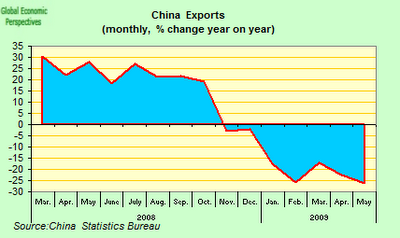

The United States needs to reduce its trade deficit, but arithmetic being what it is, that can happen only if other countries reduce their trades surpluses. That means Germany and Japan, but most of all it means China —  and as the chart on the right shows, China’s exports are indeed down. Good news? Not really: as Brad Setser has pointed out in the past, this only produces a declining trade surplus if imports also go up — or at least decline at a slower rate than exports. Ed Hugh delivers the bad news:

and as the chart on the right shows, China’s exports are indeed down. Good news? Not really: as Brad Setser has pointed out in the past, this only produces a declining trade surplus if imports also go up — or at least decline at a slower rate than exports. Ed Hugh delivers the bad news:

The decline [in exports] was the biggest since Bloomberg data began in 1995. And more to the point as far as Brad is concerned China’s imports dropped 25.2 percent last month, compared with a 23 percent fall in April. Hence China just one more time ran an increased trade surplus (up to $13.4bn in May from $13.1bn in April), and it is no clearer to me than it is to Brad how a country running a trade surplus can be leading a surge in global demand. Indeed this months data, far from prodiving evidence of an accelerating “recovery” continues to point towards ongoing weakness in global demand, just like the evidence we are receiving from Germany and Japan.

Ed has more at the link, including some detail about China’s imports that provides even more cause for gloom, but the bottom line is that there’s not much hope in the short term that China will be leading a global recovery. Their economy isn’t rebalancing, it’s just falling. No green shoots here.