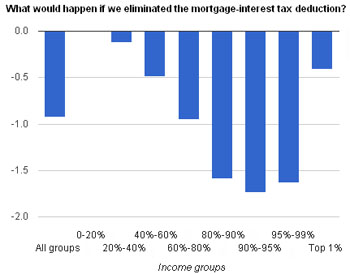

Is the mortgage interest deduction a “middle class” benefit? Sort of. Based on data from the Tax Policy Center, Ezra Klein offers the chart on the right, which shows how much it saves various income groups.  If you’re low-income, the average benefit is 0-0.1% of your income. If you’re smack in the middle of the income range, the benefit is about 1% of your income. If you’re at the top of the income range — but not in millionaire land — the benefit is about 1.6-1.7% of your income.

If you’re low-income, the average benefit is 0-0.1% of your income. If you’re smack in the middle of the income range, the benefit is about 1% of your income. If you’re at the top of the income range — but not in millionaire land — the benefit is about 1.6-1.7% of your income.

The reason for this is obvious. Lower income people are unlikely to own homes or have big mortgages, so they get no benefit. Median earners are more likely to own homes, but their mortgages are still small. High earners nearly all own homes and all have big mortgages. The result is a tax break that doesn’t merely rise linearly with income. Even in percentage terms it’s actively more beneficial the more money you make.

So what if you wanted to make it a little less plutocratic? Some ideas are here, but probably the simplest would be to reduce the cap. Currently the mortgage interest deduction can be taken on loans up to $1 million. If you cut that to, say, $250,000, the middle class would largely keep the same benefit it has now and the upper income brackets would get a benefit about the same or a bit lower (in percentage terms). Plus it would reduce the artificial incentive to buy ever bigger houses. Seems like the least we should do.