You probably already know this, but here’s yet another paper that demonstrates the foolishness of putting money into actively managed mutual funds.  The authors used historical data and simulations to figure out if actively managed funds performed better than passive investments, and the chart on the right shows the answer: the blue line represents active funds and the red line represents the average distribution of passive investments. The zero point on the x-axis represents average performance.

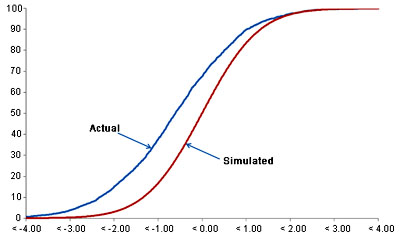

The authors used historical data and simulations to figure out if actively managed funds performed better than passive investments, and the chart on the right shows the answer: the blue line represents active funds and the red line represents the average distribution of passive investments. The zero point on the x-axis represents average performance.

Along the entire curve, the authors found that a higher percentage of funds performed worse than passive investments. For example, about 70% of active funds perform at zero or worse, compared to only 50% of passive invesetments. 90% perform under +1.0 compared to only 80% of passive investments.

If you drop out fees, active funds do slightly better: there are still more big losers than with passive investments but there are also a few more big winners. When you add in fees, though, this small effect is completely swamped and active funds are lousy investments all the way around. Don’t waste your money.

Next up: could somebody please do with hedge funds? I suspect the results would be about the same. Via Felix Salmon.