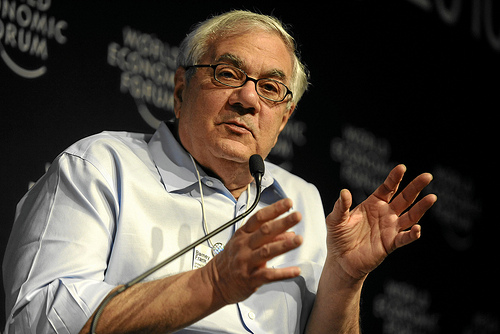

Flickr/<a href="http://www.flickr.com/photos/worldeconomicforum/4317682779/">World Economic Forum</a>

Rep. Barney Frank (D-Mass.), chair of the powerful House financial services committee, has issued a challenge to Senate Republicans: If GOPers want to kneecap an independent consumer protection agency, they should do it in public, not behind closed doors. “Procedurally, the Senate Republicans are killing this or watering it down,” Frank told Mother Jones. “Senate Republicans should stand up publicly and oppose it. At the very least, they have to do that. And there’s going to be public reaction against that.”

Over the weekend, Sen. Chris Dodd (D-Conn.), the banking committee’s chairman and leader on financial reform, circulated a plan to create a watered-down consumer-protection agency within the Treasury Department. Frank, who helped pass a financial-reform bil last year that included an independent Consumer Financial Protection Agency, called Dodd’s proposal “weaker than I was hoping.” Frank added that the draft’s stipulation that certain rule-writing by the proposed consumer agency would require approval from a separate risk-management council “is a terrible idea.” He also lamented that the consumer agency wouldn’t have full authority over payday lenders and debt collection and settlement companies.

If a watered-down version of a consumer-protection agency does emerge in the Senate’s final financial-reform bill, Frank said he will fight to make sure a consumer agency with independence and increased authority for consumer protection makes it onto the president’s desk. “I’m gonna do everything I can” to make sure the House’s Consumer Financial Protection Agency survives, Frank vowed. “I want [Republicans] to take a public vote at the very least.”