Christmas in California #3. Location: Balboa Peninsula, Newport Beach.

Christmas in California #3. Location: Balboa Peninsula, Newport Beach.

Here is AT&T on the Republican tax plan:

June 2017: “AT&T is on pace to invest around $22 billion in the United States this year, CEO Randall Stephenson told CNBC on Thursday….Ahead of the tech meeting, Stephenson told “Squawk Box” the company will increase its capital investments if Trump delivers on tax reform by the end of the year.”

Today: “Once tax reform is signed into law, AT&T plans to invest an additional $1 billion in the United States in 2018….Since 2012, AT&T has invested more in the United States than any other public company. Every $1 billion in capital invested in the telecom industry creates about 7,000 jobs for American workers, research shows.”

In the most recent quarter, American companies increased their investments in equipment by 6.3 percent. AT&T appears to be planning an increase of 4.5 percent. I am unimpressed.

But that’s not all! There’s also this:

December 15: “AT&T today provided details of a tentative agreement reached with the Communications Workers of America in Mobility Orange contract negotiations….Among provisions of the offer: Retroactive wage increases back to Feb. 12, 2017, and a $1,000 lump sum, if the agreement is ratified by Jan. 12, 2018.”

Today: “Once tax reform is signed into law, AT&T plans to…pay a special $1,000 bonus to more than 200,000 AT&T U.S. employees — all union-represented, non-management and front-line managers.

Why do I have a feeling that this $1,000 bonus was already in the works for everyone, not just Mobility Orange folks? I guess I’m just cynical.

In any case, AT&T sure does seem to be going out of its way to suck up to President Trump. I wonder why that could be? It’s a mystery….

POSTSCRIPT: I should make clear that I don’t blame AT&T for these announcements. Given Trump’s well known ego, it would probably be a breach of fiduciary responsibility if they didn’t slather him with praise at every opportunity.

I am so tired of this shit:

This is not a password to get into Fort Knox. It’s to get access to news articles. Just stop it.

White House economic adviser Gary Cohn just can’t figure out why the Republican tax plan is so unpopular:

“To be honest with you, I don’t know,’’ Cohn said Wednesday at a Washington event hosted by Axios, when asked why the plan lacked public support. Middle-income Americans “are getting the largest percentage tax savings of anyone in the whole distribution. So we have clearly not communicated that.” Only 24 percent of Americans think the plan is a good idea, and almost two-thirds believe it was designed to help the wealthy, according to an NBC News/Wall Street Journal poll released Tuesday.

I dunno. Does Cohn really not get it? Or is he just playing his assigned role? The thing is, there’s a very narrow sense in which Cohn is correct. If someone is paying taxes of 5 percent, and you give them a tax cut of 0.5 percent, that’s a reduction of a tenth. If a millionaire is paying 30 percent and you give them a tax cut of 1.5 percent, that’s three times as big but it’s a reduction of only a twentieth. But if Cohn assumes that this is how people view things, he’s either dumb or delusional.

So let’s go over it for him. I won’t bother showing you projections from the TPC since they’re all a bunch of commies, but here are the estimates from Congress’s own Joint Committee on Taxation:

The immediate impact of the tax bill is to give small benefits to the middle class and big benefits to the rich. The impact in 2027 is for the middle class to see a tax increase while the rich continue to get a small tax cut. No matter which year you choose, the rich do a whole lot better than the middle class.

Plus there’s the fact that the whole bill is designed as a big cut in corporate taxes, which the public has been opposed to by huge margins for the entire past year. Bottom line: this is not hard to understand. The public dislikes the tax bill because it’s obviously a gigantic giveaway to corporations and the rich.

And as long as we’re on the subject of Cohn, he also said this:

He said if he could change one thing about the plan, he would strip the carried-interest provision in the tax code that largely benefits Wall Street investors. Trump, who promised to end the provision during his presidential campaign, was unable to convince lawmakers to make the change, Cohn said. “We’ve been trying to cut carried interest — we probably tried 25 times,” Cohn said. “We hit opposition in that big white building with the dome at the other end of Pennsylvania Avenue every time we tried.”

I don’t recall so much as a single leak suggesting that anyone in the White House ever pushed for this. But let’s assume Cohn is telling the truth. It means that on an issue of huge importance to the president (25 times he tried!) he couldn’t get Congress to throw him even this small bone. Is Trump really treated with such immense disdain by his fellow Republicans? Apparently so. He must have really been pissed off about this. I know he’s the shy, retiring type, but you’d think he might have at least tweeted something about it.

The Trump administration has proposed a new rule that allows restaurant owners to collect all tips and then distribute them among both tipped and nontipped employees:

The proposal would help decrease wage disparities between tipped and non-tipped workers…such as restaurant cooks and dish washers. These “back of the house” employees contribute to the overall customer experience, but may receive less compensation than their traditionally tipped co-workers.

Isn’t that sweet? Trump is looking out for cooks and dishwashers, the hardworking, unsung heroes who keep our nation’s restaurants going. But perhaps you think maybe there’s more going on here? I don’t know what’s made you so cynical about our president, but just this one time you’re right. The Economic Policy Institute has done some calculations, and Eli Day reports on the fine print:

Here’s the rub: The rule doesn’t actually require that employers share those tips with untipped staff. Under the proposal, employers can pocket those tips as long as workers earn the minimum wage….According to EPI’s estimates, employers across the country are likely to pocket $5.8 billion worth of employees’ wages if the rule goes through, in addition to an estimated $50 billion in wage theft already occurring nationwide.

Here’s the funny thing: the Department of Labor is required by law to produce an estimate of the amount of tips that will be transferred from workers to employers under the proposed rule. But they didn’t. Is that because it’s impossible? Not at all: EPI includes a mind-numbingly complete appendix that explains their methodology—methodology that could easily be used by DOL’s wonks to create their own assessment. The problem, of course, is that DOL doesn’t want to produce an official document that suggests their rule will lead to billions of dollars in lower wages for working-class restaurant servers. So they didn’t. That’s the Trump way, after all. He’s a hero of the working class, haven’t you heard?

Anyway, this rule will affect different states differently, since some states have their own rules that protect tipped workers. Servers in blue states like California, Illinois, and New York have little to worry about. But the folks in red states who voted for Trump are about to get screwed big time. On average, servers in these states will lose nearly half of their tip income under the new rule—and that’s after accounting for their increased minimum wage. Here’s a map. Read it and weep.

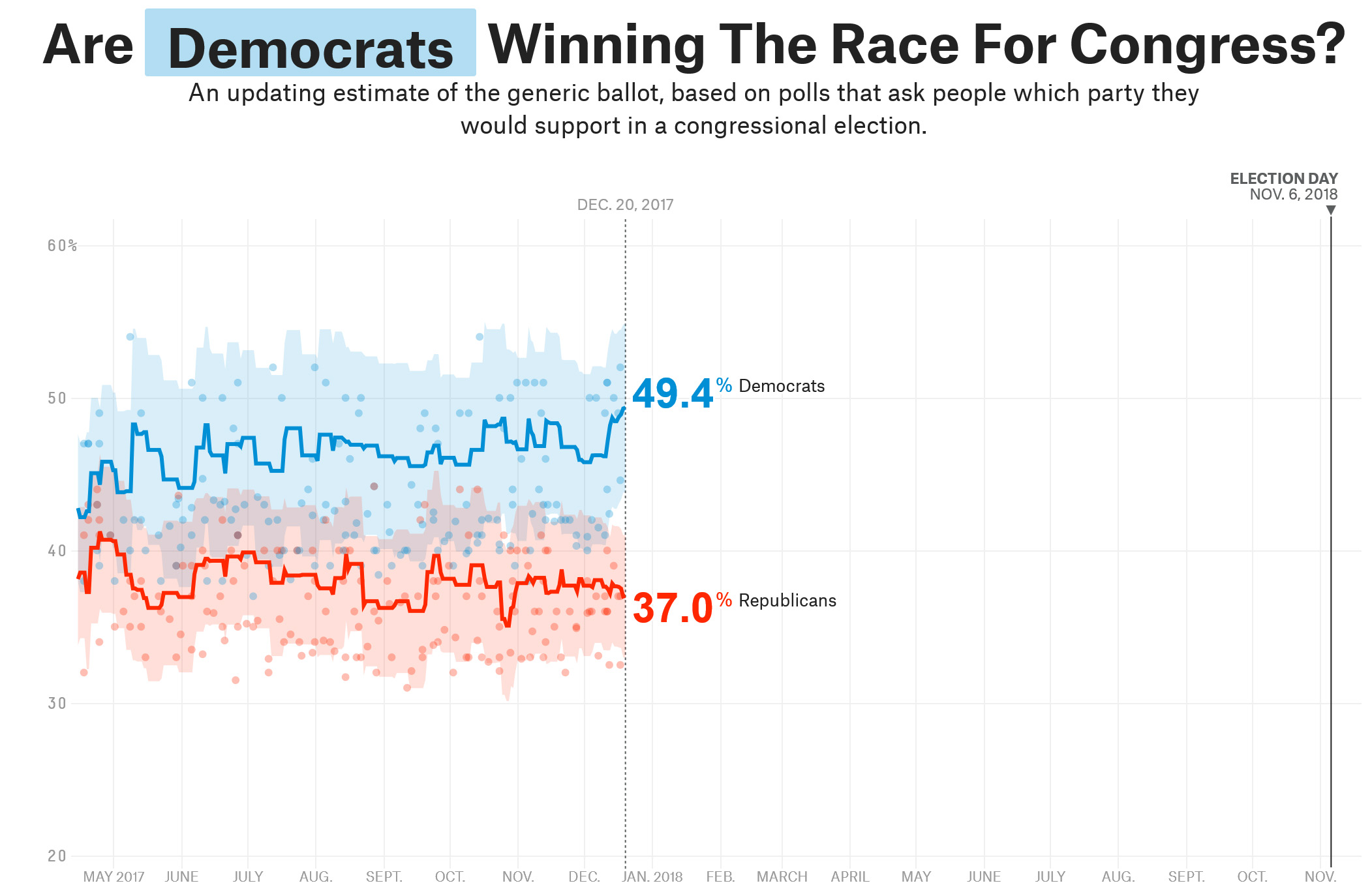

I am generally a skeptic of the “generic ballot” question. This is the one that asks if you plan to vote for a Democrat or a Republican in an upcoming congressional election, and Democrats always seem to hold a big lead. But then that lead fades away, and in the end they either win by a small amount or lose outright.

But I have to admit that the current generic ballot is pretty impressive: according to 538, Democrats are leading by a whopping 12 points. And the folks at 538 claim that generic ballot results a year ahead of the election are actually pretty predictive: anything above 5 points for the out party translates into a big win in November. So perhaps there’s some genuine cause for optimism here.

The Washington Post reports on job losses among women in the retail industry:

Between October 2016 and October 2017, women who worked in the country’s stores lost 160,300 jobs, while 106,000 men found new work in the field, the analysis from the Institute for Women’s Policy Research found. “We’ve seen many news reports of the decline in retail jobs, jobs, but few have noted that the picture in retail is much different for women and men,” researchers at the Washington think tank wrote.

That’s peculiar. But is it a more general phenomenon? Here’s the employment picture for women overall:

Women’s share of the job market has been basically flat ever since 2011. In the past year, their share of the job market has increased slightly. So if women are losing jobs in retail, it must be because they’re moving to jobs in other sectors. Is that a step up or a step down? It turns out that women’s wages have risen slightly more than men’s, but probably not enough to mean anything. Most likely everyone is moving around fairly laterally, rather than into better or worse jobs.

Christmas in California #2. Location: 17th and Linwood, Santa Ana.

Gage Skidmore/Planet Pix via ZUMA

Well, the Republican tax bill is set to pass later today. You know the basics: it cuts corporate taxes permanently but cuts individual taxes only temporarily. It’s a pretty good deal for rich people, not so great for the middle class.

You may also know that we dodged some bullets. The tax on grad students got axed, for example. Likewise, Congress got cold feet at the last second about eliminating the Johnson Amendment, which bans churches from engaging in political activity.

But there are also some less savory provisions of the tax bill that you may not have heard of. Some of them have been there all along, while some got added at the last minute. Here’s a few of them:

Chained CPI

Republicans decided to use a new measure of inflation called chained CPI to calculate tax brackets. The problem is not that chained CPI is a lousy measure of inflation—it’s actually perfectly good—but that it works properly only if everything is measured using chained CPI. But everything isn’t. What this means in the real world is that people will get moved into higher tax brackets faster than before, and this will cost them a lot of money. Here’s the estimate from the Joint Committee on Taxation:

The JCT only projects things for ten years, but I’ve added projections for the next decade after that since chained CPI is a gift that keeps on giving. And it’s worth noting just how insidious this is. For the next few years no one will notice what’s happening because the impact is small and it’s covered up by the individual tax cuts in the bill. But those expire in eight years, just as the chained CPI provision really starts to pick up steam. This means that only after 2025 will middle-class taxpayers get hit with the full cost of the chained CPI provision. By 2037 it amounts to more than $100 billion, or roughly $1,000 per household.

So who wanted this, anyway? It’s been a Republican hobbyhorse for years as a stealth way of raising money to pay for tax cuts. This year, they finally did it.

Real-Estate Partnerships

At the last minute, a provision was added that dramatically reduced taxes on certain kinds of real-estate partnerships. Why? Sen. John Cornyn, who’s in charge of rounding up support for Republican bills, said it was inserted in order to “cobble together the votes we needed to get this bill passed.”

So who wanted this, anyway? That’s a surprisingly difficult question to answer. So far, no one has taken credit for this provision, but apparently it was added by Cornyn himself. As for who it benefits, the obvious answer is that it benefits anyone with large real-estate interests. For example, one of the votes that Cornyn needed to “cobble together” came from Sen. Bob Corker, who was dead set against the tax bill because it increased the deficit, but then suddenly changed his mind after this provision was added. By coincidence, the new rules will likely save him millions of dollars in taxes on his real-estate empire.

Anyone else of note? Well, there’s the guy who has to sign the tax bill into law: Donald Trump. It’s going to save him a bundle.

Carried Interest

This is not something that was added to the bill, but something that wasn’t. Like a zombie that just won’t die, the carried-interest loophole has survived yet again—despite the fact that President Trump campaigned repeatedly on eliminating it. Hedge fund billionaires across the country breathed another sigh of relief.

So who wanted this, anyway? Hedge funds and private equity managers, primarily. Despite Trump’s big talk, in the end no one wanted to anger folks who have billions of dollars in ready cash available for political contributions.

Alimony

Alimony payments are no longer deductible. This is, fundamentally, a tax on divorce (explanation here).

So who wanted this, anyway? Maybe evangelicals, who think divorce is sinful? It’s something of a mystery, since this provision raises only a pittance. In any case, it’s going to cost a bunch of middle-class ex-couples a lot of money.

Estate Tax

The estate tax exemption was raised to $11 million per person or $22 million per couple. You probably knew that. But there’s more.

First, that exemption amount is now indexed to inflation. When it comes to things like the minimum wage, Republicans flatly refuse to consider inflation indexing. But for millionaires and their heirs? Why of course we have to index.

Second, the bill provides a truly massive and inexplicable gift to heirs of the rich. Suppose you inherit some Apple stock that’s increased in value from $1 million to $30 million. Donald Trump’s 2016 campaign tax plan would have exempted the first $22 million, but then you’d have to pay capital gains taxes on the remaining $8 million. In other words, you had to pay taxes on something. Not anymore, though. Not only has the estate tax been eliminated for estates under $22 million, but the Republican bill keeps the current “step-up” law, which means assets are automatically revalued upon death and no capital gains taxes are due. If dad sells off his holdings himself, he has to pay capital gains on the profit. But if he dies and you sell it, you’re free and clear. Even the biggest proponents of killing the estate tax never imagined a gift this brazen.

So who wanted this, anyway? You don’t have to ask, do you? This has been an obsession of the ultra-wealthy for decades. They have long loathed the fact that they can’t control their fortunes even in death, and they loathe it even more that the federal government will get a cut of their hard-earned riches. With this tax bill, they have almost reached their goal of eliminating not just the estate tax, but taxes of any kind on their accumulated wealth.

37% tax rate for millionaires

At the last minute, Republicans decided that the super-rich deserved more of a break than they were already getting: the tax rate on income over $1 million was cut from 39.6 percent to 37 percent. Just for the record, an income of $1 million puts you above the top 1 percent. It’s somewhere around the top 0.3 percent.

So who wanted this, anyway? Rich people. Duh.

Cultura/ZUMAPRESS

The New York Times reports that the IRS is in trouble:

Even before Congress began revising the tax code, the I.R.S. was struggling to keep up with an expanding workload. Since 2010, its budget has been cut by $900 million — or 17 percent, after adjusting for inflation — and its staff reduced by 21,000, or 23 percent. In the meantime, it has had to process roughly 10 million more individual returns.

The agency has been a favorite target of Republicans, who have complained that it unfairly investigated conservative organizations and reveled in irritating taxpayers. (A recent inspector general report showed that the I.R.S. had scrutinized both liberal and conservative groups.) During the campaign, President Trump accused the agency of unjustly hounding him with audits year after year. Paying as little as possible was “the American way,” he declared.

Although Treasury Secretary Steven Mnuchin has acknowledged the importance of sufficiently funding the nation’s revenue collector, Mr. Trump’s budget proposed deep cuts.

The gist of the story is that the IRS will have big problems figuring out the Republicans’ shiny new tax code while they’re already overwhelmed with routine work. But I suspect that’s a feature, not a bug. It means that not only do corporations get a big tax cut, but they can push the envelope of the new rules as hard as they want without much fear that the IRS can push back. Reducing audits on rich people is, generally, the reason for the continuing evisceration of the IRS, and this just fits the pattern.

Oh, and why did I highlight that sentence in the second paragraph? Just to show how easy it is to make sure readers know the truth. Compare that to a recent story in the Washington Post:

Years of conservative attacks on the Internal Revenue Service have greatly diminished the ability of agency regulators to oversee political activity by charities and other nonprofits, documents and interviews show….They capitalized on revelations in 2013 that IRS officials focused inappropriately on tea party and other conservative groups based on their names and policy positions, rather than on their political activity, in assessing their applications for tax-exempt status….Conservatives have likened the IRS’s extra scrutiny of the tea party groups to Watergate and called it a political witch hunt….By early 2012, tea party groups across the country were growing frustrated by the delays, some stretching to two years or more. Some activists bristled that IRS officials had sent them intrusive, wide-ranging requests for more information about political affiliations, social media posts and other details….The IG’s report was released in May 2013, triggering an uproar. It concluded that IRS officials “used inappropriate criteria that identified for review Tea Party and other organizations,” based on names or policy positions rather than an assessment of the groups’ political activity.

It is not until the 50th (!) paragraph that reporter Robert O’Harrow Jr. gets around to mentioning that liberal groups were also targeted. If you don’t manage to make it that far, you’ll leave with the impression that the IRS really did specifically target conservative groups unfairly, even though the evidence is now clear that nothing of the sort happened. What’s up with that?