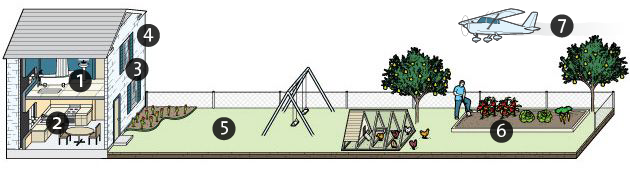

Six micrograms of lead exposure—a quantity so small it’s invisible—may be enough to permanently alter a child’s development and increase crime in a community. Watch Mother Jones political blogger Kevin Drum discuss his new cover story on lead on MSNBC’s Melissa Harris-Perry.

Pioneering lead toxicologist Howard Mielke, who we interviewed recently, was also a guest on the show:

Kevin also joined a panel with Atlanta mayor Kasim Reed to discuss why Democrats didn’t win a majority of seats in the House of Representitives, how the Dems can run better campaigns in the future, and Clinton’s 1996 Welfare Reform Act: