring systemic risk — a job which under Treasury’s proposal would be given to the Federal Reserve. On this I think I have sympathy with Treasury: the Fed in general, and the New York Fed in particular, is better placed to monitor these risks than a brand-new agency with no direct ability to supervise banks or to break them up. A giveaway appears on page 3 of the discussion draft:

“The Agency for Financial Stability will identify systemically important clearing, payments, and settlements systems to be regulated by the Federal Reserve.”

Clearly, the Fed is going to play a necessary role here, and it’s not exactly rocket science to identify key clearing and settlement systems. So why take that job from the Fed and give it to powerless technocrats in Washington?

I think I’ll take Dodd’s side here. As Felix says, there’s no question that the Fed is going to have a major role here no matter what: it’s just too big and too central to the banking system not to. But there are at least a couple of big reasons not to give it unfettered authority. First, the Fed has demonstrated pretty conclusively over the past few years that it’s too close to the banking industry, and too invested in its success, to ever be objective about the broad level of risk in the banking system. Second, pronouncements from the Fed are too powerful. The Fed would (rightly) be very reluctant to make public statements about systemic risk for fear of sending markets into a tailspin. So it wouldn’t.

The problem with Dodd’s Agency for Financial Stability, of course, is that it might end up with a fairly limited amount of substantive power. But that’s not entirely a bad thing as long as it has reputational power. Standing clearly outside the banking system would likely help it develop a reputation as an honest broker that demands attention — or, at very least, a counterweight to the institutional and industry-centric judgments of the Fed. That’s no bad thing.

Overall, it’s a mixed bag. On balance, though, I think there’s a strong need for a non-Fed voice, one that considers systemic risk to be its primary mission, not its 17th most important one. Besides, look at the Fed’s track record on assessing systemic risk so far. How much worse can a new agency be? Might as well give it a try.

UPDATE: More detail on Dodd’s proposal here from Mike Konczal.