How bad is the Republican health care bill? Nancy LeTourneau points me to Christopher Jacobs, who shares some scuttlebutt about the CBO score of a previous draft of the bill:

Based on my conversations with multiple sources close to the effort, the Congressional Budget Office (CBO) had indicated to congressional staff that the prior House framework could see at least 10 million, and potentially up to 20 million, individuals losing employer-sponsored health insurance.

Huh? Both Obamacare and the Republican bill are all about the individual market. Why would the Republican bill lead to massive declines in employer insurance?

According to CBO, the combination of a cap on the [tax] exclusion for employer-provided health insurance, coupled with an age-rated tax credit for insurance, created a dynamic where expanding health insurance coverage was all but impossible. An age-rated credit provides much greater incentive for firms to drop coverage, because all workers, not just low-income ones, can qualify for the credit.

As it happens, the cap on the tax exclusion was ditched in the version of the bill released today, but the age-based subsidies were retained. I’m going to try to recreate what this means. Here we go.

Suppose a health policy would cost you $10,000. Acme Corp. doesn’t want the hassle of running a health care plan, so instead of buying a group plan they just give you $10,000 and tell you to go out and buy your own policy. The problem is that this $10,000 is taxable, so on net a middle-class taxpayer might take home only $7,000 or so. Then he’d have to shell out another $3,000 of his own money.

That’s a bum deal, obviously. It’s better for Acme to use that $10,000 to buy you insurance. It’s the same deal for them, but since health care is nontaxable, it doesn’t cost you anything. That’s how things work today.

Obamacare doesn’t change this much since middle-class taxpayers make too much money to get any subsidies. But now let’s run this scenario under the Republican plan.

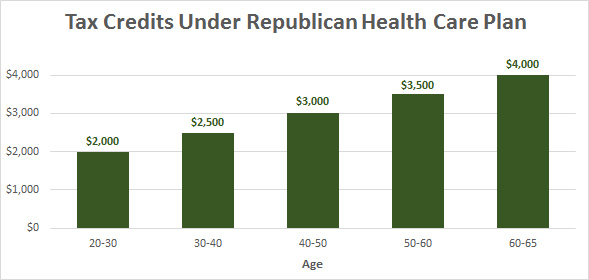

Unlike Obamacare, the GOP plan doesn’t care how much money you make. A middle-aged, middle-class worker is eligible for a $3,000 tax credit no matter what. So now Acme can give you $10,000, you take home $7,000, and then receive a $3,000 tax credit. That’s enough for you to buy a policy without shelling out any of your own money. Under those circumstances, Acme might well decide to get out of the health care business and just give people extra money they can use to buy their own coverage.

Obviously the Republican plan would affect different people differently, and not everyone would make out so well. On average, though, the Republican plan would make it more likely that an employer could just get out of the group health business altogether and not face a riot from their employees.

At the same time, poor people who don’t have employer health care in the first place would be screwed. A $3,000 tax credit wouldn’t come close to paying for an individual policy. They’d be thousands of dollars short and would simply go without, as they did before Obamacare.

The net result is that (a) lots of people would get dropped from employer health care, and (b) anybody who’s less than middle class wouldn’t be able to afford insurance using the tiny Republican tax credit, so they’d drop out of the insurance market altogether. After running the numbers, the CBO apparently figured that virtually no one who makes less than an average income would be able to afford insurance, while those above an average income would mostly be people who were just getting moved from employer coverage to individual coverage. The net result is that the Republican plan wouldn’t do any more good than no plan at all.

On the bright side, all of this means that the Republican plan wouldn’t cost much. Poor people wouldn’t use the tax credits at all, so they wouldn’t cost anything. Middle class folks who lost their employer plan would use the tax credits, but that would be made up for by taxes on the money their employer gives them to buy an individual policy. All that’s left is the high-risk pool and Medicaid—and Republicans plan to gradually cut back on Medicaid.

So I might have been wrong this afternoon. The Republican plan might cost little more than $10-15 billion per year, and on net it might cover no one at all. We’ll find out when the CBO announces its score.