Here’s your chart of the day, courtesy of McClatchy:

Here’s your chart of the day, courtesy of McClatchy:

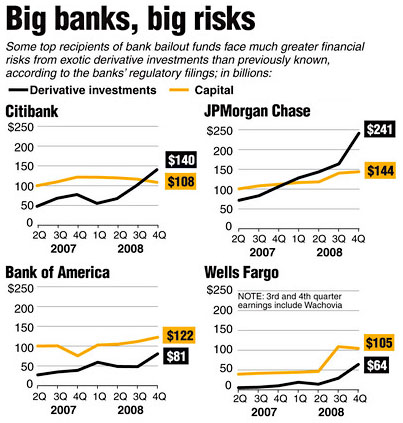

America’s five largest banks, which already have received $145 billion in taxpayer bailout dollars, still face potentially catastrophic losses from exotic investments if economic conditions substantially worsen, their latest financial reports show.

Citibank, Bank of America, HSBC Bank USA, Wells Fargo Bank and J.P. Morgan Chase reported that their “current” net loss risks from derivatives — insurance-like bets tied to a loan or other underlying asset — surged to $587 billion as of Dec. 31. Buried in end-of-the-year regulatory reports that McClatchy has reviewed, the figures reflect a jump of 49 percent in just 90 days.

Meanwhile, the Wall Street Journal reports that U.S. officials are “examining what fresh steps they might need to take to stabilize [Citibank] if its problems mount, according to people familiar with the matter.” This is in case Citi “takes a sudden turn for the worse,” which, they say hearteningly, “they aren’t expecting.” Good to hear.