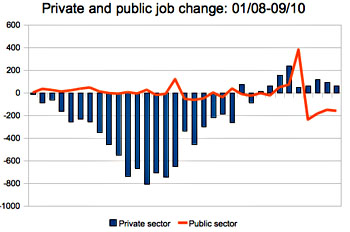

Do I have to do a post about today’s employment report? I do? Fine: it sucks. Private sector job growth was anemic, just as it has been since falling off a cliff in May, and shows no signs of picking up. Public sector job growth, thanks to state and local layoffs, was negative, just as it has been since falling off a cliff in June. As a result, total job growth was tiny, far too small even to keep up with population growth. At the rate things are going right now, unemployment is going to stay near double digits for a very, very long time.

Do I have to do a post about today’s employment report? I do? Fine: it sucks. Private sector job growth was anemic, just as it has been since falling off a cliff in May, and shows no signs of picking up. Public sector job growth, thanks to state and local layoffs, was negative, just as it has been since falling off a cliff in June. As a result, total job growth was tiny, far too small even to keep up with population growth. At the rate things are going right now, unemployment is going to stay near double digits for a very, very long time.

Too negative, you say? You want some good news, you say? Here it is:

While job creation remains scarce, there could be a silver lining. Expectations are growing that the Federal Reserve will try to stimulate the economy by stepping up its purchases of government bonds. The gloomy jobs report could give the Fed more incentive to act.

Jason Pride, director of investment strategy at wealth management firm Glenmede, said “by not being stronger, (the jobs report) gives them the window of opportunity to take action.”

Any other good news? Well, the stock market broke 11000 and the teen apparel sector posted strong growth as part of “brisk” back-to-school sales. So buck up, folks. Prosperity is right around the corner.