What’s that? The housing bubble is starting to show its age and you’re having trouble finding buyers for all the crappy CDOs you’ve put together? That won’t do at all: if the market gets wind that no one actually wants the toxic waste lying around on your books, the show could be over. What to do?

Faced with increasing difficulty in selling the mortgage-backed securities that had been among their most lucrative products, the banks hit on a solution that preserved their quarterly earnings and huge bonuses:

They created fake demand.

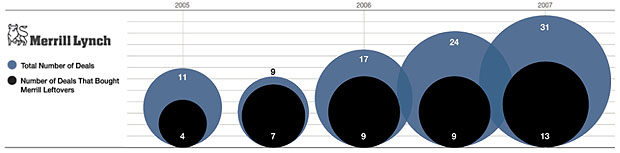

….An analysis by research firm Thetica Systems, commissioned by ProPublica, shows that in the last years of the boom, CDOs had become the dominant purchaser of key, risky parts of other CDOs, largely replacing real investors like pension funds. By 2007, 67 percent of those slices were bought by other CDOs, up from 36 percent just three years earlier. The banks often orchestrated these purchases. In the last two years of the boom, nearly half of all CDOs sponsored by market leader Merrill Lynch bought significant portions of other Merrill CDOs.

ProPublica also found 85 instances during 2006 and 2007 in which two CDOs bought pieces of each other’s unsold inventory. These trades, which involved $107 billion worth of CDOs, underscore the extent to which the market lacked real buyers. Often the CDOs that swapped purchases closed within days of each other, the analysis shows.

Not only does this hide the fact that there’s low demand for your toxic waste, but it generates fees for all on both sides of the deal. It’s a twofer!

The chart below shows how much of its own inventory Merrill Lynch bought at the height of the bubble. For all the gory details, just click the link and read the whole story.